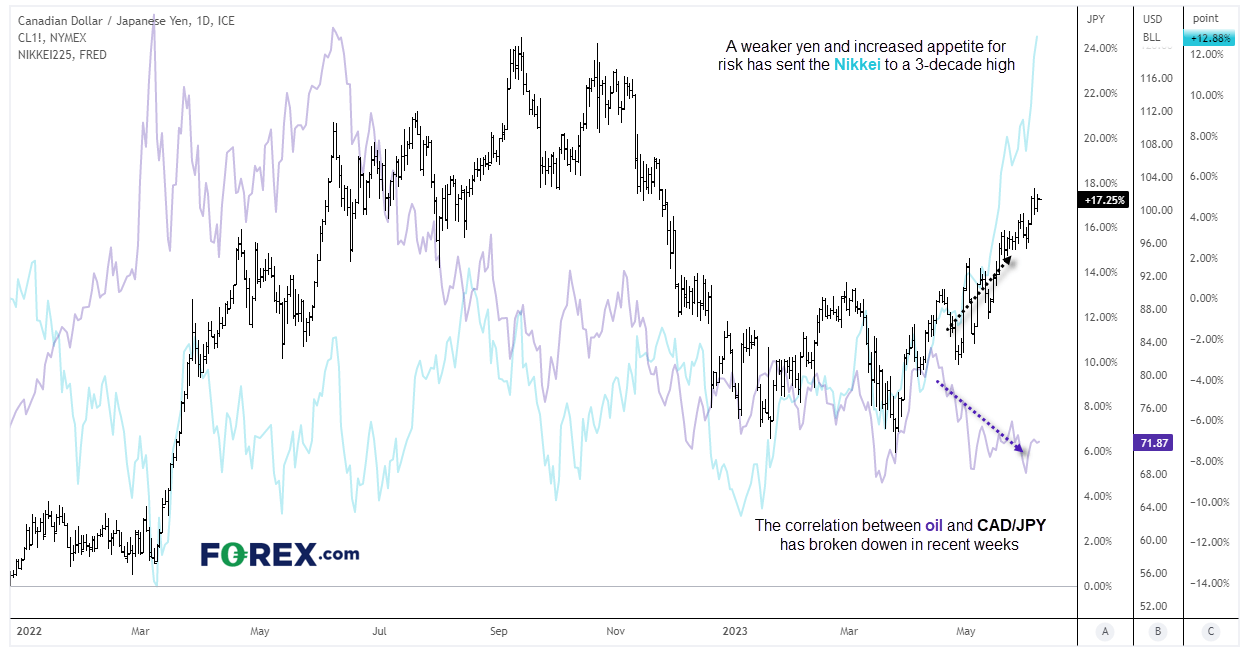

Monetary policy divergences and increased appetite for risk are key drivers for CAD/JPY

Correlations are far from perfect, but they can complement trends amongst markets over the longer-term and help explain the underlying dynamics of a move. Taking CAD/JPY as an example, oil prices can be a key driver of the Canadian dollar as it is a key export for the Canadian economy. Appetite for risk can also support commodity currencies such as CAD and global indices, whilst seeing an outflow from the yen (a safe haven) to support pairs such as CAD/JPY. Of course, monetary policy is also a key factor for respective economies, and the fact that economic data supports higher rates for the BOC (Bank of Canada) whilst the BOJ (Bank of Japan) stick to their ultra-dovish guns helps to explain why CAD/JPY has produced a very strong rally of late.

Incidentally, the weaker yen has helped to propel the Nikkei 225 to a three-decade. Global stock markets have also seen increased support in recent weeks as they became more confident that many central banks were at (or very near) the terminal rate of their tightening cycles. Yet an improvement of Canadian data (and a 25bp hike from the RBA) also saw further demand for CAD as it slightly increases the odds that the BOC may be forced to hike further.

Interestingly, the correlation between oil and CAD has broken down lately, with TWI trading closer to its 2023 low relative to its 2023 high. In turn this suggests divergent monetary policy and an improved appetite for risk have been the key drivers for CAD/JPY’s rally, and it would likely be trading even higher if there was a stronger bullish case for oil prices.

Will the BOC hike or pause today?

There was a little excitement generate for CAD bulls when the RBA hiked rates by 25bp yesterday, but if we look over some key data points form the last month I suspect the BOC still have room to hold. For now, at least. Employment remains tight, although job growth was propped up by part-time jobs whilst full-time jobs contracted in April. Unemployment and participation rate remain steady at 5% and 65.6% respectively. PMI’s have slowed, inflation metrics are trending lower whilst producer prices, retail sales and the housing sector are also cooling. GDP exceeded expectations and business confidence has continued to improve.

Whilst I personally favour a hold, it is possible we’ll see a slightly hawkish tone included in an attempt to keep inflation expectations under control, but if April’s statement is anything to go by it will be mostly balanced.

Canada’s economic data summary over the past month

- Inflation rose to 4.4% y/y (4.3% previously) and 0.7% m/m, although other annual measures of core inflation continue to trend lower

- Producer prices and retail sales continued to contract in March and April

- IVEY PMI expanded at its slowest pace in 3-months. Whilst the ‘prices’ index rose slightly it remained beneath its 12 and 3-month averages and continues to trend lower to show that inflationary pressures continue to ease

- S&P Global’s measure of manufacturing PMI contrate slightly at 49 (above 50 suggests expansion)

- Building permits fell -18.8% in April, which is its lowest level since December 2020 and permit values were lower in nine provinces, as the housing sector continued to cool

- Q1 GDP exceeded expectations at 3.1% y/y and 0.8% q/q

- Business sentiment continued to improve for a seventh month with the monthly business barometer rising to a n 11-month high (however, wage and fuel costs remain above their historical averages)

CAD/JPY daily chart

The daily chart remains in an established uptrend and trades around the midway point of a bullish channel. A bullish inside day formed yesterday, and volatility is compressing near the cycle highs to suggest another bout of volatility could be approaching.

1-day implied volatility has risen to a near 6-week high of +/- 61 pips, although this is not excessive for a central bank meeting so perhaps there is a degree of complacency here if the BC are to surprise with a hawkish hike.

Ultimately, even if the BOC were to surprise with an overly dovish hold I doubt it would see CAD/JPY move materially lower unless global markets enter a period of risk off. Retracements are then to be seen as opportunities for bulls to seek bullish setups, whilst a break of a new cycle high assumes bullish continuation. And rising oil prices could make any break higher the more direct.

WTI daily chart:

Oil prices found support after some jawboning from the Saudi prince, before weekend news of a 10% oil production cut from Saudi Arabia helped propel oil prices up to $75 at Monday’s open. The fact the weekend gap was promptly closed before pull back to $70 suggests markets aren’t overly concerned with said cuts (and are questioning whether it will be enough to support prices unless other OPEC nations follow suit). But the fact it held above $70 and printed a bullish pinbar day shows demand at the nice round number and brings the potential for a small bounce form current levels.

The 1-hour chart shows volumes were rising near the cycle lows and prices have since rallied on higher volume, and rebounded from $70 and back above the weekly pivot point. Prices are consolidating on today’s Asian session, but if prices drift lower then we see the potential for a move towards $73, near the HVN (high volume node) from the previous move lower. A break beneath $70 invalidates the near-term bullish bias, a break above $73 assumes bullish continuation towards the $75 highs (and could further support CAD/JPY).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge