Brazilian Real Talking Points:

- The Brazilian Real showed strength against both the Euro and US Dollar this week, with supports coming into play in both markets.

- USD/BRL continues to hold near longer-term support around the 4.75 handle, while EUR/BRL is holding a key spot of support after setting a fresh monthly high to begin the week.

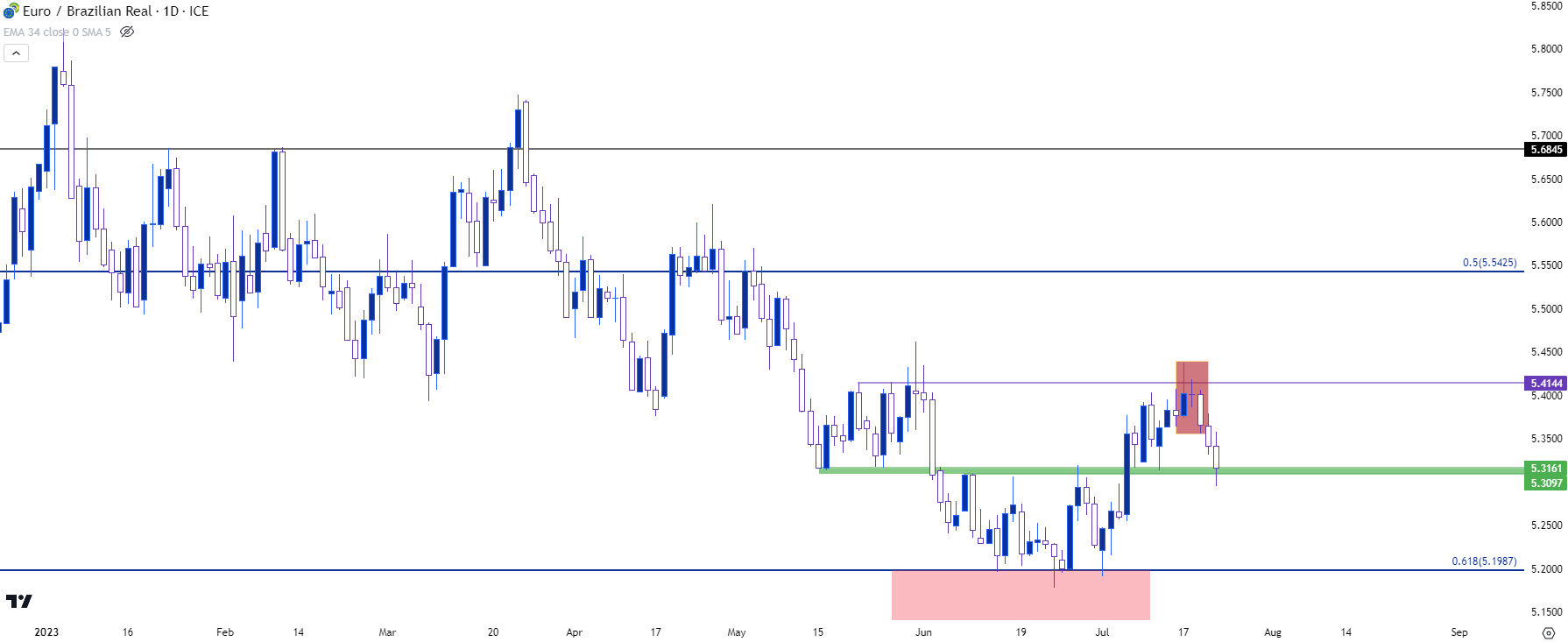

It was a week of strength for the Brazilian Real against both the Euro and US Dollar. While EUR/BRL retains some bullish tendencies as Monday saw the pair set a fresh monthly high, the rest of the week was decisively more bearish as it allowed for the build of a bearish outside bar on the weekly chart. Outside bars, similar to engulfing patterns, are often tracked with aim of continuation.

The other side of the matter is the fact that price stalled at the same support that’s been in-play previously after showing as resistance in June. This is around the 5.31 level and it remains a factor for next week.

EUR/BRL Weekly Price Chart

Chart prepared by James Stanley; EUR/BRL via Tradingview

Chart prepared by James Stanley; EUR/BRL via Tradingview

EUR/BRL Shorter-Term

From the daily chart, we can see that support coming back into the picture on Friday. There was an evening star formation that completed on Wednesday which helped to lead into that deeper pullback. So this sets up a possible bearish scenario on the shorter-term chart, but bears will still need to contend with that key support at 5.31 which bent, but didn’t break on the daily chart during Friday trade.

EUR/BRL Daily Price Chart

Chart prepared by James Stanley; EUR/BRL via Tradingview

Chart prepared by James Stanley; EUR/BRL via Tradingview

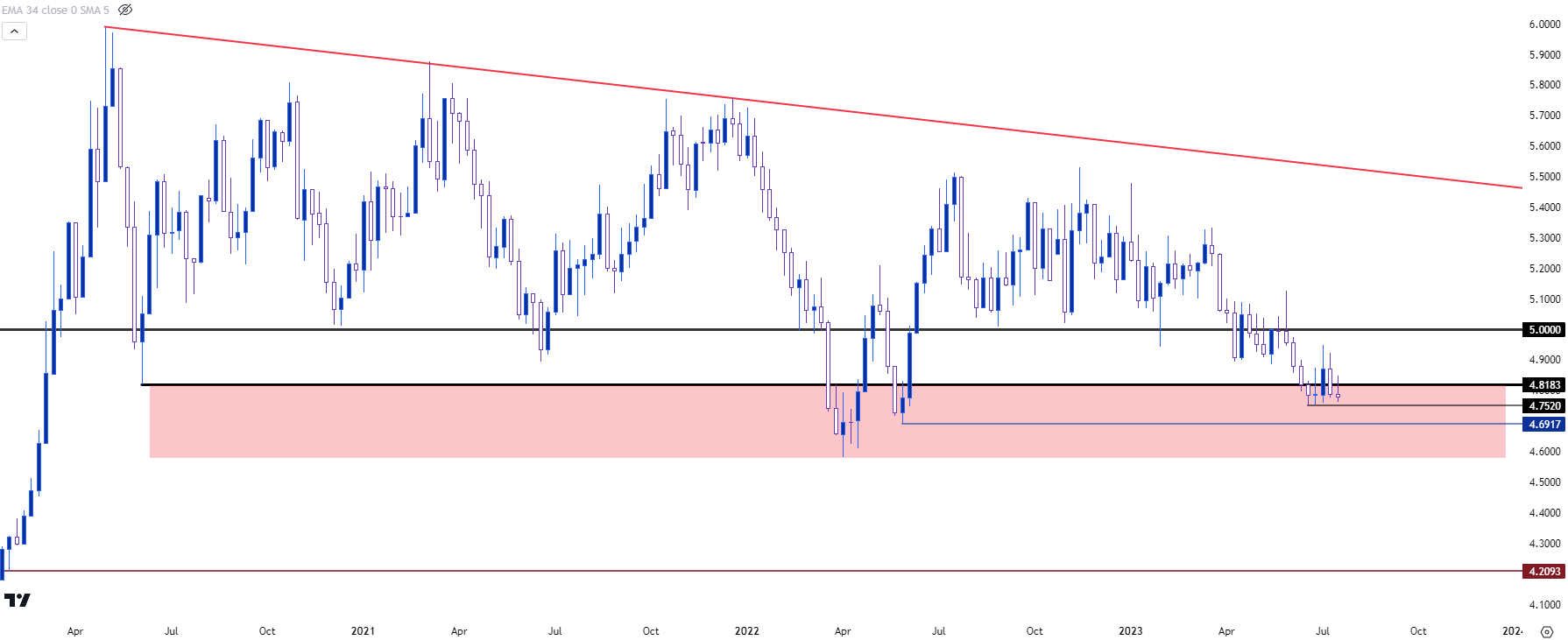

USD/BRL

The US Dollar showed strength against the Euro this week and that return of USD strength helped USD/BRL to hold support above a key spot on the chart at the 4.75 handle. This is the same support that built a morning star formation through late-June and early-July, and the low point of that setup hasn’t yet been traded through, which keeps the door open for reversal potential in the pair.

From the technical vantage point, there’s not much besides that stall at support that could be attractive for bulls. On the fundamental side, however, there may be something of note as Copom is expected to begin cutting rates while the Fed is expected to hike one more time, per CME Fedwatch. If the Fed does signal another rate hike on the horizon at next week’s rate decision, that bullish argument on the fundamental side of USD/BRL could gain some attraction.

A stall at support could be a first step towards reversal, and next week’s headlines will likely have some toll on whether this stall turns into something more.

USD/BRL Weekly Chart

Chart prepared by James Stanley; USD/BRL via Tradingview

Chart prepared by James Stanley; USD/BRL via Tradingview

--- written by James Stanley, Senior Strategist