Australian Dollar technical outlook: AUD/USD short-term trade levels

- Australian Dollar plunges into support pivot at monthly lows

- AUD/USD risk for further loses while below the monthly open

- Resistance 6991-7017, 7077, 7136– support 6872,6805/16 (key), 6728

The Australian Dollar plunged more than 4.4% off the monthly highs with AUD/USD now approaching a key support pivot- major test for the bears. These are the updated targets and invalidation levels that matter on the AUD/USD short-term technical chart.

Discussing this Aussie setup and more in the Weekly Strategy Webinars beginning February 27th.

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: The Australian Dollar is in retreat for the second consecutive day with AUD/USD testing the entire breath of a nine-day range this week. The sell-off takes Aussie back into the 38.2% retracement of the 2021 decline near 6872- looking for possible price inflection off this mark.

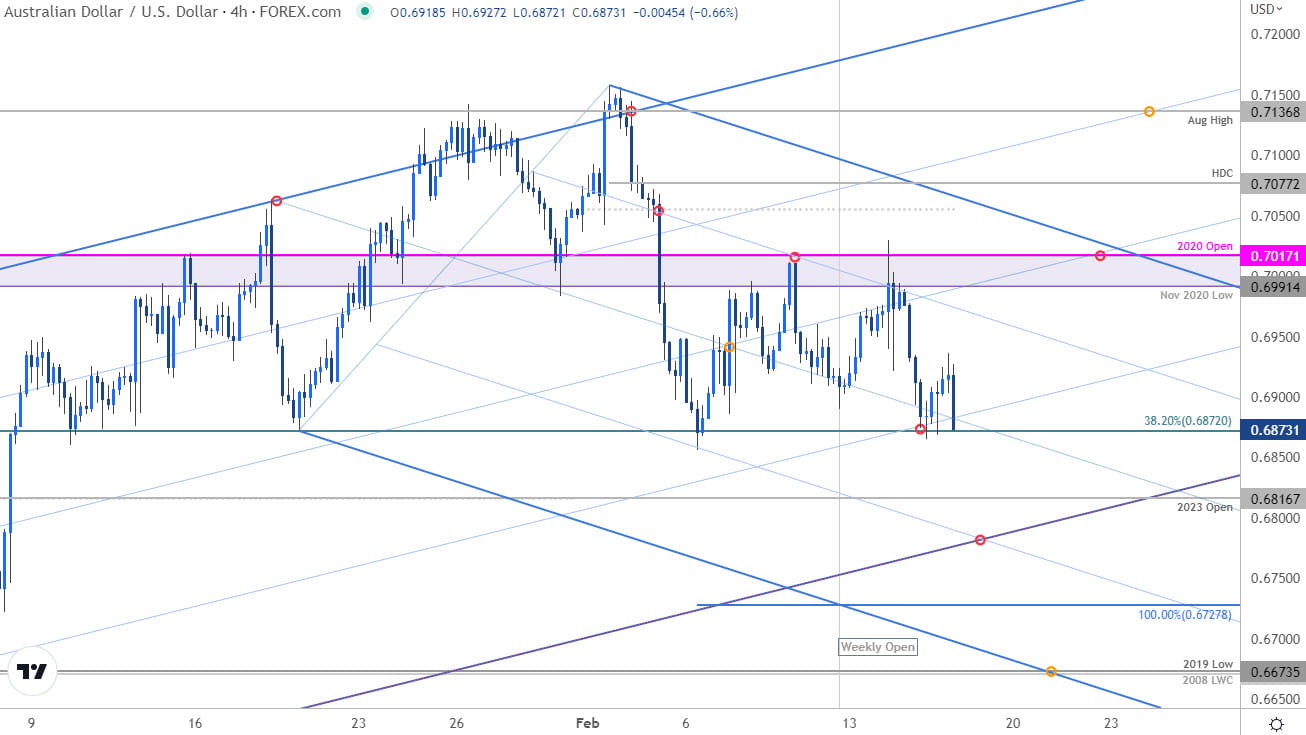

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD testing the weekly range lows in early US trade- a break / close below this threshold would expose the 200-day moving average / objective yearly open at 6805/16. Ultimately, a break below the broader October uptrend would be needed to suggest a larger reversal is underway towards the 100% extension at 6728 and the 2008 low-week close / 2019 low at 6670/73.

Initial resistance stands with the 75% parallel (currently ~6950s) backed by 6991-7017. Broader bearish invalidation rests with the yearly high-day close at 7077- a breach / close above this threshold would be needed to mark resumption of the broader uptrend.

Bottom line: AUD/USD is testing the weekly / monthly opening-range lows – looking for a reaction. From at trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards the yearly open / lower parallel- rallies should be capped by the February open at 7055 IF price is heading lower on this stretch.

Review my latest Australian Dollar weekly technical forecast for a look at the longer-term AUD/CAD trade levels.

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar short-term outlook: USD/CAD Bulls Emerge

- Euro short-term technical outlook: EUR/USD decision time

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex