Australian Dollar Technical Outlook: AUD/USD Short-term Trade Levels

- Australian Dollar plunges rebound off technical support now testing resistance

- AUD/USD threatening breakout of multi-month consolidation pattern

- Resistance 6523/25, 6566/67 (key), 6606– Support 6630, 6399 (key), 6321

The Australian Dollar rallied more than 1.3% over the past two-days with AUD/USD building on a rebound off technical support. The recovery is now approaching pivotal resistance and the battle lines are drawn within the February opening-range. These are the updated targets and invalidation levels that matter on the AUD/USD short-term technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this AUD/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar Short-term Outlook we noted that AUD/USD had, “broken multi-month uptrend support with the sell-off now approaching a key inflection zone- looking for a reaction down here. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch toward 6500 – rallies should be limited to 6670 IF price is heading lower on this stretch with a close below this pivot zone needed to fuel the next major move in price.”

Aussie rallied more than 1.5% the following days to register a high at 6624 before reversing sharply into February. Price has now plunged more than 2.7% off the late-January highs with AUD/USD rebounding off slope support this week. A two-day rally is now testing confluent resistance near the December & January lows / weekly-open and we’re on the lookout for possible price inflection up here.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD trading within the confines of descending wedge formation. A rebound off slope support is now testing initial resistance at 6523/25 with the January trendline just higher. Ultimately, a topside breach / close above the February open / 200-day moving average at 6566/67 is needed to suggest a more significant low was registered this week (near-term bearish invalidation). Subsequent resistance objective eyed at the 38.2% Fibonacci retracement of the December decline / monthly opening-range high at 6606/10.

Slope support currently rests near ~6630s and is backed by the 78.6% retracement of the October rally at 6399- an area of interest for possible downside exhaustion / price inflection IF reached. Losses below this threshold would threaten a test of the 2023 low-day close (LDC) near 3621.

Bottom line: The Australian Dollar has rebounded off downtrend support on building momentum divergence with the rally now testing near-term resistance- risk for price inflection. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – the weekly opening-range is preserved within the broader wedge formation heading into Friday and we’re looking for the breakout to offer guidance here. Ultimately, a close above 6567 would be needed to suggest a larger reversal is underway. Review my latest Australian Dollar Weekly Forecast for a closer look at the longer-term AUD/USD technical trade levels.

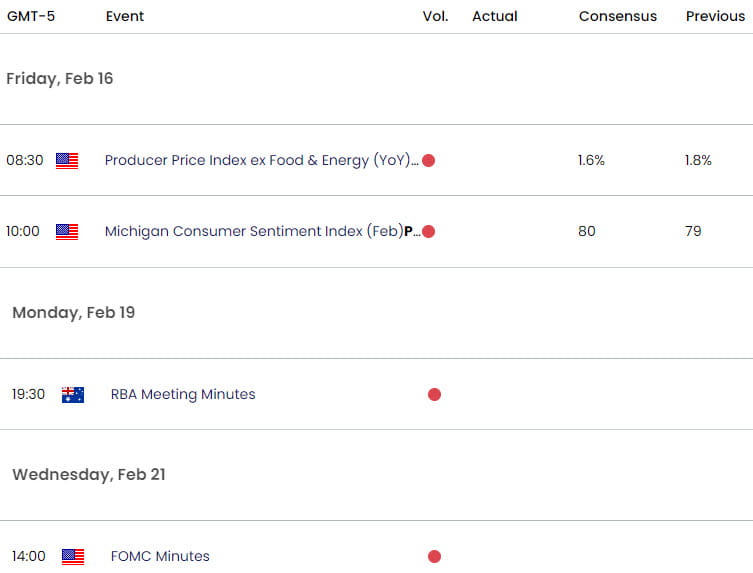

Key AUD/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar Short-term Outlook: USD/CAD Battle Lines Drawn

- US Dollar Short-term Outlook: USD Bulls Eye Major Resistance

- Euro Short-term Technical Outlook: EUR/USD Plunge Pauses at Support

- British Pound Short-Term Outlook: GBP/USD Slams to Support

- Gold Short-term Outlook: Gold Bull Flag Holds 2K- Can Buyers Drive?

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex