British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound rallies more than 4.5% off yearly low- falters into resistance post-FOMC

- GBP/USD monthly opening-range set- risk for larger correction while below weekly high

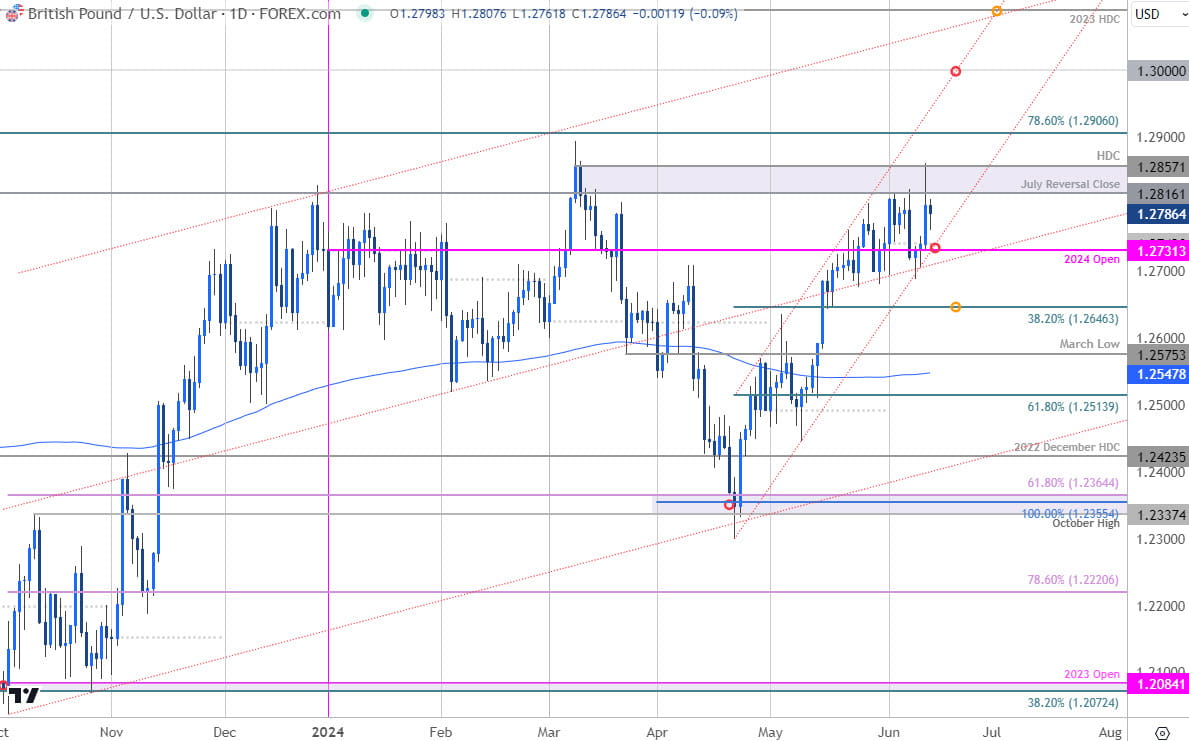

- Resistance 1.2816/57 (key), 1.2906, 1.30- Support 1.2721/31, 1.2646, 1.2575,

The British Pound surged to fresh multi-month highs post-FOMC with the GBP/USD rally extending more than 1.3% off the weekly low before exhausting into technical resistance yesterday. The threat now rises for a larger correction on the heels of a 4.56% rally off the yearly lows with the monthly opening-range now set heading into the BoE next week. Battle lines drawn on the Sterling short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this GBP/USD setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Short-term Outlook we highlighted that a breakout of the May opening-range in GBP/USD, “keeps the outlook weighted to the topside into the close of the month with major resistance levels eyed just higher- risk for possible exhaustion / price inflection.” We specifically noted that a breach higher would, “keep the focus on a stretch towards the yearly high-day close (HDC) at 1.2857- watch the weekly closes.”

Sterling ripped higher on the heels of the FOMC rate decision yesterday with GBP/USD registering an intraday high at 1.2860 before closing nearly 0.5% off the highs. We’ve been highlighting the ongoing momentum divergence into these recent highs and the threat for near-term exhaustion rises here with the immediate focus on a breakout of the 1.2731-1.2857 range for guidance.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD continuing to trade within the confines of an ascending channel formation extending off the April lows with the monthly opening-range catching the lower parallel this week. Support rests with the objective weekly & yearly opens at 1.2721/31- a break / close below this threshold would be needed to suggest a more meaningful high was registered yesterday. Subsequent support seen at 1.2646, the March low at 1.2575 and the 61.8% Fibonacci retracement / 200-day moving average at 1.2514/47- look for a larger reaction there IF reached.

Key resistance now stands at 1.2816/57- a region defined by the July weekly-reversal close, the December swing high, and the 2024 high-day close (HDC). A topside breach / weekly close above this threshold is needed to mark uptrend resumption with subsequent resistance objectives eyed at 1.2906 and the 1.30-handle.

Bottom line: The April rally has extended more than 4.5% off the yearly lows with the rally exhausting into technical resistance this week near the yearly highs. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops. Rallies should be limited to 1.2857 IF price is going to correct lower here with a close below the weekly-open needed to fuel a larger decline. Ultimately, we’re on the lookout for a possible exhaustion low in the weeks ahead.

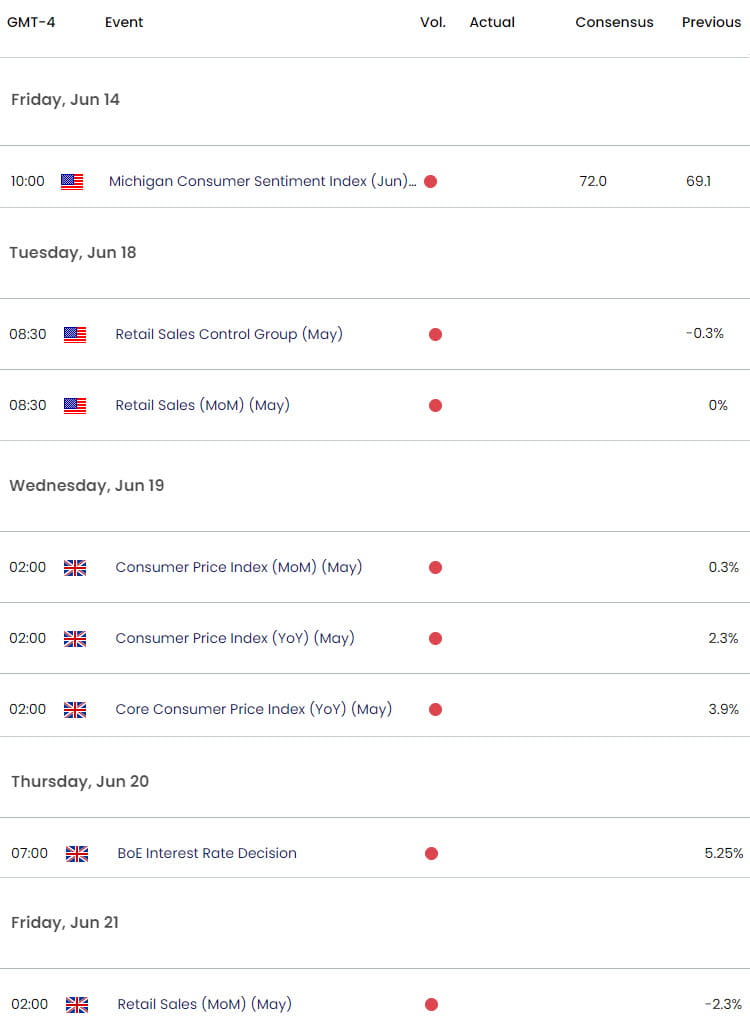

Note that the June opening-rage remains preserved heading into Friday with the US retail sales, UK inflation (CPI), and the Bank of England interest rate decision on tap next week. Stay nimble into the releases and watch the weekly closes here for guidance. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD trade levels.

Key GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Fed Battles Lines Drawn

- Euro Short-term Outlook: EUR/USD Bulls Eye the Break- NFP, Fed on Tap

- Gold Short-term Outlook: XAU/USD Slides into Support- Breakout Looms

- Canadian Dollar Short-term Outlook: USD/CAD Rally at Trend Resistance

- US Dollar Short-term Outlook: USD Battle Lines Drawn at Major Support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex