Australian Technical Forecast: AUD/USD Weekly Trade Levels

- Australian Dollar rallies more than 7% off yearly low- three-week rally now testing resistance

- AUD/USD risk for near-term exhaustion / price infection- US Inflation data on tap

- Resistance 6793-6818 (key), 6872, 7000- Support 6673/93, 6572, 6433 (key)

The Australian Dollar ripped into key technical resistance last week with a three-week rally now testing a major pivot zone around the objective yearly open. The battle lines are drawn for the bulls at the top of a multi-year consolidation pattern. These are the levels that matter on the AUD/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar Technical Forecast we noted AUD/USD had, “defended support at the lower bounds of a multi-year trendline and puts Aussie right back in the middle of the yearly range. From a trading standpoint, losses should be limited to the weekly open IF price is heading higher on this stretch with a close above 6693 needed to suggest a more significant low was registered this week.”

Aussie ripped through this pivot zone last week with the rally now testing key technical resistance at 6794-6819- a region defined by the 61.8% extension of the April advance, the objective 2024 yearly open, and the 61.8% Fibonacci retracement of the 2023 decline. Note that the late-2023 consolidation resistance and the 2013 trendline are positioned just higher and ultimately, a breach / weekly close above the December high / 38.2% retracement at 6871/72 is needed to suggest is larger trend reversal is underway here. Initial resistance objectives eyed near the 2021 low-week close (LWC) at the 70-handle in the event of a breakout.

Initial weekly support now rests back at 6673/93- a region defined by the 2019 low, the 2008 low-week close (LWC) and the May high-week close (HWC). A break / close below this threshold would shift the focus back towards this yearly consolidation pattern – the 52-week moving average currently rests near the yearly LWC at ~6572 with critical support steady at the April LWC at 6433.

Bottom line: AUD/USD has rallied into key technical resistance near the yearly highs- risk for possible topside exhaustion / price inflection into this zone in the weeks ahead. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to 6673 IF Aussie is heading higher on this stretch with a close above 6872 needed to suggest a more significant breakout of a multi-year formation is underway.

Keep in mind we get the release of key US inflation data this week with the July Personal Consumption Expenditure (PCE) on tap Friday. Stay nimble into the release and watch the weekly close here. Review my latest Australian Dollar Short-term Outlook for a closer look at the near-term AUD/USD technical trade levels.

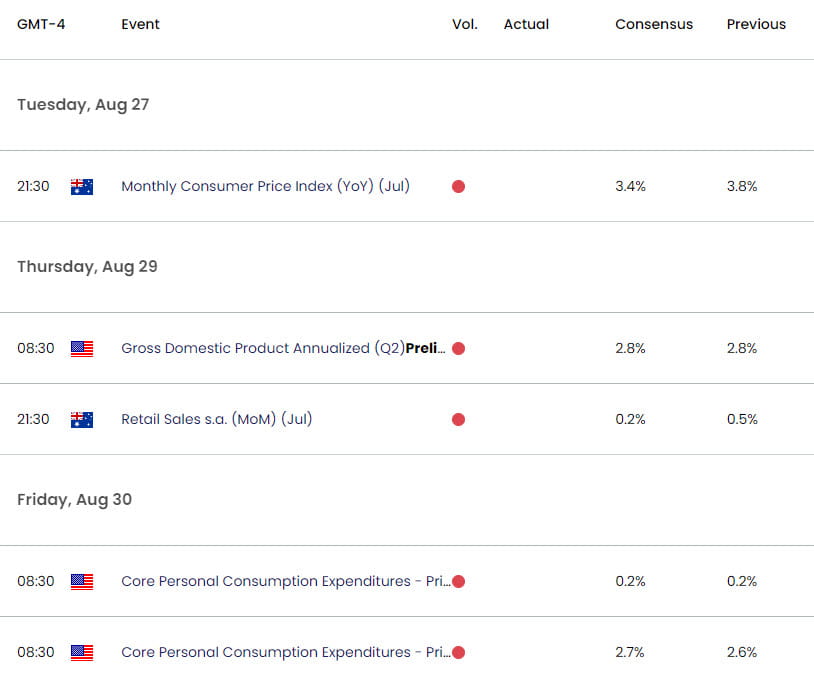

Australia / US Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- US Dollar Index (DXY)

- British Pound (GBP/USD)

- Japanese Yen (USD/JPY)

- Euro (EUR/USD)

- Gold (XAU/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex