Bank of Japan (BoJ) Interest Rate Decision

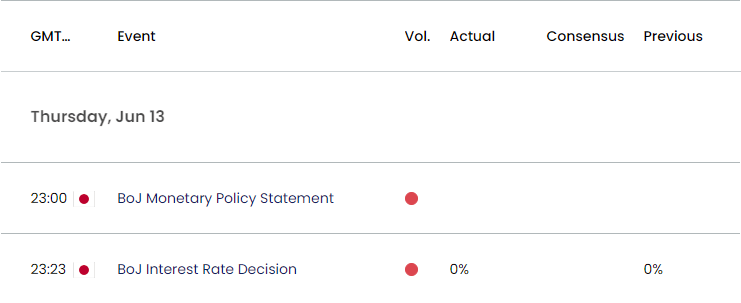

The Bank of Japan (BoJ) voted unanimously to keep interest rates at 0.0% to 0.1% in June 2024, while the central bank reiterated its plan from the March meeting to scale back its non-standard tools.

Japan Economic Calendar – June 14, 2024

According to the official statement, the BoJ ‘will decide on a detailed plan for the reduction of its purchase amount,’ with Governor Kazuo Ueda and Co. going to stay that ‘it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

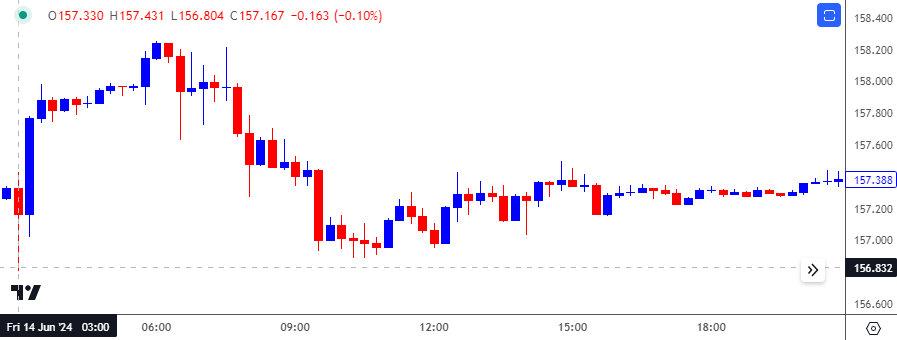

USD/JPY Price Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

USD/JPY climbed to a session high of 158.26 as the BoJ stuck to the status quo, but the market reaction unraveled as the exchange rate closed the day at 157.39. Nevertheless, the Japanese Yen struggled to hold its ground following the BoJ meeting as USD/JPY staged a five-day rally to approach the April high (160.22).

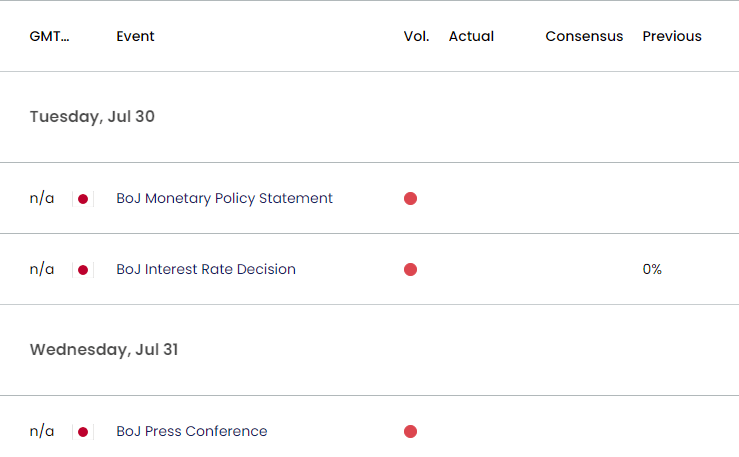

Looking ahead, the BoJ may stick to the sidelines even though ‘underlying CPI inflation is expected to increase gradually,’ and more of the same from the BoJ may generate a similar reaction to the June meeting as the central bank shows little intentions of carrying out a rate-hike cycle.

At the same time, Governor Ueda and Co. may pursue a restrictive policy as ‘Japan's economy is likely to keep growing at a pace above its potential growth rate,’ and a BoJ rate-hike may generate a bullish reaction in the Japanese Yen as market participants prepare for a change in regime.

Additional Market Outlooks

AUD/USD Forecast: RSI Recovers from Oversold Zone

US Dollar Forecast: GBP/USD Tests Former Resistance Zone for Support

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong