British Pound Technical Forecast: GBP/USD Weekly Trade Levels

- British Pound plummets into confluent support at the 2023 yearly-open

- GBP/USD medium-term outlook on hinges on monthly opening—range breakout

- Sterling resistance 1.2315/97, 1.25, 1.2720/73 – Support 1.2084-1.2113, 1.1841, 1.1632

The British Pound plunged more than 8.4% off the yearly highs verse the US Dollar with GBP/USD carving the October opening-range just above key support at the objective yearly open. The focus is on a breakout of this key range in the weeks ahead with the broader July decline vulnerable while above this zone. These are the updated targets and invalidation levels that matter on the GBP/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Weekly Forecast we noted that the freefall in GBP/USD was, “approaching a key technical confluence into channel support. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards 1.21- rallies should be limited to 1.2397 IF price is heading lower with a break below channel support needed to mark resumption of the July downtrend.”

Sterling briefly registered an intraday low at 1.2037 before rebounding sharply with a six-day rally faltering last week into confluent resistance at 1.2314/97- a region defined by the 61.8% Fibonacci retracement of the yearly range, the May low-week close and the January high-week close. We’ll continue to reserve this range as our bearish invalidation level with a breach / weekly close above ultimately needed to invalidate the July downtrend. Subsequent resistance objectives eyed at the 1.25-handle backed by a more significant confluent zone at 1.2720/73.

Weekly support remains unchanged at the objective yearly open / 2023 low-week close at 1.2084-1.2113- a break / weekly close below this threshold is needed to fuel the next major leg lower in price towards channel support / January lows at 1.1841.

Bottom line: The British Pound is trading within a well-defined range just above key support– price has now tested both support & resistance and keeps the focus on a breakout of the 1.2084-1.2397 range for directional guidance. From a trading standpoint, the bears are vulnerable while above the yearly open- rallies should be limited to 1.2315 IF price is heading lower on this stretch with a break / close below this key support zone needed to mark resumption of the July downtrend. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

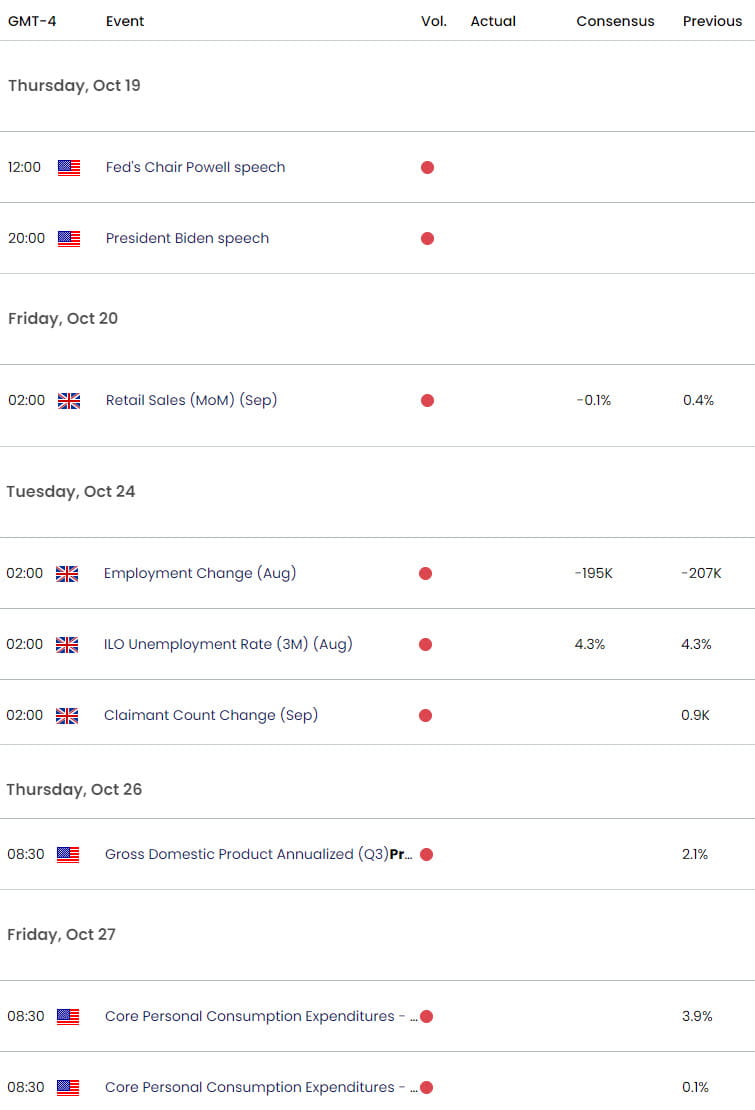

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- US Dollar (DXY)

- Gold (XAU/USD)

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex