British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound rallies seven of the past nine-days- February opening-rage preserved

- GBP/USD rallies 1.53% off monthly lows- risk for price inflection into technical resistance

- Resistance 1.2707/31, 1.2773-1.2823, 1.2906– Support 1.2636, 1.2591, 1.2525/43

The British Pound is poised to snap a five-day winning streak with the recent GBP/USD rally faltering into monthly-open resistance for the past four-days. The immediate advance may be vulnerable here and the focus is on possible topside exhaustion / price inflection into this key pivot zone. These are the updated targets and invalidation levels that matter on the GBP/USD short-term technical charts into March-open.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In my last British Pound Short-term Outlook we noted that GBP/USD had, “broken a seven-week range with the decline testing a key technical support hurdle this week. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to the monthly open IF price is heading lower here with a weekly close sub-1.2525 needed to mark downtrend resumption.” Sterling tested this key support numerous times with the rebound taking price back into resistance at the objective monthly-open.

Key resistance is eyed just higher at 1.2707/31- a region defined by the 100% extension of the monthly advance, the 61.8% retracement of the December decline, and the objective yearly open. Risk for topside exhaustion / price inflection into this zone over the next few days.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD trading within the confines of a proposed ascending pitchfork formation with the median-line further highlighting key resistance at 1.2707/31. Initial support now rests near 1.2636 and is backed by the 61.8% Fibonacci retracement of the monthly advance at 1.2591 (note the 200-day moving average just lower at ~1.2570). Key support remains unchanged at the 38.2% retracement / 100% extension at 1.2525/43 – a break / close below this threshold would ultimately threaten resumption of the broader downtrend.

A topside breach / daily-close above the objective yearly-open at 1.2731 would be needed to invalidate the December downtrend with critical resistance unchanged at 1.2773-1.2823- a region defined by the February 2019 low, the 2024 yearly opening-range highs, and the June high-day close (HDC). A close above this threshold would be needed to suggest a more significant low was registered this month and clear the way for a possible test of the 1.29-handle.

Bottom line: Sterling remains within the confines of the February opening-range heading into the close of the month, with the weekly opening-range intact on Tuesday- look for the breakouts to offer further guidance here. From at trading standpoint, the immediate advance may be vulnerable into the 1.27-handle – a good zone to reduce long-exposure / raise protective stops. Losses should be limited to 1.2591 IF price is heading higher on this stretch with a close above 1.2731 needed to fuel the next move. Stay nimble into the monthly cross with key US inflation data Thursday and Non-Farm Payrolls (NFP) next week likely to fuel some volatility here. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD trade levels.

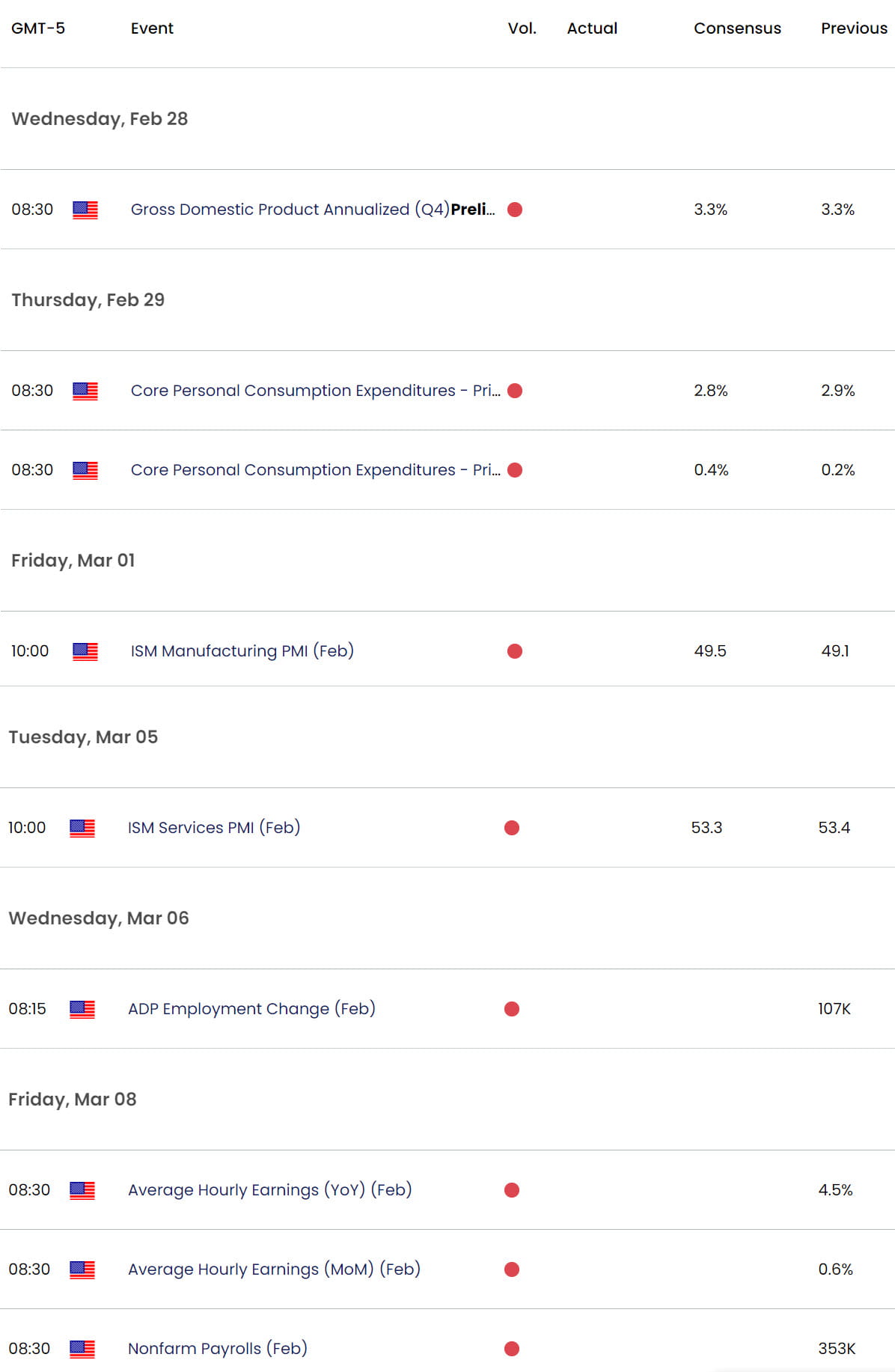

Key GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold Short-term Outlook: XAU/USD Bulls Pounce on 2K Test

- Australian Dollar Short-term Outlook: AUD/USD Bulls Re-Appear

- Canadian Dollar Short-term Outlook: USD/CAD Battle Lines Drawn

- US Dollar Short-term Outlook: USD Bulls Eye Major Resistance

- Euro Short-term Technical Outlook: EUR/USD Plunge Pauses at Support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex