British Pound Outlook: GBP/USD

GBP/USD approaches the April 2022 high (1.3167) as a bull-flag formation appears to be unfolding, with the recent advance in the exchange rate pushing the Relative Strength Index (RSI) into overbought territory for the first time in 2023.

British Pound Forecast: GBP/USD Bull Flag Formation Unfolds

GBP/USD continues to trade to fresh yearly highs in July as it extends the advance following the larger-than-expected slowdown in the US Consumer Price Index (CPI), and the move above 70 in the RSI is likely to be accompanied by a further advance in the exchange rate like the price action from 2021.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

UK Economic Calendar

Looking ahead, the update to the UK Consumer Price Index (CPI) may sway GBP/USD as Bank of England (BoE) Governor Andrew Bailey argues that ‘both price and wage increases at current rates are not consistent with the inflation target,’ and signs of sticky inflation may generate a bullish reaction in the British Pound as it puts pressure on the central bank to pursue a more restrictive policy.

However, a marked slowdown in the UK CPI may lead to a wider dissent within the Monetary Policy Committee (MPC) amid the 7 to 2 split seen at the June meeting, and it remains to be seen if Governor Bailey and Co. will alter the forward guidance at the next interest rate decision on August 3 as ‘CPI inflation was expected to fall significantly further during the course of the year.’

Until then, developments coming out of the US may also influence GBP/USD as the Federal Reserve is expected to implement higher interest rates later this month, and a hawkish rate-hike may prop up the Greenback as the Summary of Economic Projections (SEP) show a steeper path for the Fed Funds rate.

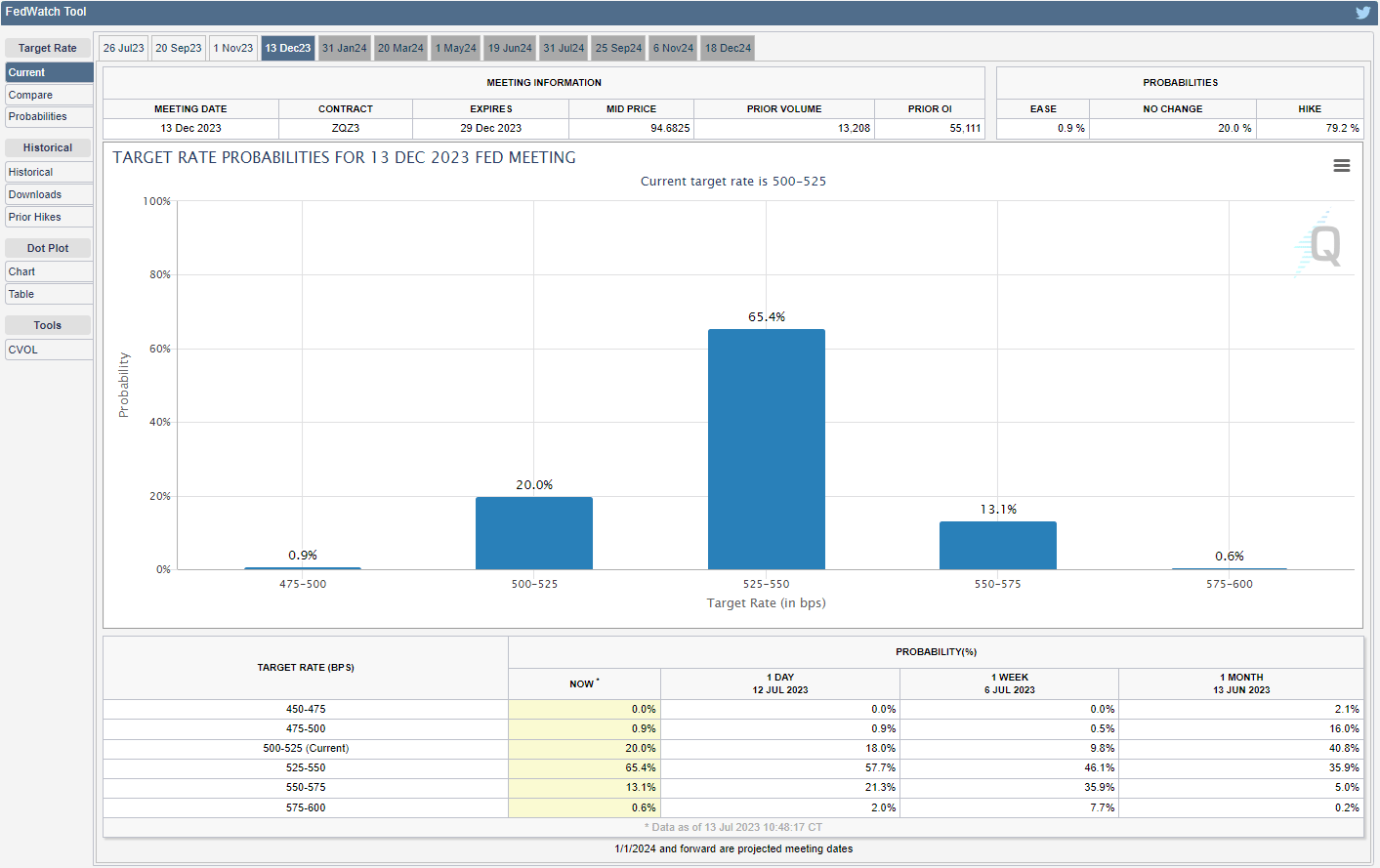

Source: CME

However, the CME FedWatch Tool reflects growing speculation for a looming change in Fed policy as it now shows a greater than 80% probability of seeing the benchmark interest rate at 5.25% to 5.50% in December, and the US Dollar may face headwinds ahead of the FOMC decision on June 26 as the central bank appears to be nearing the end of its hiking-cycle.

With that said, recent price action may lead to a test of the April 2022 high (1.3167) as GBP/USD extends the series of higher highs and lows carried over from last week, and the move above 70 in the Relative Strength Index (RSI) is likely to be accompanied by a further advance in the exchange rate like the price action from 2021.

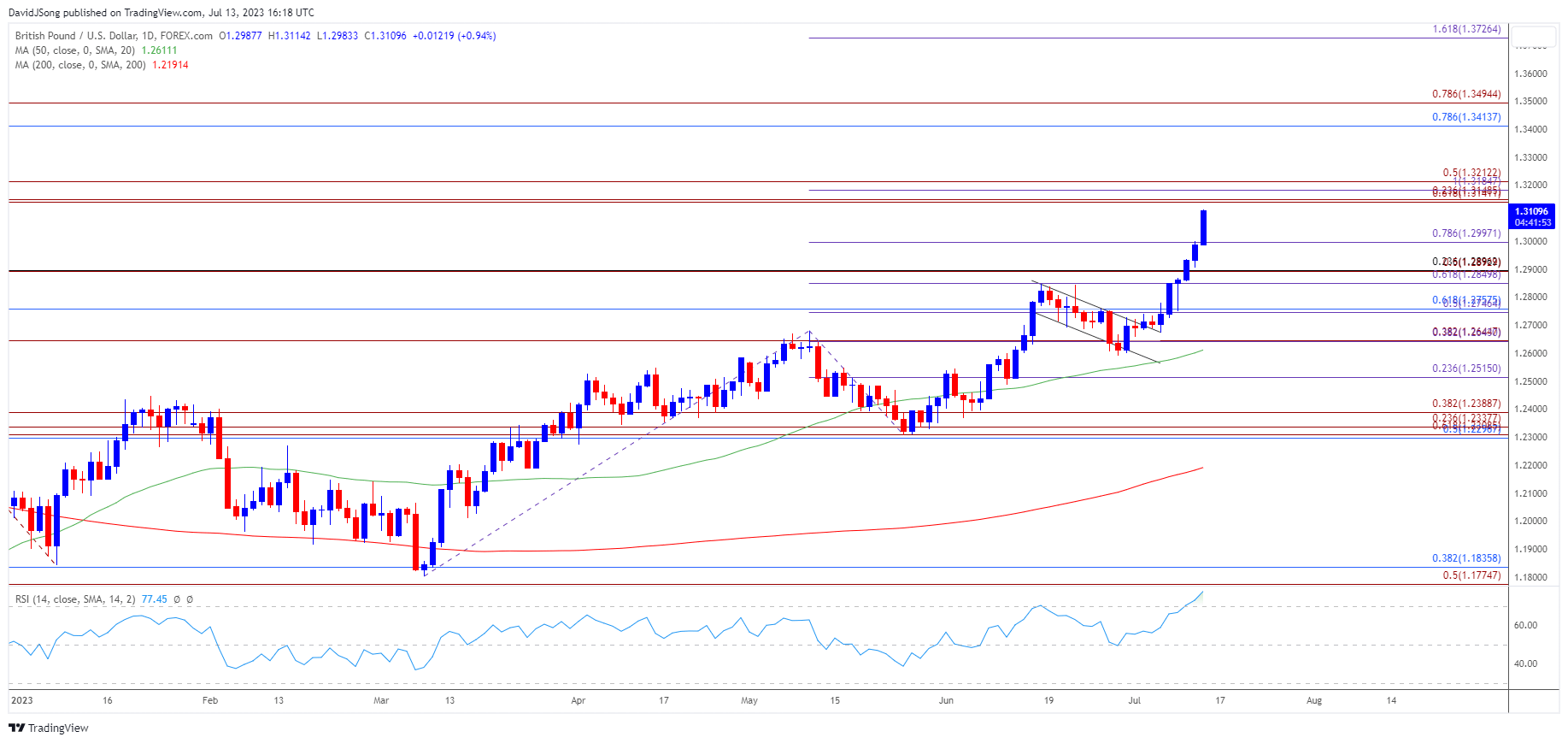

British Pound Price Chart – GBP/USD Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- A bull flag formation appears to be unfolding as GBP/USD clears the June high (1.2848), with the advance in the exchange rate pushing the Relative Strength Index (RSI) into overbought territory for the first time in 2023.

- GBP/USD may continue to trade to fresh yearly highs as long as the RSI holds above 70, with a move above the April 2022 high (1.3167) opening up the 1.3410 (78.6% Fibonacci retracement) to 1.3500 (78.6% Fibonacci extension) region, which includes the March 2022 high (1.3438).

- However, failure to break/close above the 1.3140 (61.8% Fibonacci extension) to 1.3210 (50% Fibonacci extension) area may curb the bullish reaction action in GBP/USD, with a move below the 1.3000 (78.6% Fibonacci extension) handle bringing the 1.2850 (61.8% Fibonacci extension) to 1.2900 (23.6% Fibonacci retracement) region back on the radar.

Additional Market Outlooks

USD/CAD Reveres Ahead of 50-Day SMA to Snap July Opening Range

EUR/USD Clears Monthly Opening Range to Eye April High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong