British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound rallies more than 1.6% since start of July- now testing major resistance pivot

- GBP/USD weekly opening-range set – Key US Inflation data (CPI/PPI) on tap

- Resistance 1.2816/57 (key), 1.2906, 1.2962- Support 1.2773, 1.2731, 1.2644 (key)

The British Pound surged into the July open with GBP/USD rallying back into a critical pivot zone near the yearly highs. The battle lines are drawn with the weekly opening-range preserved ahead of key inflation data over the next few days. These are the levels that matter on the Sterling short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this GBP/USD setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Short-term Outlook we noted that the April rally was , “exhausting into technical resistance near the yearly highs… Rallies should be limited to 1.2857 IF price is going to correct lower here with a close below the weekly-open needed to fuel a larger decline. Ultimately, we’re on the lookout for a possible exhaustion low in the weeks ahead.” Sterling turned sharply lower the following day with GBP/USD plunging 1.9% off the highs into the close June.

Price rebounded off the 61.8% Fibonacci extension at 1.2614 into the start of the month with a V-shaped recovery of more than 1.8% taking GBP/USD back into the same key resistance zone at 1.2816/57 – a region defined by the July weekly-reversal close, the December swing high, and the 2024 high-day close (HDC). The focus is on a reaction into this key threshold this week with the immediate long-bias vulnerable while below.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD trading within the confines of an ascending pitchfork formation extending off the monthly low with the upper parallel further highlighting this week’s test of key resistance at 1.2816/57. The weekly opening-range has taken shape just below and the focus is on a breakout here for guidance.

Initial support rests with the February 2019 swing low at 1.2773 and is backed by the objective 2024 yearly open at 1.2731- pullbacks would need to be limited to this threshold for the monthly advance to remain viable. Broader bullish invalidation now raised to the July open at 1.2644.

A topside breach / daily close above this key pivot zone is needed to mark uptrend resumption with subsequent resistance objectives eyed at the 78.6% retracement of the 2023 decline at 1.2906 and the 61.8% extension of the March rally at 1.2962- look for a larger reaction there IF reached.

Bottom line: The British Pound is once again testing major technical resistance near the yearly highs and while the medium-term outlook remains constructive, the immediate advance may be vulnerable into his threshold. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to the lower parallel IF price is heading for the breakout with a close above 1.2857 needed to keep the long-bias in play towards fresh yearly highs.

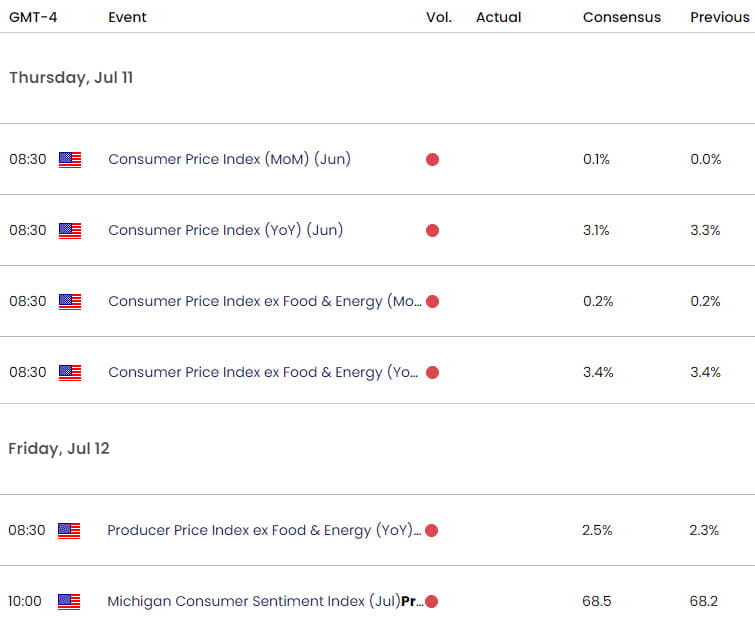

Keep in mind we get the release of key US inflation data with the Consumer Price Index (CPI) & Producer Price Index (PPI) slated for Thursday & Friday respectively. Stay nimble into the release and watch the weekly close for guidance. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD trade levels.

Key GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Euro Short-term Technical Outlook: EUR/USD Bulls Eye Range Resistance

- Gold Short-term Outlook: XAU/USD Coils into July- Breakout Ahead

- Canadian Dollar Short-term Outlook: USD/CAD Bulls Keep 2024 Uptrend

- US Dollar Short-term Outlook: USD Rally Reacts to Major Resistance

- Australian Dollar Short-term Outlook: AUD/USD Fed Battles Lines Drawn

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex