Bullish Factors

-

Fed officials at the Jackson Hole symposium may advocate further interest rate readjustments throughout the year, which could contribute to strengthening the US currency.

-

China's economy may continue to signal an economic slowdown and difficulties in its real estate sector, dampening foreign investors' appetite for risky assets and weakening the real.

Bearish Factors

-

The possibility of a final vote on the fiscal framework in the Chamber of Deputies would increase optimism about the Brazilian macroeconomic and fiscal scenario. It may contribute to attracting foreign investment, strengthening the real.

-

Disclosure of the IPCA-15 should reinforce the perception that inflation in Brazil is moderating. There is room for the Central Bank to maintain its pace of interest rate cuts, strengthening the real.

Week in review

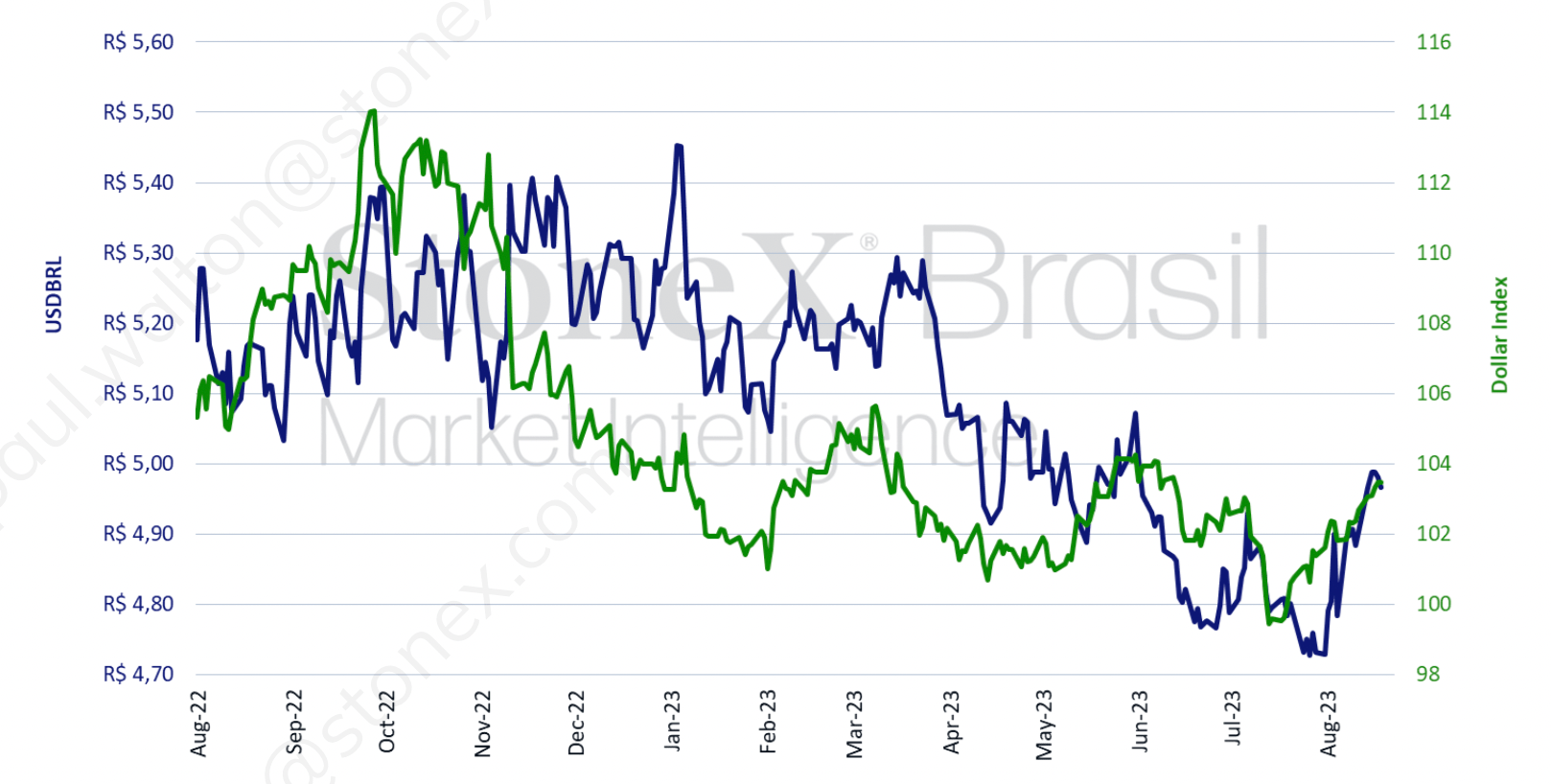

The USDBRL ended the week higher for the third consecutive week, ending the session on Friday (18) quoted at BRL 4.966, a variation of +1.3% in the week, +5.0% in the month and -5.9% in the year. The dollar index closed this Friday's session at 103.5 points, a weekly gain of 0.8%, a monthly gain of 1.8% and an annual gain of 0.2%.

The foreign exchange market echoed the release of the minutes of the Federal Open Market Committee (FOMC) decision, concerns about the Chinese economy and its real estate sector and friction between the Administration and the Chamber of Deputies.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

THE MOST IMPORTANT EVENT: Jackson Hole Symposium

Expected impact on USDBRL: bullish

The focus of investors this week should be on the annual Jackson Hole monetary policy symposium held by the Federal Reserve (Fed), which will take place from Thursday (24) to Saturday (26). While most of the discussion is more academic, Fed Chairman Jerome Powell's opening remarks and several interviews with central bank officials contain important clues to the evolution of global economic policy and are closely watched by investors. The theme of this year's Symposium is “structural changes in the global economy,” which may give rise to discussions on topics such as de-globalization, structural changes in world inflation, and interest rates that are considered neutral (that is, that do not accelerate or reduce inflation).

In recent discussions, members of the US central bank sought to reinforce the unusual character of the US economy, with falling inflation accompanied by resilience in employment and growth, stressing the importance of data released before each monetary policy decision. Thus, it is likely that, in their speeches, the authorities will try to keep the options open for the next interest rate decisions without committing to new highs or interrupting the monetary tightening cycle.

Last week, despite the latest decision of the Federal Open Market Committee (FOMC) mentioning a disagreement among its members on what the future trajectory of US interest rates should be, investors gave greater weight to the fact that “most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.” As a result, yields on 10-year US Treasuries hit their highest level in 10 years, contributing to a strengthening dollar and hurting appetite for risk assets.

Inflation in Brazil

Expected impact on USDBRL: bearish

This week the Brazilian Consumer Price Index 15 (IPCA-15) will also be released, showing a reading close to zero in the general index and growth around 0,30% in its core. The data should reinforce the perception that there is room for the Brazilian Central Bank to maintain the pace of interest rate cuts suggested in the last decision of 0.50 p.p. at each meeting. The next inflationary readings, however, should be higher due to the recent readjustment of Petrobras fuel prices, made to align domestic prices to international parity, which may influence the stance of the Monetary Policy Committee (Copom).

Possibility of voting on the fiscal framework

Expected impact on USDBRL: bearish

After the dissatisfaction of Deputies with criticism made by the Minister of Finance, Fernando Haddad, to the Chamber of Deputies, the meeting of party leaders to discuss the vote on the fiscal framework bill (PLP 93/2023) was postponed to this Monday (21). A vote could be held as early as this week if there is a deal. The text approved in the Federal Senate was different from that approved by the Chamber and, therefore, the procedural rite requires that deputies analyze only the amendments to the project, that is, the points modified by the Senators, accepting the suggestions or returning to the text initially approved in the Lower House. However, some political analysts cast doubt on this possibility due to the constant postponements of the ministerial reform in the government of Luiz Inácio Lula da Silva, which would seek to accommodate more space for center-right parties, the so-called “centrão.”

Concerns about China's economic outlook

Expected impact on USDBRL: bullish

Last week, the international business environment was one of considerable risk aversion and caution amid the release of lower-than-expected economic data for China and with Chinese real estate companies having trouble meeting their financial commitments and the most indebted of them, Evergrande, requesting the restructuring of its debts in the United States. The country's central bank even unexpectedly cut one of its benchmark interest rates, lowering the interest on one-year loans from 2.65% p.a. to 2.50% p.a., but it was not enough to calm investors. There is an expectation that the Chinese authorities will continue to announce new incremental measures to regain the confidence of market players.

Key Indicators

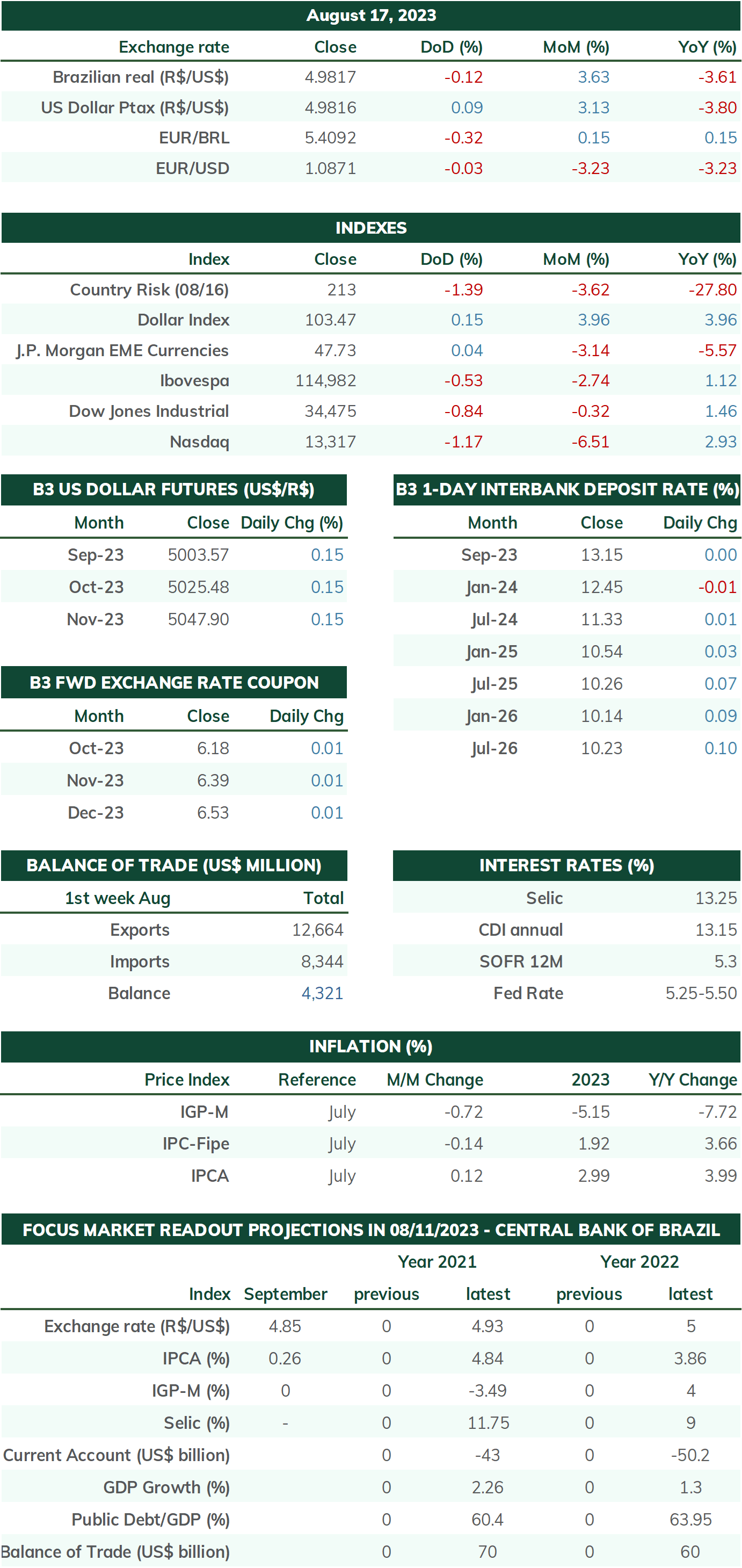

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

Analysis by: Leonel Oliveira Mattos ([email protected]), Alan Lima ([email protected]), and Vitor Andrioli ([email protected]). Translation by Rodolfo Abachi ([email protected]).

Financial editor: Paul Walton ([email protected]).