Canadian Dollar Technical Forecast: USD/CAD Weekly Trade Levels

- Canadian Dollar intraweek reversal post-Fed takes USD/CAD back towards yearly high

- USD/CAD bulls eye key resistance at major technical hurdle- PCE on tap next week

- Resistance 1.3623/53, 1.38, 1.3881– Support ~1.3447/81, 1.3344, 1.3218/25

The Canadian Dollar is off just 0.2% this week against the US Dollar with USD/CAD poised to mark a second consecutive weekly advance. The exchange rate has only seen two-down weeks so far in 2024 and while the outlook is still constructive, the advance remains vulnerable while below a key technical barrier we’ve been tracking for months now. These are the updated targets and invalidation levels that matter on the USD/CAD weekly technical chart into the close of the month.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In my last Canadian Dollar Technical Forecast we noted that the multi-month uptrend in USD/CAD had failed into resistance and, “while the medium-term outlook remains constructive, the immediate advance may still be vulnerable here. From at trading standpoint, losses should be limited to 1.3341 for the 2024 advance to remain viable in the weeks ahead with a close above 1.3653 needed to fuel the next leg in price towards multi-year range highs.”

The USD/CAD stance remains unchanged post-Fed with price continuing to trade just below confluent resistance at 1.3623/53- a region defined by the 61.8% Fibonacci retracement of the October sell-off and the 2023 high-week close (HWC). Note that the multi-month uptrend also converges on this threshold and a breach / weekly close above is needed to suggest a larger breakout is underway towards the 1.38-handle and the 2022 high-week close (HWC) at 1.3881.

Weekly support rests with the 38.2% retracement / 52-week moving average at 1.3447/81- a break / weekly close below this threshold would threaten a correction within the 2021 advance with key support / broader bullish invalidation steady at 61.8% retracement of the December advance near 1.3344.

Bottom line: A rebound off uptrend support has us looking for a retest of uptrend resistance. From a trading standpoint, look to reduce portions of long-exposure / raise protective stops on a stretch towards 1.3623/53 IF reached- losses should be limited to 1.3447 IF price is heading higher on this stretch with a close above this hurdle needed to fuel the next major leg in price.

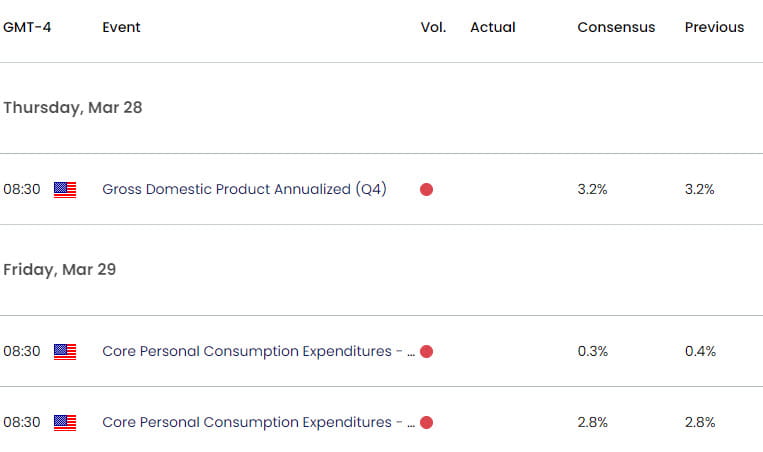

Keep in mind we get the releases of the Fed’s preferred inflationary gauge next week with the US core personal consumption expenditures (PCE) on tap into the close of the month. Stay nimble into the releases and watch the March close for guidance. Review my latest Canadian Dollar Short-term Outlook for a closer look at the near-term USD/CAD technical trade levels.

US/ Canada Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- Crude Oil (WTI)

- S&P 500, Nasdaq, Dow

- Gold (XAU/USD)

- British Pound (GBP/USD)

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex