Canadian Dollar Outlook: USD/CAD

USD/CAD struggles to hold above the 50-Day SMA (1.3698) as it extends the decline from the start of the week, and the exchange rate may threaten the ascending channel from earlier this year as it continues to carve a series of lower highs and lows.

Canadian Dollar Forecast: USD/CAD Ascending Channel Under Threat

USD/CAD gives back the advance following the Bank of Canada (BoC) rate cut as it trades to a fresh weekly low (1.3690), but the deviating paths for monetary policy may keep the exchange rate afloat as the Federal Reserve appears to be on track to keep US interest rates higher for longer.

Meanwhile, the BoC may further adjust the forward guidance for monetary policy as ‘first-quarter GDP growth was slower than forecast,’ and Governor Tiff Macklem and Co. may further support the economy at the next meeting on July 24 as ‘recent data has increased our confidence that inflation will continue to move towards the 2% target.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

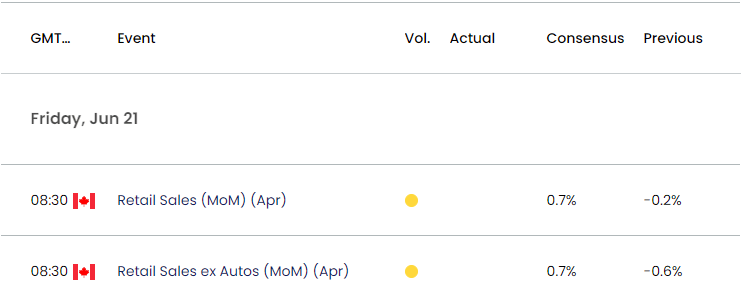

Canada Economic Calendar

However, the update to Canada’s Retail Sales report may push the BoC to the sidelines as household spending is projected to increase 0.7% in April, and a marked rebound in private-sector consumption may generate a bullish reaction in the Canadian Dollar as market participants scale back bets for back-to-back rate cuts.

At the same time, a weaker-than-expected retail sales report may drag on the Canadian Dollar as it puts pressure on the BoC to implement another rate-cut, and USD/CAD may attempt to retrace the decline from the start of the week should the development fuel speculation for lower interest rates in Canada.

With that said, the diverging paths between the Fed and BoC may keep USD/CAD within the ascending channel from earlier this year as Chairman Jerome Powell and Co. retain a restrictive policy, but the exchange rate may threaten the formation should it extend the recent series of lower highs and lows.

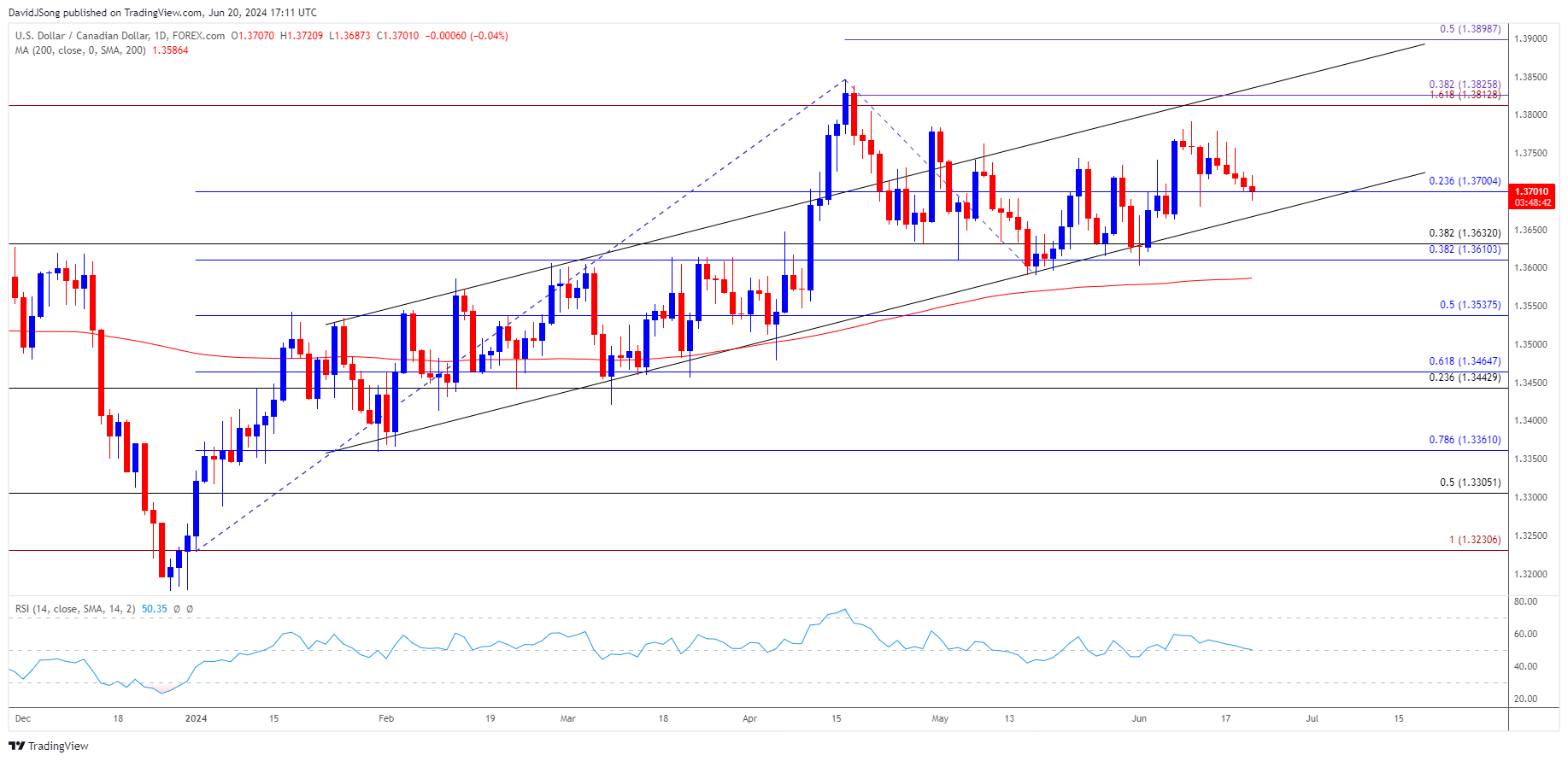

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD continues to carve a series of lower highs and lows as it falls for the fifth consecutive day, and the exchange rate may threaten the ascending channel from earlier this year as it struggles to hold above the 50-Day SMA (1.3698).

- A breach below the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region may lead to a test of the May low (1.3590), with the next area of interest coming in around 1.3540 (50% Fibonacci retracement).

- At the same time, failure to close below 1.3700 (23.6% Fibonacci retracement) may keep USD/CAD above channel support, and the exchange rate may attempt to retrace the decline from the monthly high (1.3792) if it breaks out of the bearish price series.

Additional Market Outlooks

British Pound Forecast: GBP/USD to Face Slowing UK CPI Ahead of BoE

US Dollar Forecast: EUR/USD Susceptible to Test of May Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong