British Pound, GBP/USD Talking Points:

- Tomorrow brings the Bank of England’s rate decision with expectation for additional tightening out of the BoE.

- The British Pound has been an outperformer of recent. I had highlighted this fact ahead of last week’s FOMC rate decision and that theme has since continued, with GBP/USD pushing up to a fresh yearly high before paring back that gain to begin this week. Will the BoE give the British Pound another shot-in-the-arm for bullish continuation scenarios?

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

Inflation remains stubbornly high in the UK, illustrated again this morning with headline inflation beating expectations at 8.7% v/s the 8.4% that was expected. Core inflation beat, as well, with a 7.1% read against a 6.8% expectation and this highlights the divergence between the UK and counterparts in the US and Europe.

While last week saw the Fed pause after headline inflation dipped to 4%, even with core inflation remaining elevated above 5%, tomorrow’s Bank of England rate decision takes place with much different context. The BoE is expected to hike and given the level of inflation the bank may have little choice but to remain hawkish.

FX markets have been displaying a similar theme of late, as the British Pound has retained strength against many major currencies, setting a fresh 7-year high in GBP/JPY as GBP/USD has jumped to a fresh yearly high.

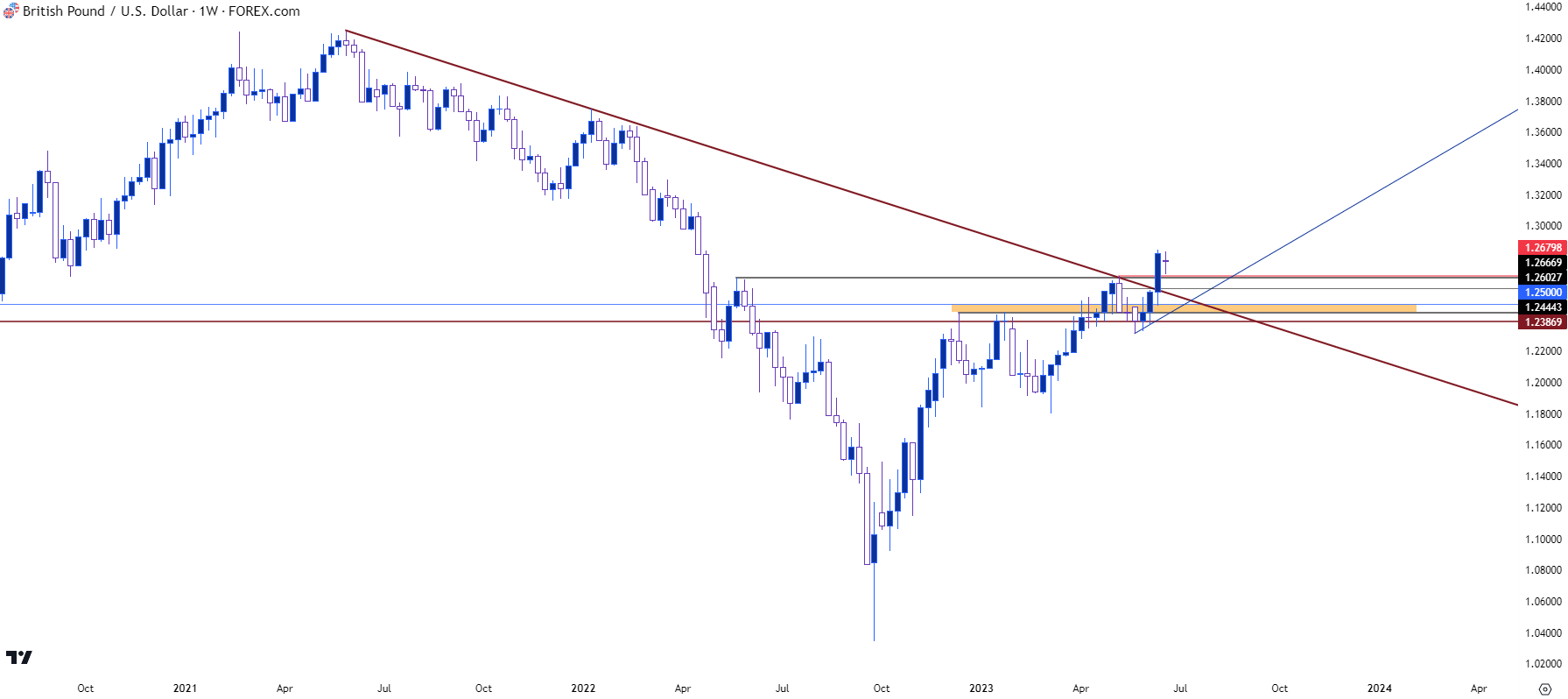

Last week, ahead of the FOMC rate decision, I remarked that GBP/USD may be one of the more attractive venues for USD-weakness scenarios. At the time, price was holding below a long-term bearish trendline that had already been tested for resistance in early-May. But, last week’s one-two combo of the Fed on Wednesday and the ECB on Thursday helped bulls to mount above that trendline, while pushing a fresh yearly high in the GBP/USD pair. That strength continued through Friday trade, with a pullback beginning to show after the weekly open.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

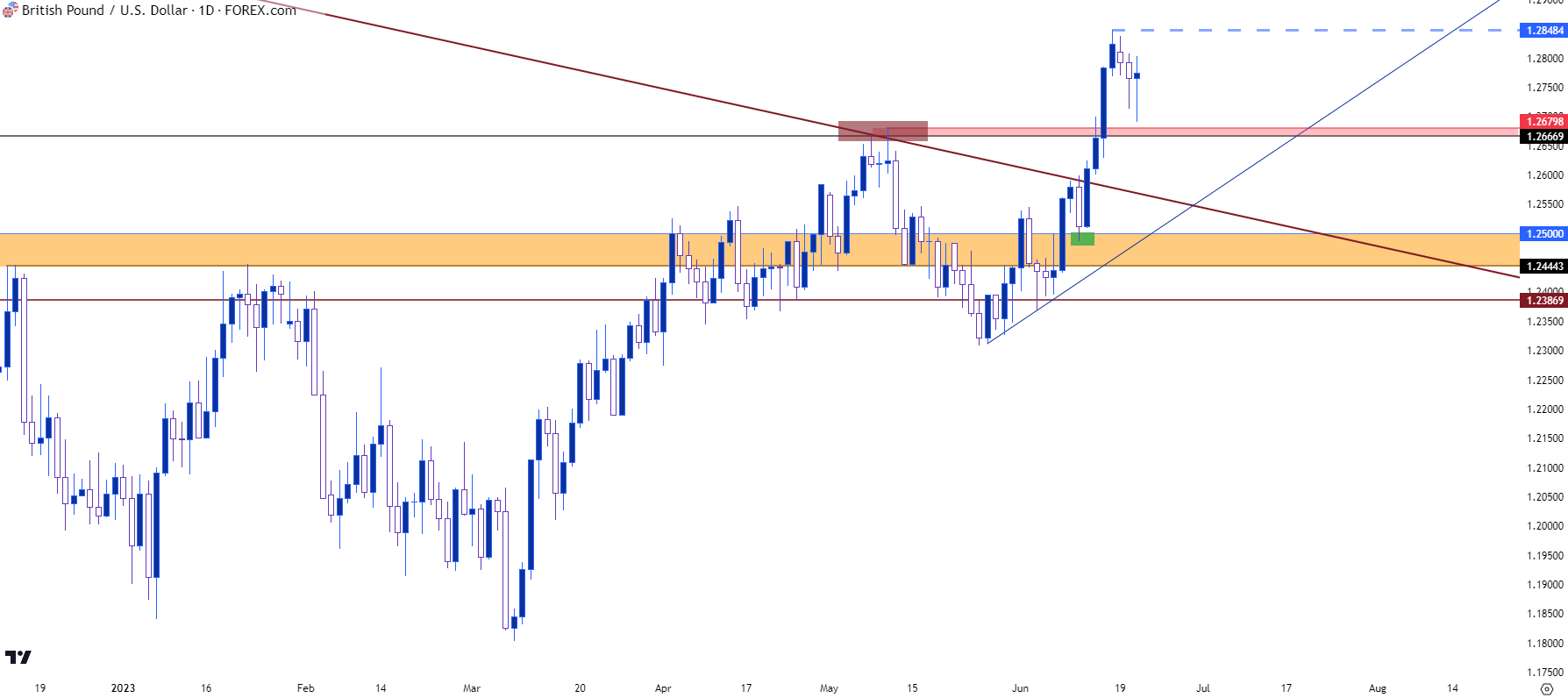

GBP/USD Shorter-Term

From the daily chart, we can see a strong effort from bulls last week even with a significant amount of headline-drive on the macro front.

The week began with a test of support at prior resistance, as taken from the 1.2444-1.2500 zone. But that pullback was all the weakness that the pair was going to show last week as that was followed by four days of intense gains, eventually setting that fresh yearly high.

Along the way, we did see a quick hold of resistance at a key level at 1.2667 as the Wednesday candle closed just under that level. But the Thursday thrust sent it back above this price and, as of yet, we haven’t seen a support test at this spot of prior resistance which had previously marked the yearly high in the pair.

This becomes an item of support for tomorrow’s rate decision that remains of interest. It may not come into play, however, as the past two days have seen pullbacks countered with bullish pressure, which keeps the door open for breakout potential should price press to fresh highs. The current yearly high is just inside of the 1.2850 level, and a break above starts to open the door for a re-test of the 1.3000 psychological level.

If support doesn’t hold at 1.2667, there would still be some previously bullish structure to work through, and there’s potential for support to show at the same resistance trendline that held the highs in early-May and then again last week. For tomorrow, that projects to around 1.2566, which if held, would still be a higher-low above last week’s swing-low at the 1.2500 handle and thereby could keep bullish continuation scenarios in order.

GBP/USD Daily Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

--- written by James Stanley, Senior Strategist