Bank of England (BoE) Interest Rate Decision

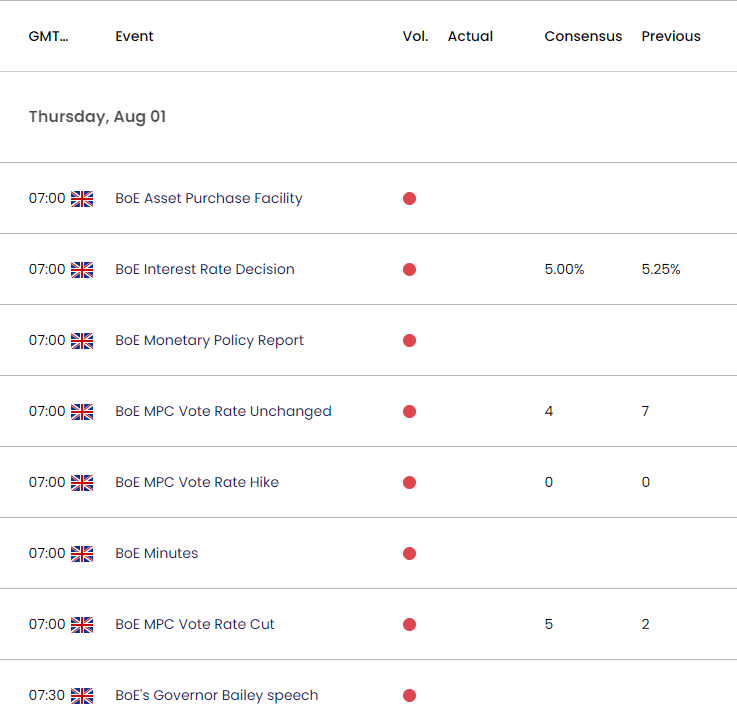

The Bank of England (BoE) voted 7 to 2 in June to keep the Bank Rate at 5.25%, with two officials pushing for a rate-cut as monetary policy ‘needed to become less restrictive now to enable a smooth and gradual transition in the policy stance.’

UK Economic Calendar – June 20, 2024

The Monetary Policy Committee (MPC) warned that ‘monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target’ and went onto say that ‘the Committee would keep under review for how long Bank Rate should be maintained at its current level.’

The comments suggest the Governor Andrew Bailey and Co. are in no rush to switch gears as inflation is expected to ‘increase slightly in the second half of this year, to around 2½%,’ but a growing number of BoE officials may adjust their stance as ‘the Committee recognised that the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

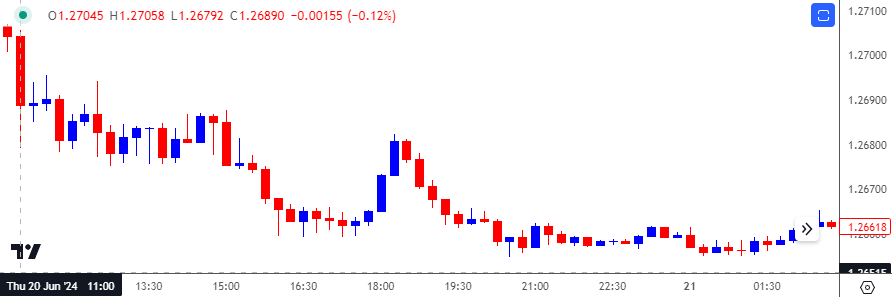

GBP/USD Price Chart –15 Minute

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

GBP/USD gave back the advance from the start of the week even as the BoE kept UK interest rates on hold, with the exchange rate struggling closing the day at 1.2655. The decline in GBP/USD carried into the end of the week as the exchange rate slipped to a fresh monthly low (1.2622) following the BoE meeting.

Looking ahead, the BoE is expected to deliver a 25bp rate in July, and a change in regime may produce headwinds for the British Pound as market participants brace for a less restrictive policy.

However, the majority of the MPC may keep UK interest rates on hold amid the stickiness in the UK Consumer Price Index (CPI), and another 7 to 2 split may generate a bullish reaction in the British Pound as the central bank continues to combat inflation.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Holds Above Former Resistance

AUD/USD Forecast: RSI Recovers from Oversold Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong