Bank of Canada (BoC) Interest Rate Decision

The Bank of Canada (BoC) continued to unwind its restrictive policy in July, with the central bank reducing the benchmark interest rate by 25bp to 4.50% from 4.75%.

Canada Economic Calendar – July 24, 2024

According to the quarterly Monetary Policy Report (MPR), ‘consumer price index (CPI) inflation in Canada is moving closer to the 2% target as monetary policy works to reduce price pressures.’

In turn, the BoC insists that ‘inflation is no longer broad-based’ after delivering its second consecutive rate-cut, and it remains to be seen if Governor Tiff Macklem and Co. will continue to switch gears over the remainder of the year as ‘core inflation is expected to ease to about 2.5% in the second half of 2024.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

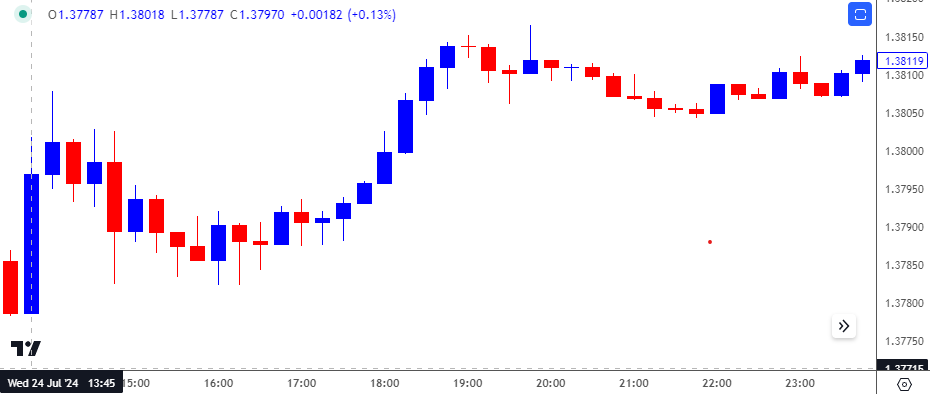

USD/CAD Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/CAD on TradingView

The Canadian Dollar came under pressure as the BoC delivered another rate-cut, with USD/CAD appreciating throughout the day to close at 1.3817. The weakness in Loonie persisted throughout the remainder of the week as USD/CAD closed at 1.3849.

Looking ahead, the BoC is expected to reduce the benchmark interest rate by 25bp to 4.25% in September from 4.50%.

With that said, another BoC rate-cut may produce headwinds for the Canadian Dollar like the reaction from the previous meeting, but the policy meeting may generate a bullish reaction in Loonie should the central bank keep Canada interest rates on hold.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of March Low

GBP/USD Pullback Brings RSI Back from Overbought Zone

AUD/USD Vulnerable amid Struggle to Test January High

Euro Forecast: EUR/USD Preserves Advance Following Fed Symposium

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong