Brazilian Real Talking Points:

- I’ve been discussing rate cut potential out of Brazil and this week saw that theme begin in a surprising manner as Copom cut rates by 50 basis points, to 13.25%. The wider expectation was for a 25 bp move and that surprise helped to stoke Real weakness against both the US Dollar and the Euro.

- EUR/BRL was holding a key support level coming into this week and that rate cut helped to propel price higher. However, EUR/BRL still remains below key resistance so bulls will need to continue to press to force trends higher. USD/BRL touched a trendline ahead of the Friday NFP report, which brought a strong drive of USD-weakness which helped to offset some of the prior move.

Rate cuts have been rumored around Copom for some time now but few were expecting to hear what happened this week, as the bank cut rates by 50 basis points. Markets were looking for a more moderate 25 bp hike as the first move of loosening in this cycle, and when 50 was announced instead a push of BRL weakness entered the equation.

In USD/BRL, the pair put in a strong bounce on Thursday and that propelled price from the same long-term support that I’ve been discussing of late, and up to the batch of swing highs from earlier in July. There was also a resistance assist from a bearish trendline that can be found by connecting March and May swing highs. Friday brought a change of pace as the US Dollar pulled back after NFP and that erased some of the move, but as we’ll see on a shorter-term chart, this could have bullish continuation potential given the leap in price over the past week.

USD/BRL Daily Chart

Chart prepared by James Stanley; USD/BRL via Tradingview

Chart prepared by James Stanley; USD/BRL via Tradingview

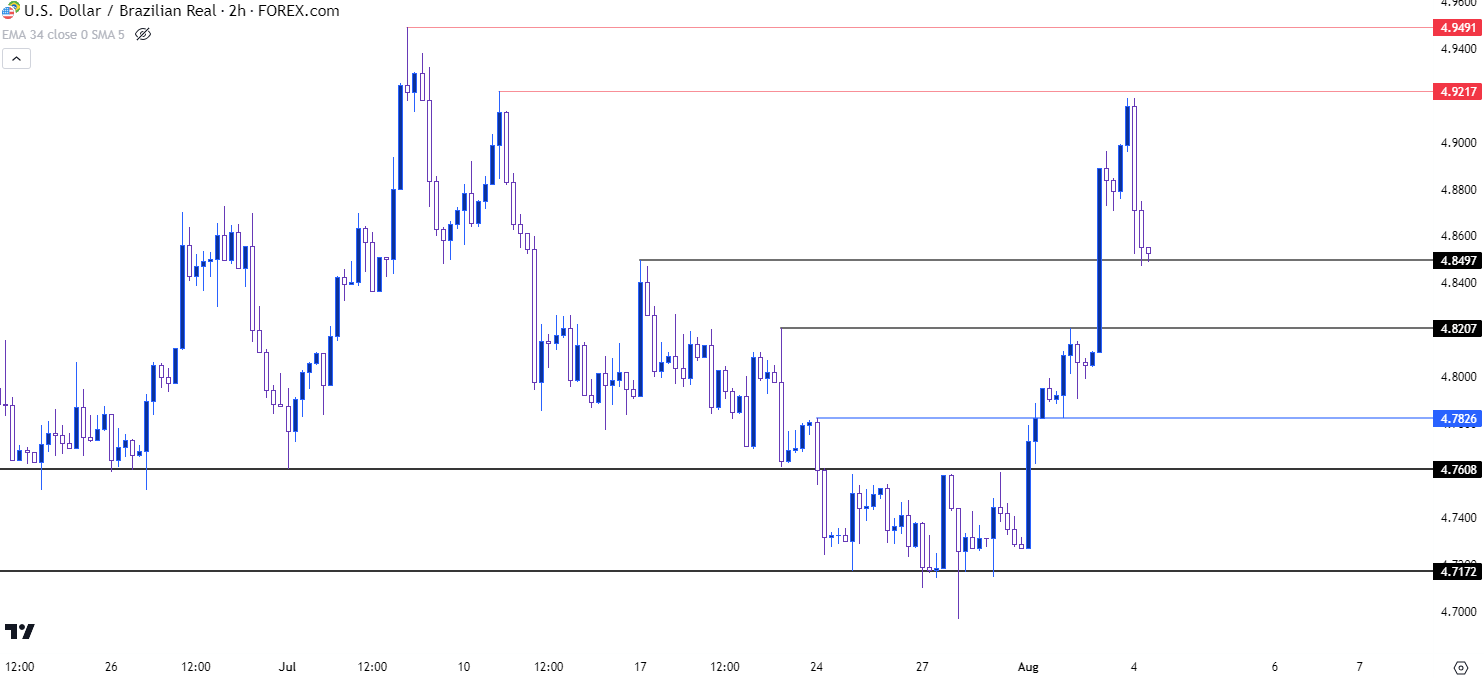

USD/BRL Shorter-Term

From the four-hour chart below, we can see a fresh higher-high, and we can also see a portion of that breakout erased during Friday trade. But this does keep open the door for higher-low support and given the proximity on the chart to longer-term support, there’s a few areas of note.

Price is already testing one of those levels around the 4.85 level, and there’s another similar spot of prior resistance that could function as higher-low support, and this plots around the 4.82 handle. If bulls can’t hold that, then the next spot of support would be around the 4.7826 level before a return to longer-term support.

USD/BRL Two-Hour Price Chart

Chart prepared by James Stanley; USD/BRL via Tradingview

Chart prepared by James Stanley; USD/BRL via Tradingview

EUR/BRL

The week began with a grinding support test in EUR/BRL, and this was at the same level that I’ve been talking about in these Real Technical Analysis pieces, plotted at the Fibonacci level of 5.1987. That same price had already held the lows on Thursday and Friday of the prior week, and it did the same on Monday and Tuesday.

Bulls finally responded on Tuesday and news of the rate cut helped to further the move in the middle of the week, eventually prodding price back above the 5.31 level.

At this point from the daily chart, price remains in a range and we’re in the upper half of that mean reversion at the moment, which can be an inopportune time for directional plays. What could make that more enticing however is a pullback to support at that familiar 5.31 area with a show of support from bulls. On the other side of the coin resistance has remained in-place since mid-May, and a push up to that spot with a hold could keep range continuation scenarios in order on the pair. That resistance plots at 5.4144.

Above that resistance, the next level of interest plots at 5.4380 and that was a lower-high, so bulls taking that out would be a higher-high and would point to the possibility of bullish trend scenarios.

EUR/BRL Daily Price Chart

Chart prepared by James Stanley; EUR/BRL via Tradingview

Chart prepared by James Stanley; EUR/BRL via Tradingview

--- written by James Stanley, Senior Strategist