Canada Consumer Price Index (CPI)

Canada’s Consumer Price Index (CPI) fell to 2.7% in June from 2.9% per annum the month prior, while the core rate of inflation widened to 1.9% from 1.8% during the same period.

Canada Economic Calendar – July 16, 2024

The update from Statistics Canada showed that the decline in the headline reading was largely due to a slowdown in gasoline prices, with report also highlighting that ‘prices for durable goods fell 1.8% year over year in June, following a 0.8% decline in May.’

At the same time, the report revealed that ‘on a year-over-year basis, consumers paid more for food purchased from stores in June (+2.1%) compared with May (+1.5%), marking the second consecutive month that grocery price growth accelerated.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

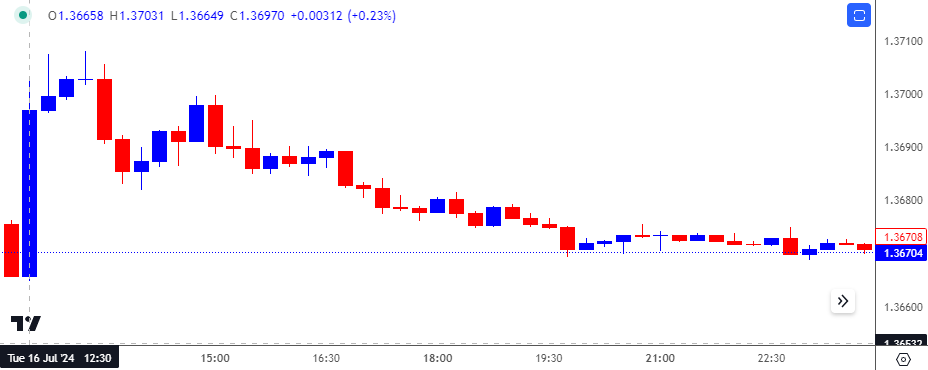

USD/CAD Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/CAD on TradingView

USD/CAD climbed to a session high of 1.3708 despite the mixed developments surrounding Canada’s CPI but the market reaction was short-lived as the exchange rate closed the day at 1.3673. Nevertheless, USD/CAD traded higher over the remainder of the week to close Friday at 1.3715.

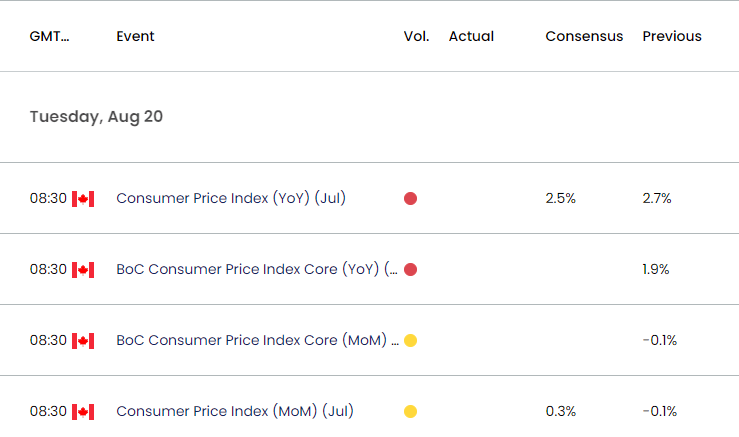

Looking ahead, Canada’s CPI is expected to decline for the second consecutive month, with the headline reading projected to narrow to 2.5% in July from 2.7% per annum the month prior.

Further evidence of slowing inflation may encourage the Bank of Canada (BoC) to pursue a more accommodative policy as ‘there are signs of slack in the labour market,’ and the Canadian Dollar may face headwinds over the remainder of the week on the back of speculation for lower interest rates.

However, a higher-than-expected CPI print may push Governor Tiff Macklem and Co. to the sidelines as the central bank insists that ‘monetary policy decisions will be guided by incoming information,’ and the Canadian Dollar may outperform against its US counterpart ahead of the next BoC meeting on September 4 amid waning expectations for another rate-cut.

Additional Market Outlooks

GBP/USD Forecast: Test of Weekly High in Focus

US Dollar Forecast: AUD/USD Bullish Price Series Persists

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

NZD/USD Rate Outlook Hinges on RBNZ Interest Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong