British Pound Outlook: GBP/USD

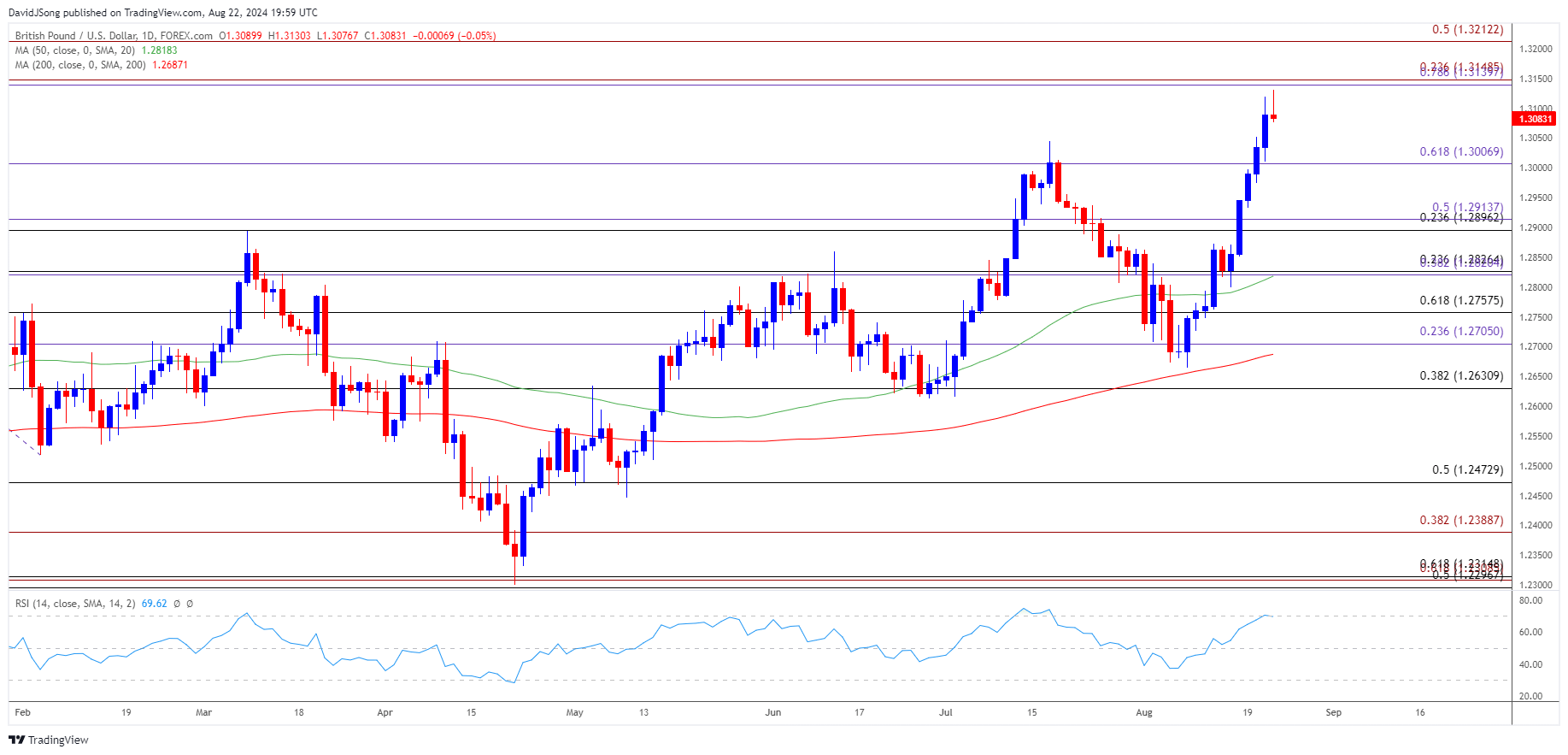

The recent advance in GBP/USD seems to have stalled ahead of the 2023 high (1.3143) as it pulls back from fresh yearly high (1.3130), but the rally may persist as the Relative Strength Index (RSI) flirts with overbought territory.

British Pound Forecast: GBP/USD Rally Eyes 2023 High

Keep in mind, GBP/USD took out the July high (1.3045) earlier this week even though the Bank of England (BoE) shifts gears ahead of the Federal Reserve, and the British Pound may continue to outperform against its US counterpart as the 50-Day SMA (1.2818) reestablishes a positive slope.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

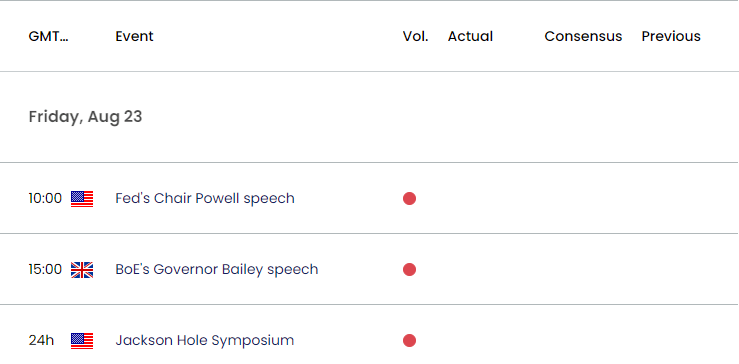

Economic Calendar

With that said, it remains to be seen if the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming will influence GBP/USD as Fed Chairman Jerome Powell and BoE Governor Andrew Bailey are scheduled to speak at the event, but the exchange rate may continue to trade to fresh yearly highs as it extends the bullish price series from last week.

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD may attempt to test the 2023 high (1.3143) as it continues to carve a series of higher highs and lows, with a break/close above the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) region opening up 1.3210 (50% Fibonacci extension).

- A further advance in GBP/USD should keep the Relative Strength Index (RSI) in overbought territory, but the oscillator may show the bullish momentum abating if it struggles to hold above 70.

- A move below 1.3010 (61.8% Fibonacci extension) may push GBP/USD back towards the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) area, with the next region of interest coming in around 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement).

Additional Market Outlooks

Gold Price Forecast: XAU/USD Pullback Keeps RSI Below 70

Canada Retail Sales Report Preview (JUN 2024)

AUD/USD Rally Pushes RSI Towards Overbought Territory

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong