Canada Retail Sales

Canada’s Retail Sales report showed a larger-than-expected decline in May, with household spending falling 1.3% following the 1.7% rise the month prior.

Canada Economic Calendar – July 19, 2024

A deeper look at the report from Statistics Canada showed that ‘sales were down in eight of nine subsectors, led by decreases at food and beverage retailers,’ while core retail sales fell ‘1.4% in May on lower receipts at all core retail subsectors.’

The report also revealed that ‘the sole increase in retail sales in May was observed at motor vehicle and parts dealers (+0.8%), up for the third time in four months,’ while retail e-commerce spending was ‘down 3.6% to $3.9 billion in May, accounting for 5.9% of total retail trade, compared with 6.1% in April.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

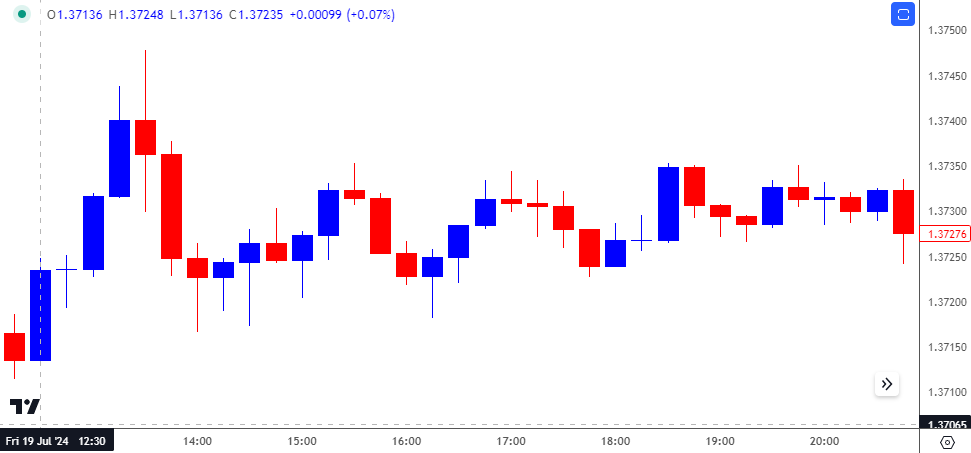

USD/CAD Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/CAD on TradingView

USD/CAD climbed to a session high of 1.3748 following the decline in Canada Retail Sales, but the market reaction unraveled as the exchange rate closed at day at 1.3728. Nevertheless, the Canadian Dollar continued to weaken against its US counterpart in the week ahead, with USD/CAD pushing above the June high (1.3792) to close the week at 1.3835.

Looking ahead, the update to Canada’s Retail Sales report is anticipated to show another contraction in June, with household spending projected to fall 0.3% following the 0.8% decline the month prior.

Signs of a slowing economy may encourage the Bank of Canada (BoC) to pursue a more accommodative policy as Governor Tiff Macklem and Co. acknowledge that ‘broad inflationary pressures are easing,’ and a dismal development may produce headwinds for the Canadian Dollar as it fuels speculation for lower interest rates.

However, a better-than-expected Retail Sales report may push the BoC to the sidelines following the back-to-back rate-cuts, and a rebound in household consumption may generate a bullish reaction in the Canadian Dollar as it raises the central bank’s scope to keep Canada interest rates on hold.

Additional Market Outlooks

AUD/USD Rally Pushes RSI Towards Overbought Territory

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

Canadian Dollar Forecast: USD/CAD Susceptible to Test of July Low

GBP/USD Forecast: Test of Weekly High in Focus

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong