British Pound Technical Forecast: GBP/USD Weekly Trade Levels

- British Pound rally stalls in into uptrend resistance- risk for exhaustion / price inflection

- GBP/USD September range intact ahead of Fed, BoE rate decisions- breakout pending

- Resistance 1.3273 (key), 1.3413, 1.3671/85– Support 1.3091, 1.30, 1.2731/73 (key)

The British Pound is poised for a breakout with GBP/USD trading within a well-defined monthly opening-range just below trend resistance. The focus is on a breakout in the days ahead with the Federal Reserve and Bank of England interest rate decisions on tap over the next 72 hours. These are the levels that matter on the GBP/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In my last British Pound Weekly Forecast we noted that GBP/USD had, “exhausted into uptrend resistance last week and although the broader outlook is still constructive, the risk remains for a bull market correction towards trend support. From a trading standpoint, losses should be limited to the 1.30-handle IF price is heading higher on this stretch with a close above 1.3273 needed to fuel the next leg in price.” Sterling dropped nearly 2% off those highs with price registering an intraweek low at 1.3002 last week before rebounding. The September opening-range is now set (1.3239-1.3002) – looking for the breakout in the days ahead.

Initial support rests at the 1.30-handle and is backed by the objective yearly open / February 2019 swing low at 1.2731/73- losses should be limited to this threshold IF Sterling is heading higher here. Broader bullish invalidation now rests with the 2024 low-week close (LWC) at 1.2494.

Resistance remains with the 2021 low-week close at 1.3273- a breach / weekly close above the median-line would be needed to mark uptrend resumption towards subsequent resistance objectives at the 78.6% retracement of the 2021 decline near 1.3414 and 1.3671/85- a region defined by the 1.618% Fibonacci extension of the October advance and the 2022 high-week close (HWC). Look for a larger reaction there IF reached.

Bottom line: The British Pound is trading just below trend resistance with the September opening-range intact heading into the FOMC and BoE interest rate decisions. The immediate focus is on a breakout with the long-bias vulnerable sub-1.3273. From a trading standpoint, losses should be limited to 1.2731 IF Sterling is heading higher on this stretch with a close above the median-line needed to mark uptrend resumption.

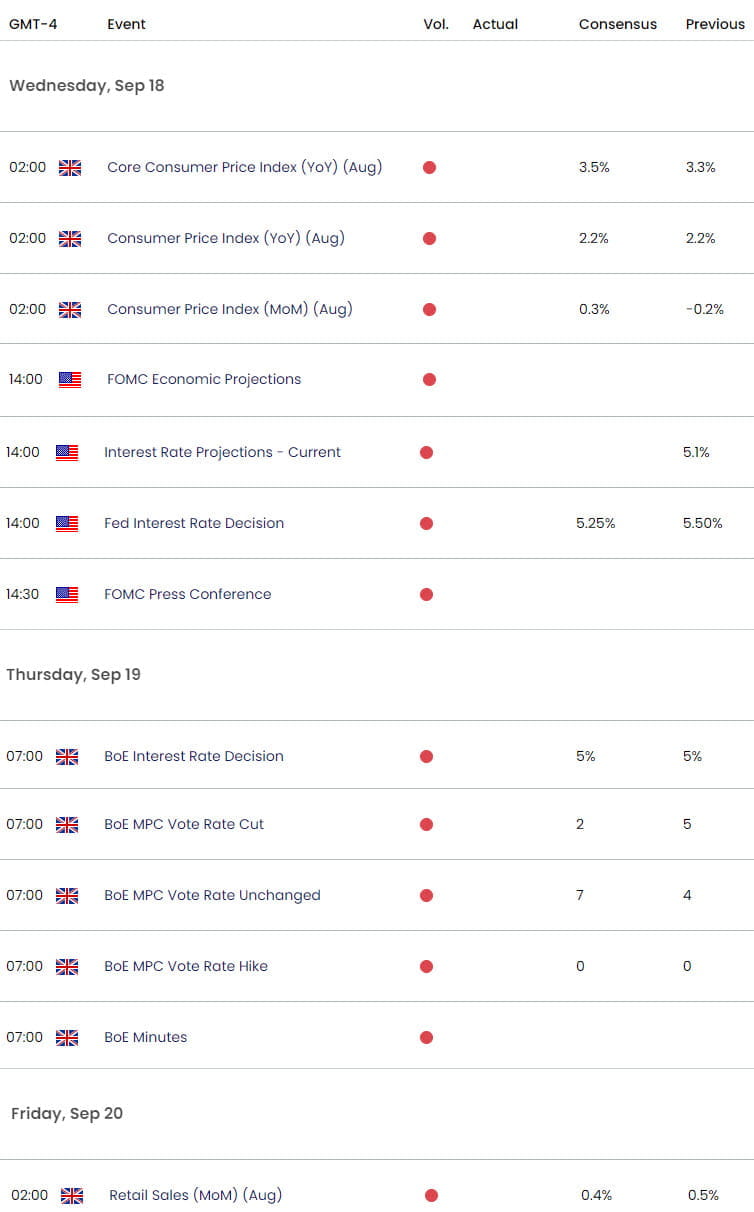

Keep in mind that we get the updated summary of economic projections and interest rate dot-plot from the Fed tomorrow with the Bank of England on tap Thursday. Stay nimble into the releases and watch the weekly close here for guidance. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Australian Dollar (AUD/USD)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- US Dollar Index (DXY)

- Euro (EUR/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex