Canadian Dollar Talking Points:

- USD/CAD was in a firm sell-off into last week’s close, driving down to the 1.3500 psychological level.

- This week has so far been a change of pace, with buyers showing up to defend that support, and making a push back above the 1.3600 handle. There’s some additional resistance just above that bulls will have to contend with should the move continue.

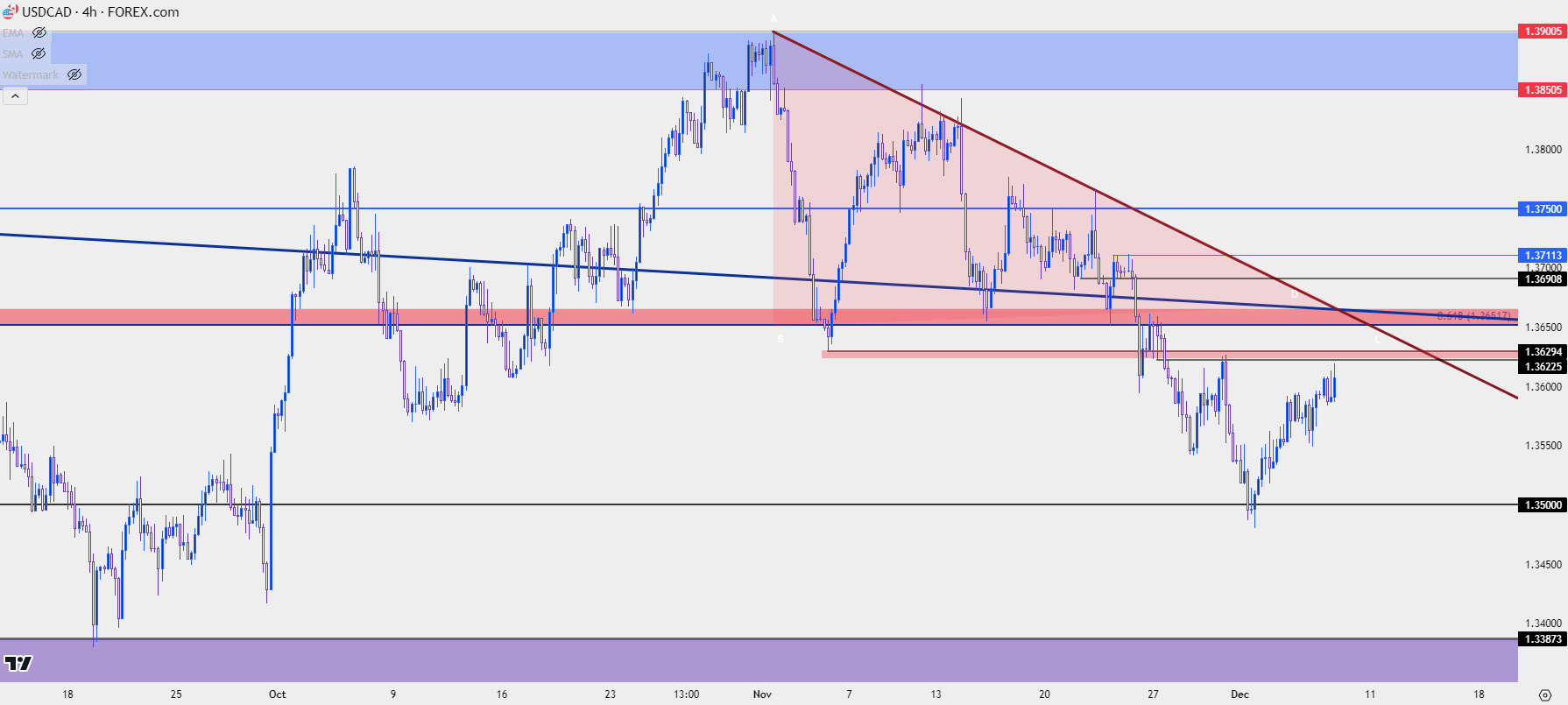

USD/CAD broke down below support in a descending triangle in late-November, and that move continued through the December open, with the pair pushing down to a fresh two-month low.

Sellers attempted to continue the move after the weekly open but were quickly rebuffed, as a hammer formation built on the first four-hour bar for this week and, so far, that’s led to a strong push through this week’s trade.

Given the aggression in the prior sell-off this does beg the question as to whether this bounce is a corrective pullback in a larger bearish move; or if a low is in-place that bulls could work with for a bit. For context, there are a couple of key resistance levels nearing and the way that sellers treat those tests could give a glimpse to sentiment in USD/CAD.

Nearby and just overhead is the 1.3625 level, which I had looked at in the webinar the week before last as a lower-high resistance inflection was beginning to form. But it’s the price above that which may carry more weight, as this is the same 1.3652 level that’s been in-play for more than a year now in various ways. This is the 61.8% Fibonacci retracement of that move that’s built over the past three years, and most recently this was support-turned-resistance as the breakdown move built.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

USD/CAD Longer-Term

The bigger question around USD/CAD at the moment may be longer-term in nature, and whether the symmetrical wedge that’s been building for the past three years is going to yield to a breakout. That theme did begin to show in October trade with USD/CAD jumping up to a fresh yearly high. But, the pair found resistance at a familiar spot in the 1.3850-1.3900 zone, and that led to a strong pullback that eventually drove down to 1.3500.

But, now that bulls are back on the bid and price is approaching resistance from prior support, the question is whether they might have more strength in store. Alternatively, the bounce that’s shown this week may be a pullback in a broader bearish theme as price works back into the symmetrical wedge formation. In that case, there is a deeper support zone as taken from the below weekly chart, which spans from 1.3338 up to 1.3387.

That zone is also confluent with a trendline that’s been at work for a couple of years now, and that confluent remains into the end of this year’s trade, so that spot will retain a degree of interest for support potential for the next few weeks.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

--- written by James Stanley, Senior Strategist