GBP/USD Key Points

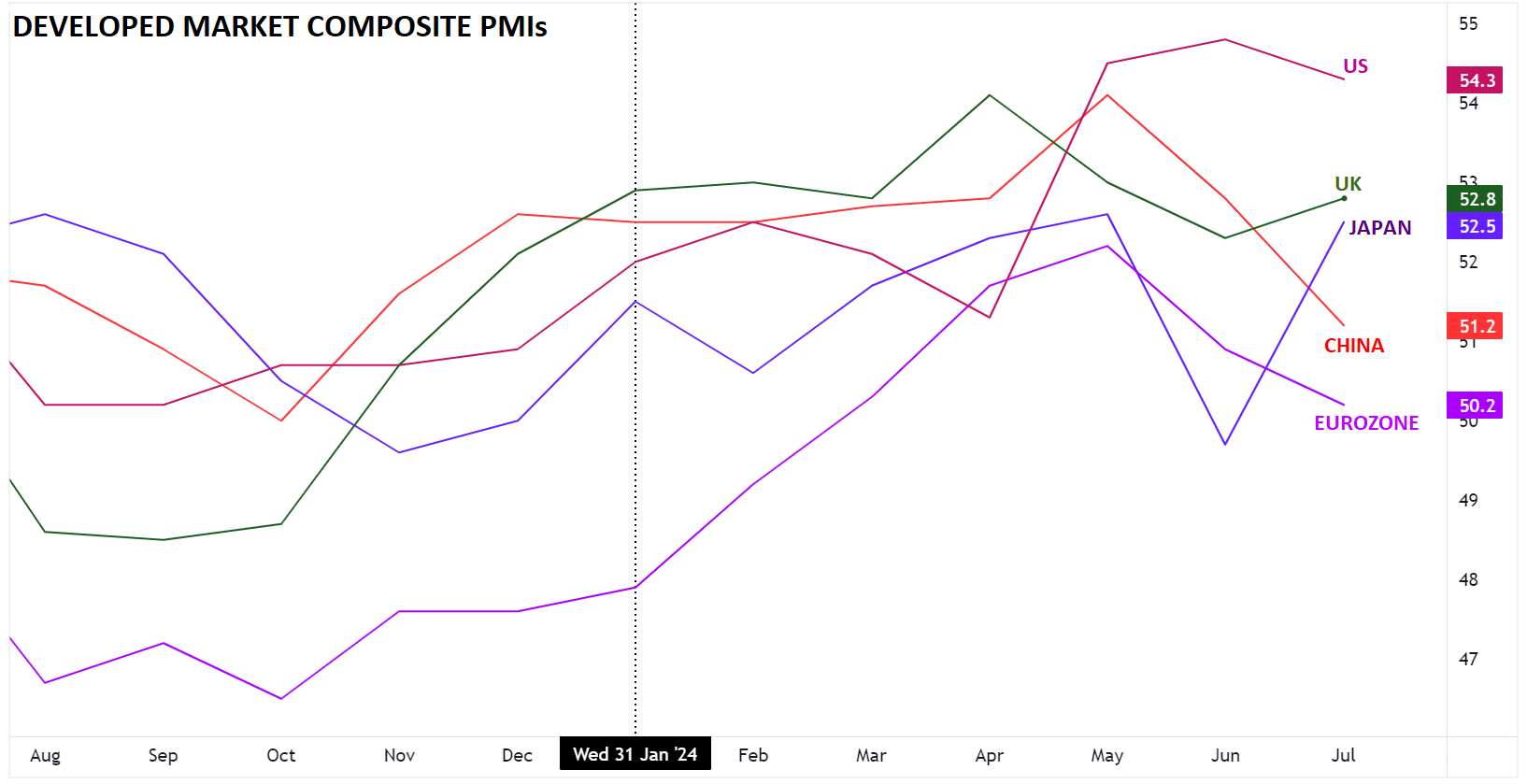

- The UK economy is still performing well and showing consistent growth (>50) per recent PMI figures

- Tomorrow’s Flash PMI reading will likely be the biggest economic release of the week for GBP/USD

- A confirmed break above previous highs in the 1.3050 zone opens the door for a continuation toward 1.3150, whereas a reversal near here could take the pair back toward previous-resistance-turned-support in the upper-1.28s next

For economic data (if not necessarily price action) the first few days of this week have been a proverbial “calm before the storm.” Rather than key in to the third- and fourth-tier economic data releases just because they’re the only thing on the calendar, traders have been trying to frontrun the more significant economic developments scheduled for release in the back half of the week, including tomorrow’s Flash PMI surveys and Friday’s highly-anticipated Jackson Hole keynote speech by Fed Chairman Powell.

Keying in on the former, the UK was actually the best-performing developed economy in the first half of the year based on the timely PMI survey. Even after ticking down a bit this summer, the UK (green) economy is still performing relatively well and showing consistent growth (>50) by this measure:

Source: TradingView, StoneX

With expectations centered on a reading in the mid-52s, tomorrow’s Flash PMI reading will likely be the biggest economic release of the week for sterling, which as we note below, is on testing a key level against the US dollar.

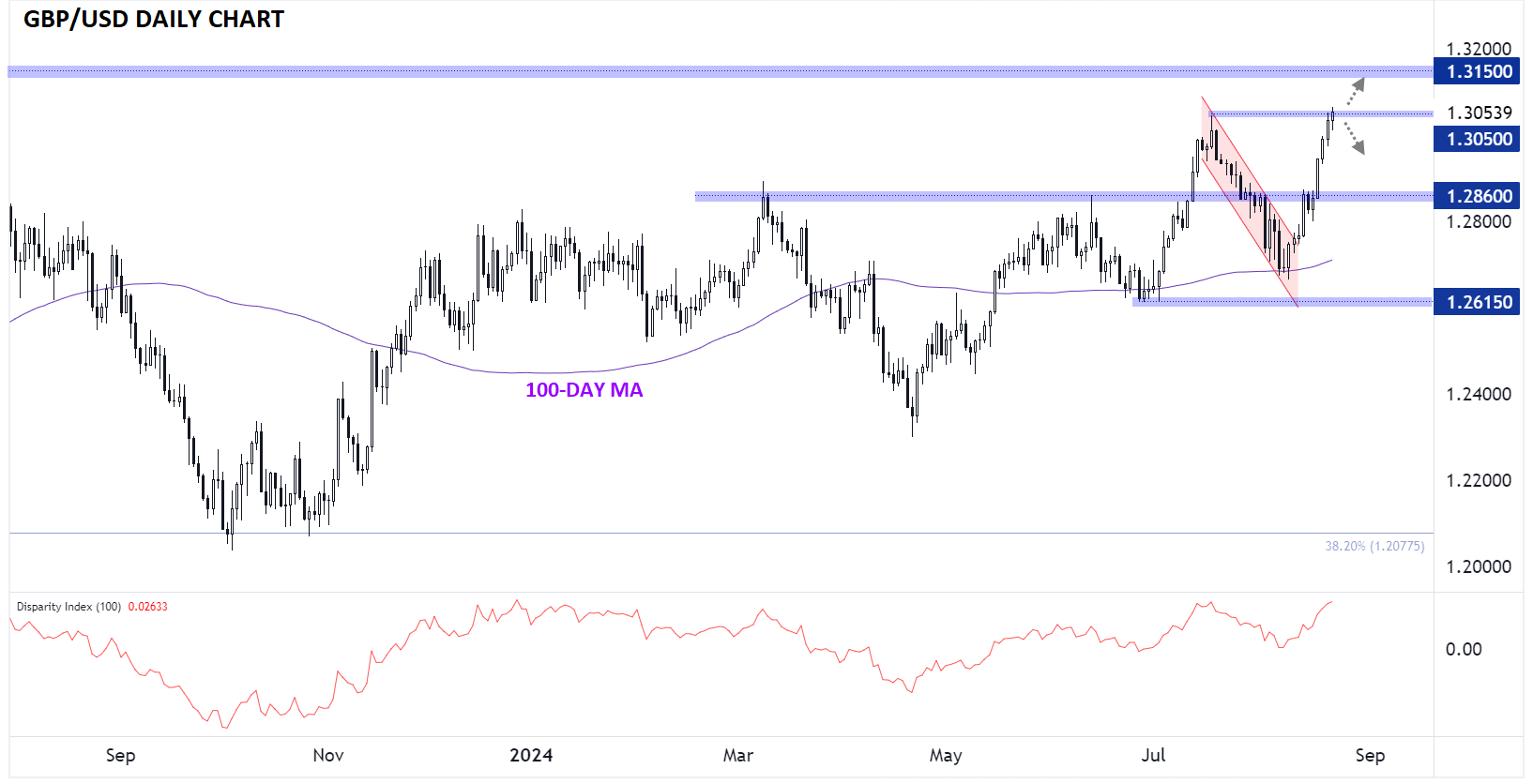

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Looking at the chart, GBP/USD has seen a tremendous surge over the past two weeks. Cable was trading closer to 1.2700 earlier this month before rising 8 of the last 9 days (and currently working on 9 of the last 10) to hit a 13-month high at 1.3050 as of writing.

Despite the impressive short-term momentum (or perhaps because of it), GBP/USD is now reaching an overbought extreme. As the subpanel on the chart above shows, the disparity of the currency pair from its 100-day MA has reached 3%, the most extreme deviation from its medium-/longer-term trend this year. Therefore, GBP/USD may be more vulnerable than usual to mean reversion if the UK PMIs come in below expectations (or developments on the US side of the Atlantic come in better than anticipated).

Regardless, the battlelines are clearly drawn – a confirmed break above previous highs in the 1.3050 zone opens the door for a continuation toward 1.3150, whereas a reversal near here could take the pair back toward previous-resistance-turned-support in the upper-1.28s next.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX