Australian Dollar Technical Outlook: AUD/USD Short-term Trade Levels

- Australian Dollar plunges more than 5% off December high- breaks October uptrend

- AUD/USD sell-off approaching first major support hurdle- risk for near-term exhaustion

- Resistance 6630s, 6670/74, 6739– Support 6500/18 (key), 6400, 6321

The Australian Dollar is poised for a third-consecutive weekly decline with AUD/USD now off nearly 4.2% since the start of the year. A break below multi-month, uptrend support threatens a deeper setback here with the first major support hurdle now in view- risk for possible downside exhaustion / price inflection. These are the updated targets and invalidation levels that matter on the AUD/USD short-term technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this AUD/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar Short-term Outlook we noted that AUD/USD was approaching a major technical confluence into, “6670s – losses should be limited to 6548 IF price is heading higher with a breach / close above this key technical confluence needed to mark uptrend resumption.” Aussie faltered into this zone into the December open before plunging nearly 2.5% early in the month. A strong reversal off uptrend support days later fueled a 5.3% rally that exhausted at uptrend resistance into the close of 2024.

AUD/USD has plummeted more than 5% off those highs with price breaking below uptrend support / the 200-day moving average this week. The focus is on this decline with the first major lateral level seen just lower at 6500/17 – a region defined by the 61.8% Fibonacci retracement of the October rally, the May low-day close (LDC) and the 100% extension of the December sell-off. Looking for a larger reaction into this threshold IF reached.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD trading within the confines of a short-term descending channel extending off the highs with the lower parallel further highlighting the 6500/17 support zone. Initial resistance is eyed at the highlighted trendline confluence near ~6630s and is backed loosely by the 6670/74 pivot zone (2008 low-week close / 2019 low). Near-term bearish invalidation now lowered to the 61.8% retracement of the recent decline at 6739 with a close above 6816/18 needed to mark uptrend resumption.

A break below this key support pivot would threaten a deeper Aussie correction with such a scenario exposing the 78.6% retracement at 6400 and the 2023 low-day close (LDC) at 3621- both areas of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: The Australian Dollar has broken multi-month uptrend support with the sell-off now approaching a key inflection zone- looking for a reaction down here. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch toward 6500 – rallies should be limited to 6670 IF price is heading lower on this stretch with a close below this pivot zone needed to fuel the next major move in price. Review my latest Australian Dollar Weekly Forecast for a closer look at the longer-term AUD/USD technical trade levels.

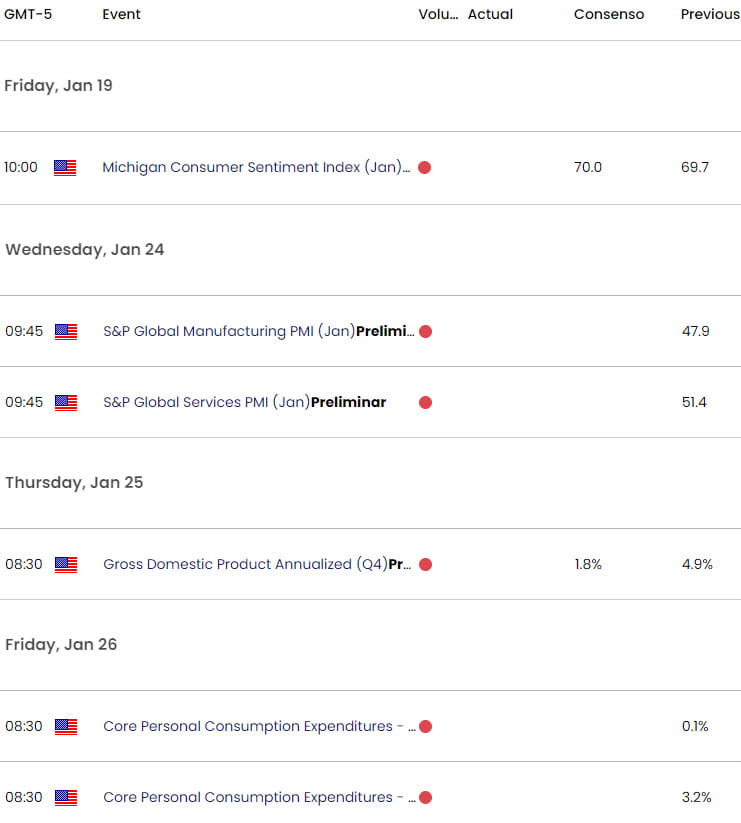

AUD/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar Short-term Outlook: USD/CAD Rips to Resistance

- US Dollar Short-term Outlook: USD Rally at Make-or-Break Resistance

- Euro Short-term Technical Outlook: EUR/USD Poised for Breakout

- British Pound Short-Term Outlook: GBP/USD Breakout Looms

- Gold Short-term Technical Outlook: Gold Bull Battle Lines Drawn

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex