Australian Dollar Outlook: AUD/USD

AUD/USD seems to be reversing ahead of the monthly high (0.6610) as it carves a series of lower highs and lows, and the exchange rate may struggle to retain the advance from the February low (0.6443) should it track the negative slope in the 50-Day SMA (0.6623).

Australian Dollar Forecast: AUD/USD Reverses Ahead of Monthly High

AUD/USD pulls back after registering an eight-day advance for the first time since 2020, and the exchange rate may consolidate over the remainder of the month as it bounces back from a fresh weekly low (0.6525).

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

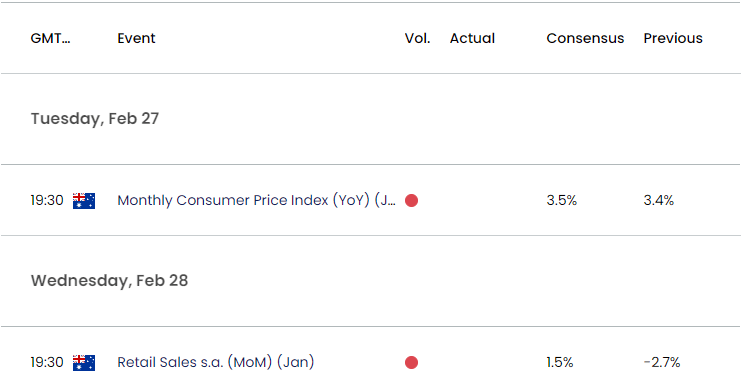

Australia Economic Calendar

Looking ahead, data prints coming out of Australia may sway AUD/USD as the Consumer Price Index (CPI) is expected to increase to 3.5% in January from 3.4% the month prior, while Retail Sales are projected to increase 1.5% during the same period.

Signs of sticky inflation along with a rebound in household spending may generate a bullish reaction in AUD/USD as it raises the Reserve Bank of Australia’s (RBA) scope to retain a restrictive policy, and the central bank may continue to strike a hawkish forward guidance as ‘members agreed that it was appropriate not to rule out a further increase in the cash rate target.’

However, a slowdown in the CPI paired with another contraction in retail sales may drag on AUD/USD as it puts pressure on the RBA to alter the course for monetary policy, and Governor Michele Bullock and Co. may gradually adjust their forward guidance over the coming months as ‘the staff’s central forecasts were for inflation to return to target within the timeframe that they had previously concluded was acceptable.’

With that said, AUD/USD may consolidate over the coming days as it appears to be reversing ahead of the monthly high (0.6610), but the exchange rate may struggle to retain the advance from the February low (0.6443) should it track the negative slope in the 50-Day SMA (0.6623).

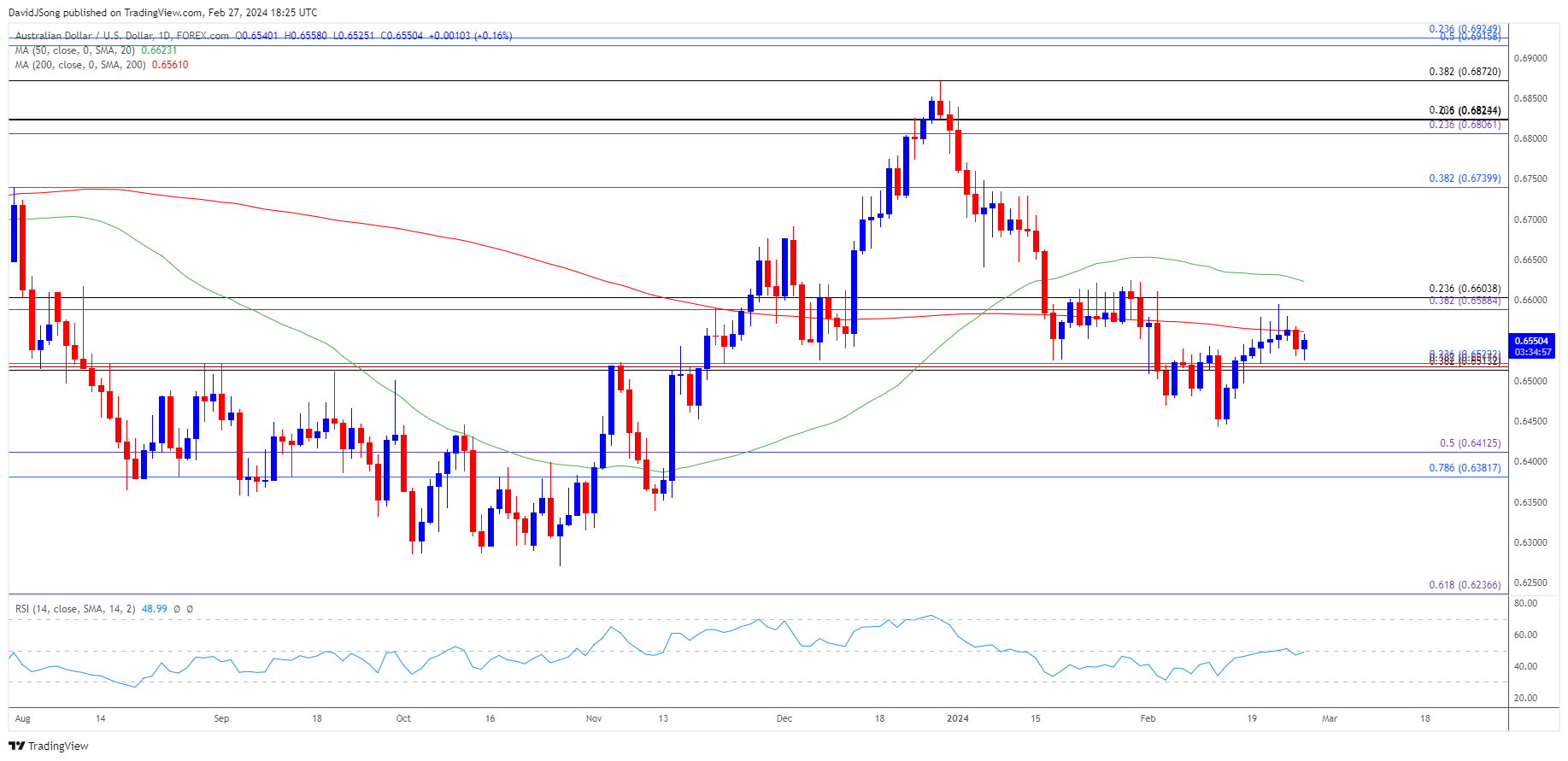

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD carves a series of lower highs and lows after failing to break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region, with a breach below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area bringing the February low (0.6443) on the radar.

- The negative slope in the 50-Day SMA (0.6623) indicates a potential change in the near-term trend as AUD/USD reverses ahead of the monthly high (0.6610), with a break/close below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region opening up the November low (0.6318).

- At the same time, a break/close above the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region may push AUD/USD lead to a test of the moving average, with the next area of interest coming in around 0.6740 (38.2% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Attempts to Trade Back Above 50-Day SMA

US Dollar Forecast: USD/CAD Coils Above 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong