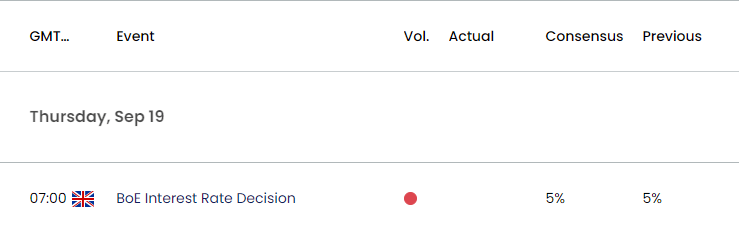

Bank of England (BoE) Interest Rate Decision

The Bank of England (BoE) reduced UK interest rates by 25bp in August, with the Monetary Policy Committee (MPC) voting 5-4 to lower the Bank Rate to 5.00% from 5.25%.

UK Economic Calendar – August 1, 2024

The minutes from the BoE meeting showed the majority voted for a rate-cut as ‘it was appropriate to reduce slightly the degree of policy restrictiveness,’ while four members preferred to keep UK interest rates on hold as ‘underlying domestic inflationary pressures appeared more entrenched.’

Despite the dissent within the MPC, the central bank emphasized that ‘monetary policy would need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term had dissipated further.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

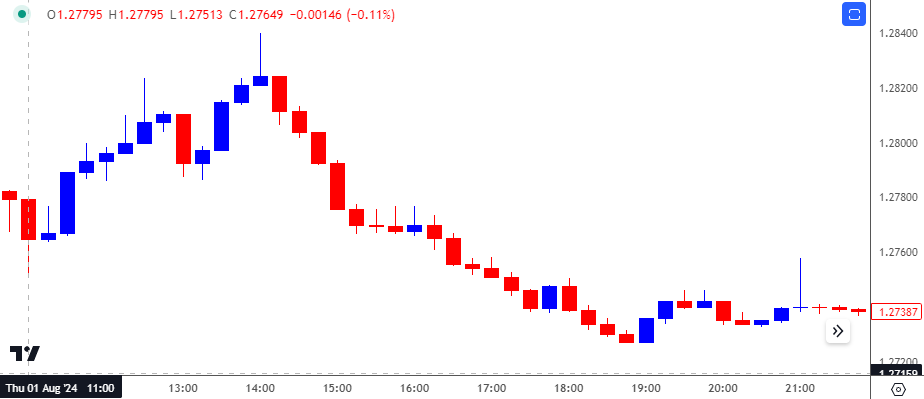

GBP/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

GBP/USD showed a limited reaction to the BoE rate-cut as it climbed above 1.2800 following the announcement but the exchange rate struggled to hold its ground as it closed the day at 1.2740. Nevertheless, the weakness in GBP/USD was short-lived as it closed the week at 1.2803.

Looking ahead, the BoE is expected to keep the Bank Rate at 5.00% in September following the 25bp rate-cut at the last meeting.

With that said, the BoE rate decision may generate a bullish reaction in the British Pound should Governor Andrew Bailey and Co. show a greater willingness to further combat inflation, but Sterling may face headwinds if the MPC prepares UK households and businesses for a less restrictive policy.

Additional Market Outlooks

AUD/USD on Cusp of Testing August High following Fed Rate Cut

EUR/USD Struggles to Test Monthly High Ahead of Fed Rate Decision

US Dollar Forecast: USD/JPY Clears December Low with Fed on Tap

GBP/USD Bull-Flag Starts to Unfold ahead of Fed and BoE Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong