British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound plunges post-BoE rate cut- Sterling down more than 2.3% off yearly high

- GBP/USD testing major technical support at April uptrend– NFP on tap

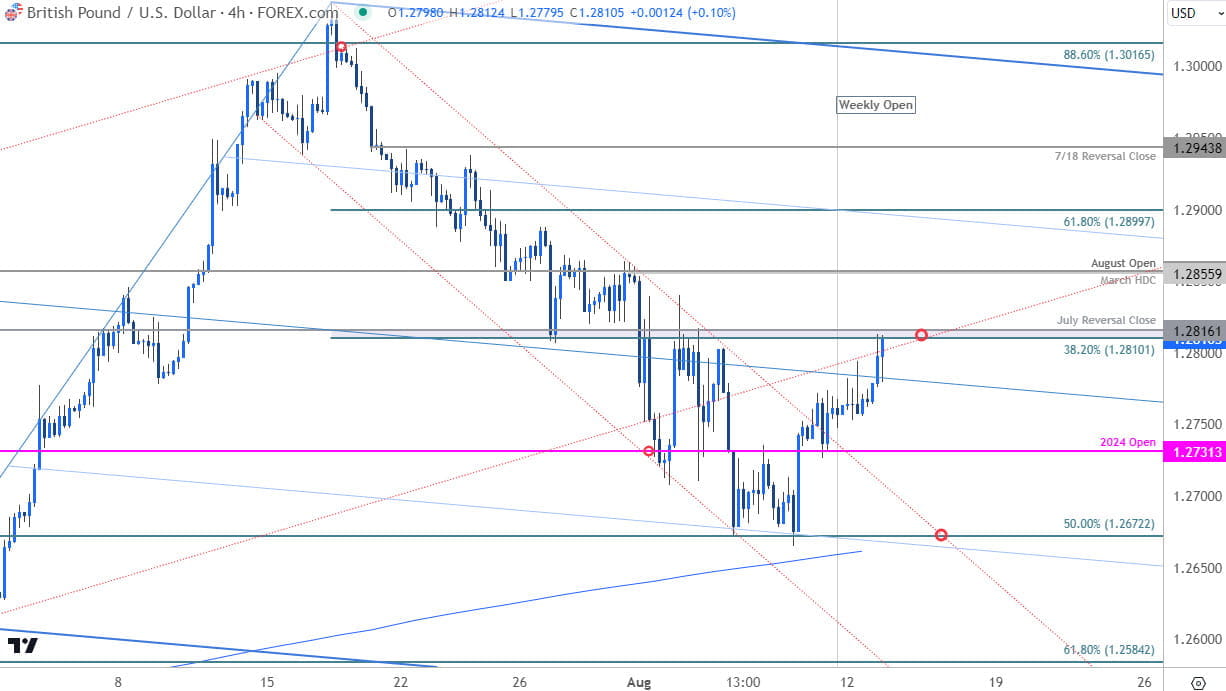

- Resistance 1.2816, 1.2857/68 (key), 1.2943- Support 1.2731/60, 1.2640/44, 1.2584

The British Pound plummeted on the heels of today’s Bank of England interest rate cut with GBP/USD poised to mark the largest single-day loss since April. The decline takes Sterling into confluent technical support at the April uptrend and the battle lines are drawn heading into Non-Farm Payrolls tomorrow. These are the levels that matter on the Sterling short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this GBP/USD setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Short-term Outlook we noted that a, “V-shaped recovery of more than 1.8% takes GBP/USD back into the same key resistance zone at 1.2816/57 – a region defined by the July weekly-reversal close, the December swing high, and the 2024 high-day close (HDC). The focus is on a reaction into this key threshold this week...” Sterling ripped higher the following day with the rally extending 3.4% off the July low before exhausting into technical resistance around the 1.30-handle.

A three-week decline off those highs is now testing confluent support at 1.2731/60- a region defined by objective 2024 yearly open and the 38.2% retracement of the yearly range. Note that basic channel support off the yearly lows also converges on this threshold and a break / weekly close below would be needed to invalidate the April uptrend. Such a scenario would expose subsequent support objectives at the July open / 200-day moving average at 1.2640/44 and the 61.8% Fibonacci retracement at 1.2584.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD trading within the confines of an embedded descending channel formation with the lower parallel further highlighting support into the yearly open. Initial resistance is eyed back at the 2023 July weekly-reversal close at 1.2816 and is backed by the March high-day close (HDC) / weekly open at 1.2857/68- we’ll reserve this threshold as our near-term bearish invalidation and a break / daily close above would be needed to alleviate further downside pressure. Topside breakout levels in the event of a breach are eyed at the 7/18 reversal close at 1.2943 with key resistance steady at 1.3000/16.

Bottom line: The British Pound is testing major technical support at the lower bounds of a multi-month uptrend support. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to the weekly opening-range highs IF price is heading lower here with a break / weekly close below the yearly open needed to fuel the next leg lower in price.

Keep in mind we are in the early throws of the August opening-range with US Non-Farm Payrolls (NFP) on tap tomorrow. Stay nimble into the release and watch the weekly closes here for guidance. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD trade levels.

Key GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold Short-term Technical Outlook: XAU/USD Bulls Get Tested

- Canadian Dollar Short-term Outlook: USD/CAD Rally Rips to Resistance

- US Dollar Short-term Outlook: USD Sell-off Sinks to Multi-Month Lows

- Australian Dollar Short-term Outlook: AUD/USD Key Support Test

- Euro Short-term Technical Outlook: EUR/USD Bulls Eye Range Resistance

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex