Brazilian Real Talking Points:

- USD/BRL finally found some element of support, holding on to the same weekly low that had come into play the week before at 4.7520. USD/BRL is working on its first green week since late-May, helped along by some dovish indication from Copom with possible rate cuts coming into the equation in August.

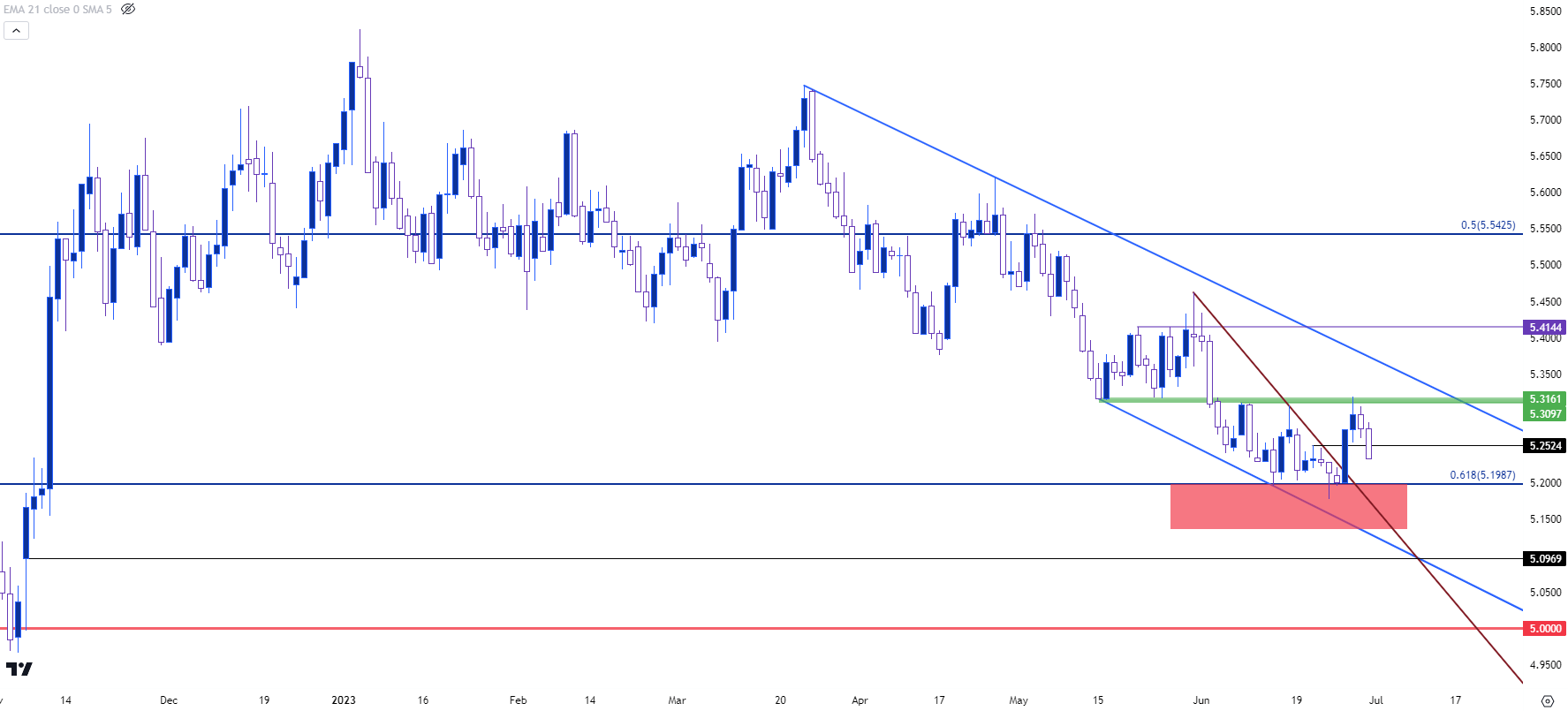

- EUR/BRL broke above a falling wedge pattern this week, after holding a key spot of support that I had looked at last week at the Fibonacci level at 5.1987. That led to a push up to resistance around the 5.31 level, which presents a fresh higher-high, keeping the door open for bulls if price can hold a higher-low to establish bullish structure in the pair.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The Brazilian Real showed weakness against both the US Dollar and the Euro this week. This theme of Real weakness got a shot-in-the-arm when meeting minutes from the Brazilian Central Bank indicated the possibility of a rate cut in August. Copom kept rates flat at 13.75% at their last rate decision as there’s been growing divergence within the committee regarding future rate adjustments, and there’s been political pressure as well, as Finance Minister Fernando Haddad remarked that the potential for easing was a positive development indicating that the government is on the right path.

From the daily chart of USD/BRL, we can see the bounce that developed this week, helped along by that dovish innuendo. That bounce in the pair found resistance at 4.8708 on Wednesday, which held through Thursday trade. And then on Friday as USD-weakness re-appeared, USD/BRL pulled back, setting the stage for an evening star reversal pattern.

Evening stars are often approached with aim of bearish reversal but are often most attractive at or near market tops. Whether this week’s high at 4.8708 establishes a top remains to be seen, as the fundamental backdrop behind the pair would not appear to support a significant bearish movement as the Fed continues to warn of two more hikes as Brazil appears to be on the cusp of monetary loosening. But we’ll look at the big picture on the next chart.

USD/BRL Daily Chart

Chart prepared by James Stanley; USD/BRL via Tradingview

Chart prepared by James Stanley; USD/BRL via Tradingview

USD/BRL Longer-Term

On a longer-term basis USD/BRL is near a very big zone of support. There’s been minimal price action below the June 2020 low since it was established at 4.8183, and the one instance from the monthly chart of when that was tested was last year, from March and through June, as a build of support showed over that four-month-period at 4.7080.

So, we have near-term support as shown on the above chart around the 4.75 level and longer-term support around the 4.70 level, with the big question as to how aggressively bears can push. If they can elicit a breach of the 4.75 level looked at above, the door opens to downside potential with the next significant spot of support at the 4.70 level.

USD/BRL Monthly Chart

Chart prepared by James Stanley; USD/BRL via Tradingview

Chart prepared by James Stanley; USD/BRL via Tradingview

EUR/BRL

For BRL bears, EUR/BRL may present a more attractive backdrop at the moment, continuing with some of the dynamics that I had looked at last week.

In last week’s Brazilian Real Technical Forecast, I looked at EUR/BRL testing a key Fibonacci level at 5.1987, along with the context of a recently-built falling wedge formation. Falling wedges are often approached with the aim of bullish reversals, and that theme began to show a bit more prominently this week as helped along by those dovish hints around future rate cuts out of Brazil.

The move remained rather clean, as well, as last week’s close held above the Fibonacci level and two recurrent tests in the early portion of this week also held that line. The low on Monday printed right at the Fibonacci level and the open on Tuesday showed a springboard move as price jumped through the resistance side of the wedge, getting another push on Wednesday.

Price moved directly up to the resistance zone that I had plotted at 5.31 and that ultimately helped to hold this week’s high. This keeps the door open for bullish themes but an important point is the premise of higher-low support, which hasn’t yet shown as we’ve merely had the breakout and test of a fresh near-term higher-high.

EUR/BRL Daily Chart

Chart prepared by James Stanley; EUR/BRL via Tradingview

Chart prepared by James Stanley; EUR/BRL via Tradingview

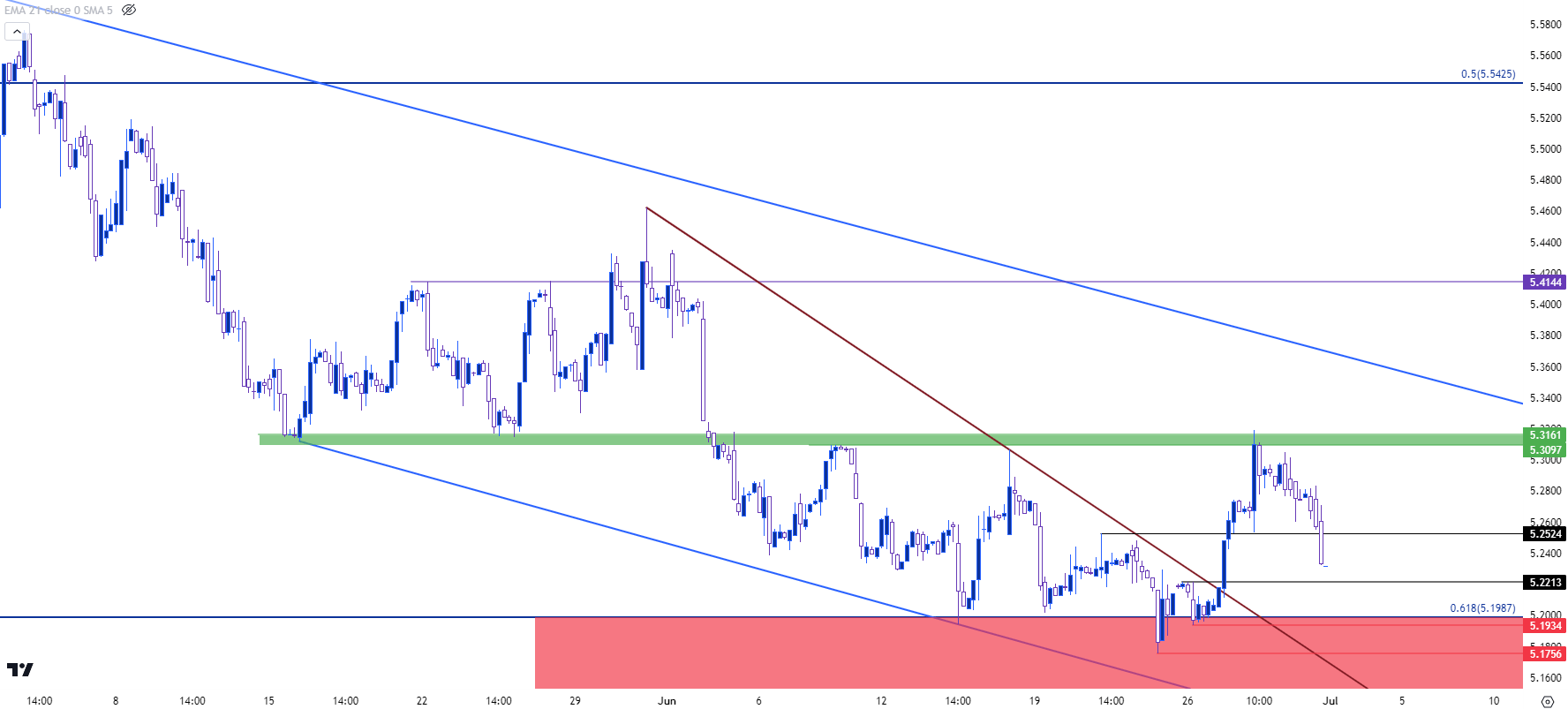

EUR/BRL Shorter-Term

For this week’s breakout to turn into anything more than a failed run from bulls, buyers are going to need to hold higher-low support above the same Fibonacci level that was in-play last week and early this week. Where that higher-low support prints could offer some key input as to how bullish buyers remain to be after the strength that showed on Tuesday and Wednesday.

Price has already pushed below one spot of prior resistance around the 5.25 level, but there’s another around the 5.2213 level and that could offer higher-low support potential, as well. If buyers can’t hold that, the 5.20 level comes into play just before the Fibonacci level at 5.1987 which creates a zone of support potential. This would still be above last week’s swing long so a show of support there could keep the door open for bulls. If bears can push below 5.1934 or, perhaps more importantly, 5.1756, that bullish reversal theme comes into question.

EUR/BRL Four-Hour Price Chart

Chart prepared by James Stanley; EUR/BRL via Tradingview

Chart prepared by James Stanley; EUR/BRL via Tradingview

--- written by James Stanley, Senior Strategist