US Dollar Outlook: GBP/USD

GBP/USD attempts to retrace the decline from the weekly high (1.2715) as the US Retail Sales report shows a 0.1% rise in May versus forecasts for a 0.2% print, but the British Pound may face headwinds ahead of the Bank of England (BoE) rate decision as the UK Consumer Price Index (CPI) is anticipated to show slowing inflation.

British Pound Forecast: GBP/USD to Face Slowing UK CPI Ahead of BoE

Keep in mind, GBP/USD failed to test the March high (1.2894) as the Federal Reserve kept US interest rates on hold, and it remains to be seen if the BoE will follow a similar approach as the central bank warns that ‘monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

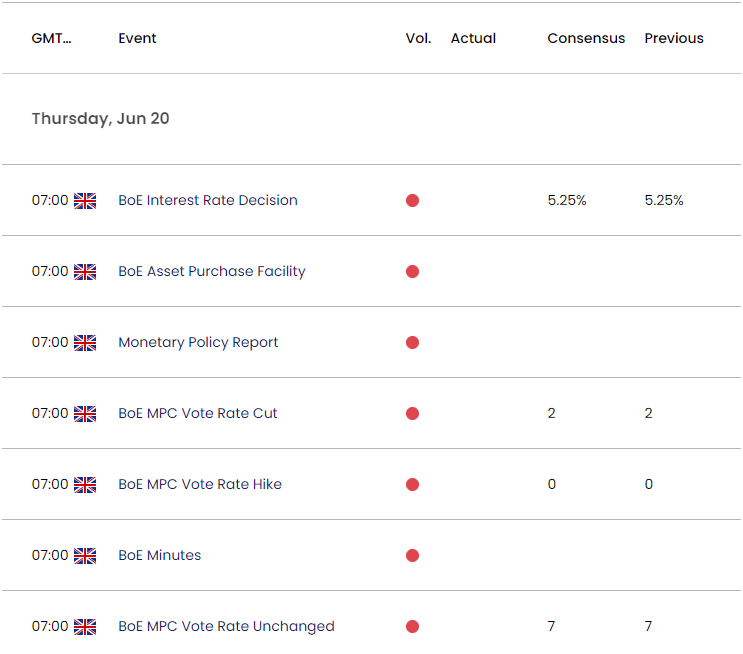

UK Economic Calendar

However, the UK CPI may encourage the BoE to adjust the forward guidance for monetary policy should the headline and core reading for inflation narrow in May, and signs of easing price growth may drag on GBP/USD as it puts pressure on the Monetary Policy Committee (MPC) to adopt a less restrictive policy.

At the same time, a higher-than-expected CPI report may push the BoE to further combat inflation, and evidence of persistent price growth may generate a bullish reaction in the British Pound as it raises the MPC’s scope to keep UK interest rates higher for longer.

As a result, the majority of the BoE may vote to retain the current policy, and another 7 to 2 split may keep GBP/USD afloat over the remainder of the month as Governor Andrew Bailey and Co. appear to be on a similar path to its US counterpart.

Nevertheless, the MPC may show a greater willingness to support the economy amid ‘a range of views about the extent of the evidence that was likely to be needed to warrant a change in Bank Rate,’ and a change in the BoE’s forward guidance may influence the near-term outlook for GBP/USD as market participants brace for a change in regime.

With that said, GBP/USD may give back the advance from the May low (1.2446) if it struggles to defend the monthly low (1.2657), but the exchange rate may trade within a defined range amid the flattening slope in the 50-Day SMA (1.2614).

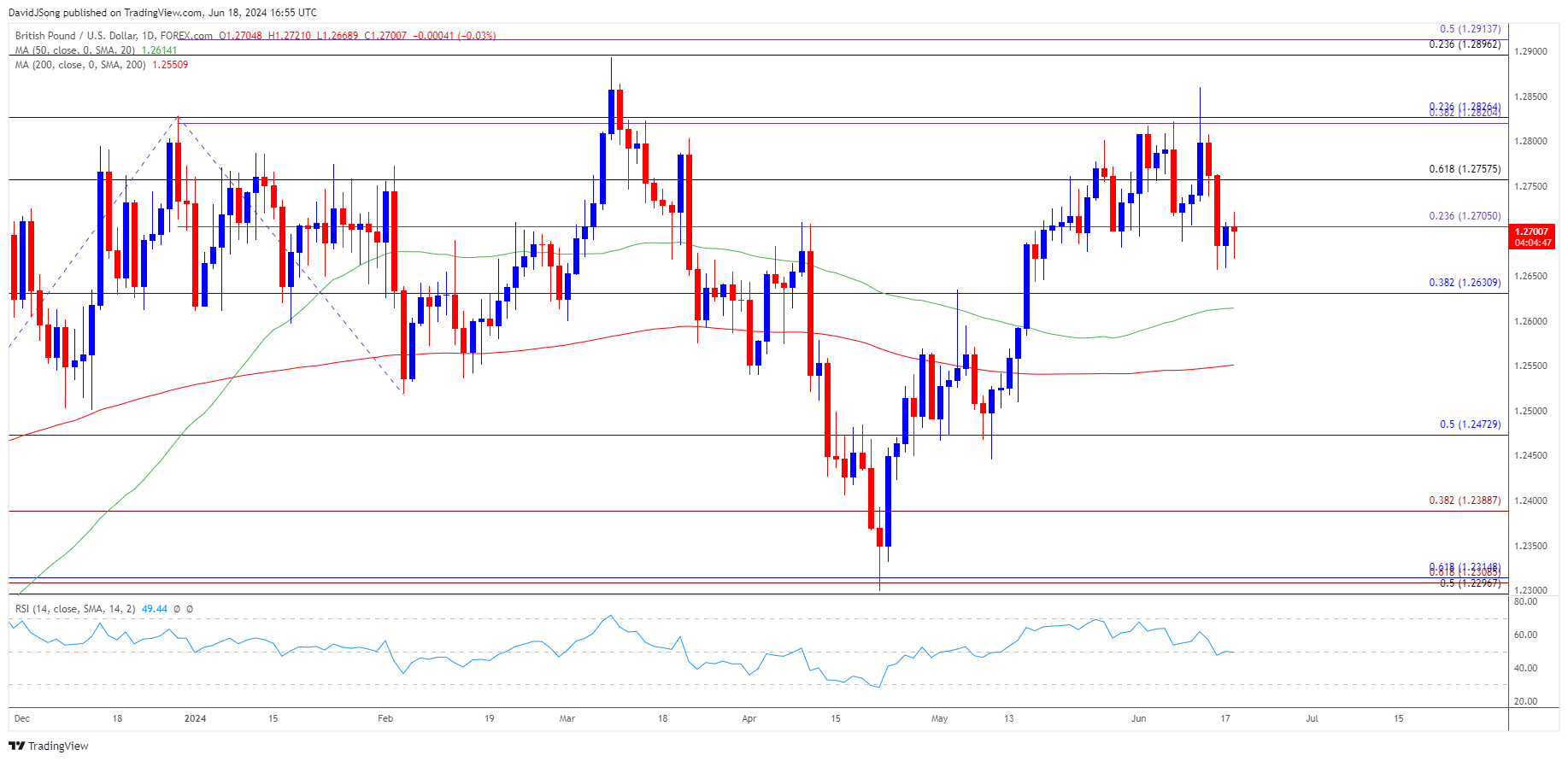

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD seems to be defending the monthly low (1.2657) as it initiates a series of higher highs and lows, with a breach above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region bringing the March high (1.2894) back on the radar.

- Next area of interest comes in around 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension), but failure to defend the monthly low (1.2657) may push GBP/USD towards 1.2630 (38.2% Fibonacci retracement).

- A move below the 50-Day SMA (1.2614) opens up 1.2470 (50% Fibonacci retracement), but GBP/USD may face range bound conditions amid the flattening slope in the moving average.

Additional Market Outlooks

US Dollar Forecast: EUR/USD Susceptible to Test of May Low

USD/JPY Reverses Ahead of June High with Fed and BoJ on Tap

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong