Australian Technical Forecast: AUD/USD Weekly Trade Levels

- Australian Dollar reverses March rally- Aussie back at key support pivot

- AUD/USD contracting below multi-month trend resistance- breakout imminent

- Resistance ~6577, 6673-6707 (key), 6810/18- Support 6500/25 (key), 6335, 6283

The Australian Dollar is attempting to snap a two-week losing streak with AUD/USD trading just above a key support pivot we’ve been tracking for months now. The battle lines are drawn heading into the close of the week / month with key US inflation data on tap Friday. These are the updated targets and invalidation levels that matter on the AUD/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In last month’s Australian Dollar Technical Forecast we noted that Aussie had been testing key support for three-week and that, “rallies should be capped by 6673-6707 IF price is heading lower with a close below 6500 needed to mark resumption.” Support held into the March-open with a massive outside-reversal candle rallying nearly 3.5% to register an intraday high at 6668. Aussie has erased those gains over the past three weeks and takes price back into critical support ahead of the March close- the stage is set for a breakout in the weeks ahead.

Critical support remains unchanged at 6500/25- a region defined by the 61.8% Fibonacci retracement of the October rally and the objective December / January swing lows. Note that the yearly close-low also converges on this threshold and a break / weekly close below would be needed to mark resumption of the December downtrend. Subsequent support eyed at the 2023 low-week close (LWC) at 6335 and the 88.6% retracement of the 2022 advance at 6829.

Initial resistance now eyed with the 52-week moving average / December trendline, currently near ~6577. Critical resistance remains unchanged at by 6673-6707- a region defined by the 2008 low-week close (LWC), the 2019 low, and the 61.8% Fibonacci retracement of the December sell-off. Ultimately, a breach / close above this region is needed to validate a breakout towards the next major technical hurdle at the objective 2024 yearly open / 61.8% retracement of the 2023 range near 6816/19.

Bottom line: Aussie is back at support around the 2024 close-low with price coiling just below multi-month slope resistance. From a trading standpoint, looking for possible inflection into key support in the days ahead – rallies should be limited to the yearly moving average IF price is heading lower on this stretch with a close below 6500 needed to fuel the next major move in price.

Keep in mind we are heading into the close of the month / quarter on Friday with US Personal Consumption Expenditure (PCE) on tap ahead of the Holiday weekend. Stay nimble into the April opening-range and look for a breakout of this multi-week consolidation pattern for guidance. I’ll publish an updated Australian Dollar Short-term Outlook once we get further clarity on the near-term AUD/USD technical trade levels.

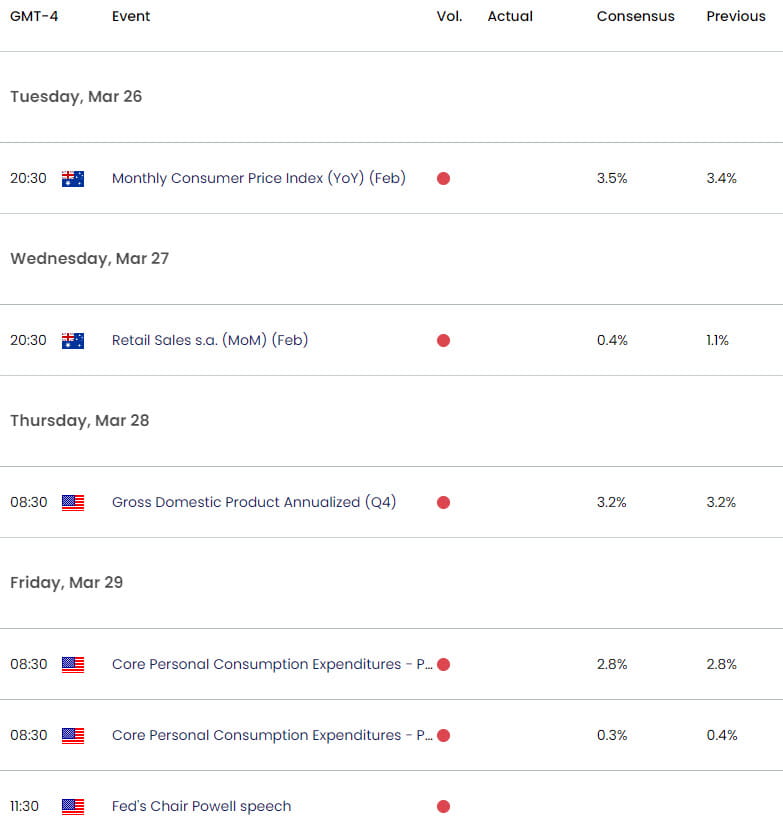

Australia / US Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- US Dollar Index (DXY)

- Crude Oil (WTI)

- S&P 500, Nasdaq, Dow

- Gold (XAU/USD)

- British Pound (GBP/USD)

- Euro (EUR/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex