Australian Dollar Technical Outlook: AUD/USD Short-term Trade Levels

- AUD/USD September sell-off halted at technical support- weekly opening-range breaks higher

- Australian Dollar stretches 1.5% off lows in two-day rally- now approaching near-term resistance

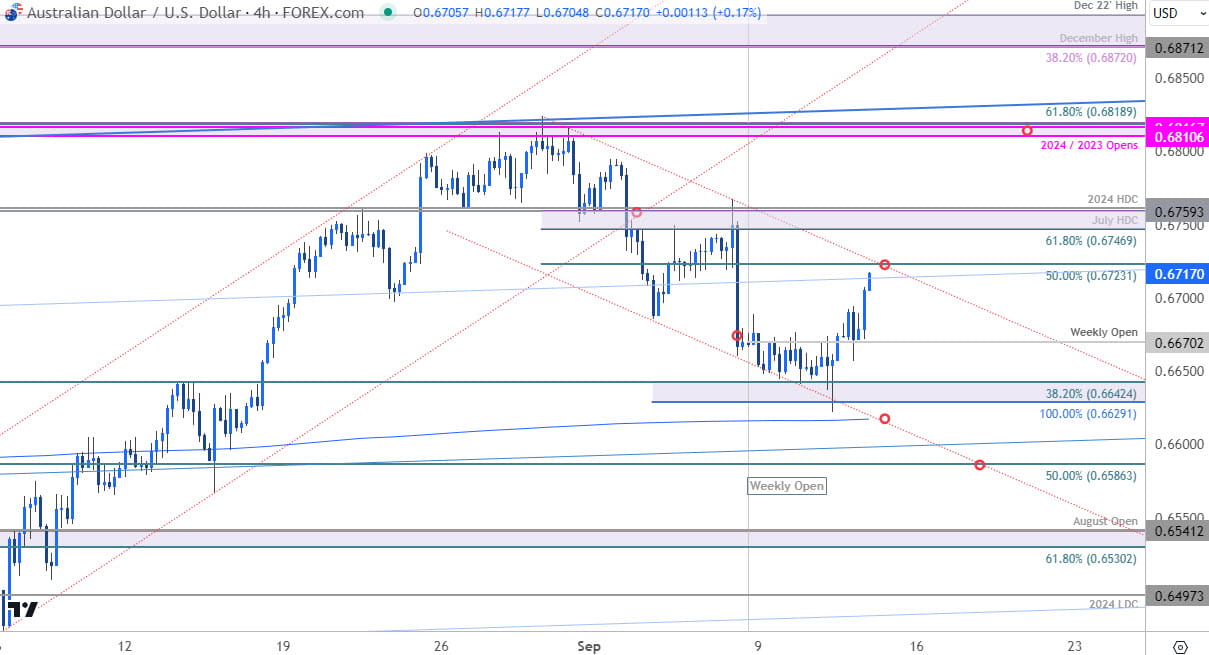

- Resistance 6723, 6747/61 (key), 6810/19– Support 6670, 6630/17 (key), 6586

The Australian Dollar has recovered nearly half of the decline off the August high with a breakout of the weekly opening-range now approaching the first major test of resistance. Battles lines drawn on the AUD/USD short-term technical charts ahead of next week’s Fed decision.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this AUD/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In last month’s Australian Dollar Short-term Outlook we noted that a three-week rally in was approaching major technical resistance, “at 6810/19- a region defined by the 2023 & 2024 yearly opens and the 61.8% Fibonacci retracement of the 2023 decline. We’re looking for possible exhaustion / price inflection into this threshold with the immediate advance vulnerable while below.”

AUD/USD briefly registered an intraday high at 6824 before reversing sharply lower into the September open with price plunging nearly 3% off the highs. Aussie rebounded off confluent support yesterday at 6629/42- a region defined by the 100% extension of the decline and the 38.2% retracement of the August rally. IF this pullback was a simple correction within the broader uptrend, these lows would need to hold.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD trading with the confines of a descending channel with the upper parallel (red) highlighting near-term resistance here around the 50% retracement at 6723. More significant resistance / near-term bearish invalidation is eyed just higher at 6747/61- a region defined by the 61.8% Fibonacci retracement of the late-August decline, the January / July 2024 high-day closes (HDC), and the objective September open. A breach / close above this threshold would be needed to suggest a more significant low was registered this week and keep the focus on a run back towards key resistance at 6810/19.

Weekly-open support rests at 6670 with a break / close below the 200-day moving average (currently ~6617) needed to suggest a deeper reversal is underway. Subsequent support objectives eyed at 6586 and the 61.8% retracement / August open at 6530/41- look for a larger reaction there IF reached.

Bottom line: A break of the weekly opening-range takes Aussie into near-term channel resistance- looking for possible inflection on a stretch towards 6723. From a trading standpoint, losses should be limited to the weekly-open IF price is heading higher on this stretch with a close above 6761 needed to mark uptrend resumption.

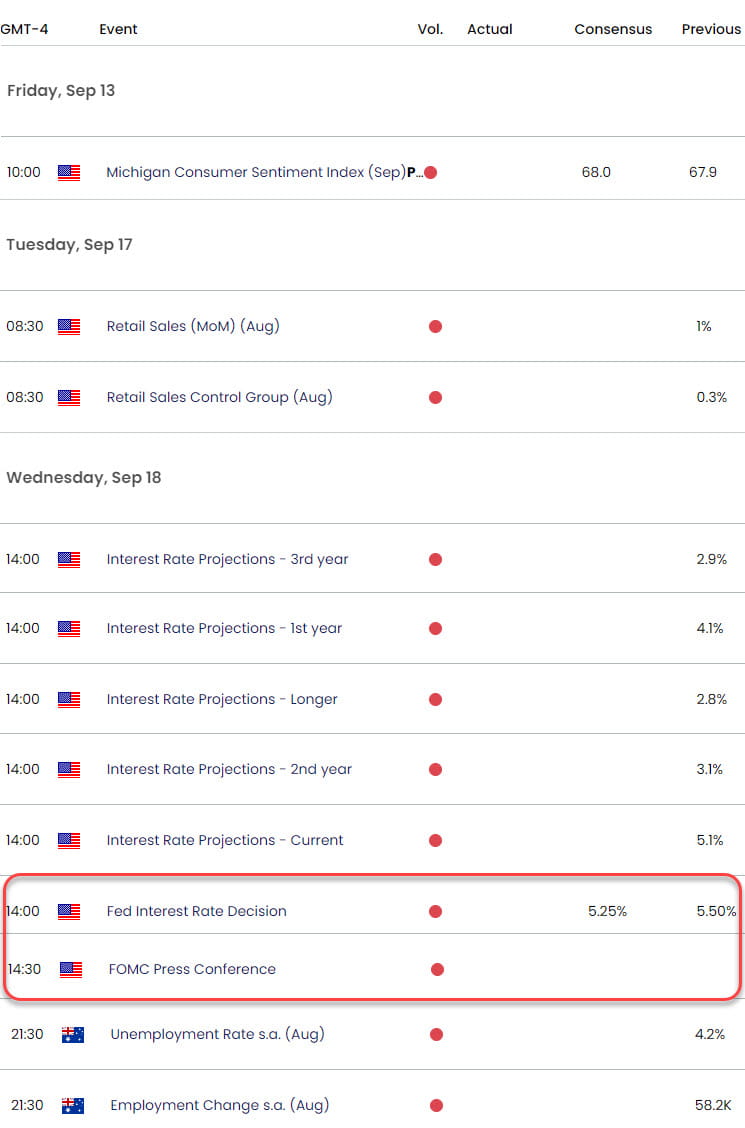

Note that the Federal Reserve interest rate decision is on tap Wednesday and the markets will be highly anticipating the FOMC’s updated economic projections as they pertain to growth, employment and inflation. As always, the dot plot will be central focus as market consensus begins to build for September to begin a series of consecutive rate cuts, well into 2025. Stay nimble into the release / subsequent presser and watch the weekly close here. Review my latest Australian Dollar Weekly Forecast for a closer look at the longer-term AUD/USD technical trade levels.

Key AUD/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Euro Short-term Technical Outlook: EUR/USD Tempts Trend Support

- US Dollar Short-term Outlook: USD Poised for Breakout Ahead of Fed

- Canadian Dollar Short-term Outlook: USD/CAD Rebound Eyes First Hurdle

- British Pound Short-term Outlook: GBP/USD Poised for Breakout

- Gold Short-term Technical Outlook: XAU/USD Slips into Support

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex