Australian Dollar Outlook: AUD/USD

AUD/USD reverses ahead of the January high (0.6839) to keep the Relative Strength Index (RSI) out of overbought territory, but the exchange rate may track the positive slope in the 50-Day SMA (0.6666) as it holds above the moving average.

Australian Dollar Forecast: AUD/USD Reverses Ahead of January High

AUD/USD no longer carves a series of lower highs and lows as it attempts to retrace the decline following the US Retail Sales report, and the exchange rate may consolidate over the remainder of the week as the Federal Reserve appears to be on track to unwind its restrictive policy.

Fed Governor Adriana Kugler points out that ‘inflation has continued to trend down in all price categories’ while speaking at the National Association for Business Economics Foundation, with the permanent voting-member on the Federal Open Market Committee (FOMC) going onto say that ‘supply and demand are gradually coming into better balance.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

As a result, Kugler states that ‘if economic conditions continue to evolve in this favorable manner with more rapid disinflation, as evidenced in the inflation data of the past three months, and employment softening but remaining resilient as seen in the past few jobs reports, I anticipate that it will be appropriate to begin easing monetary policy later this year.’

The comments suggest the FOMC will continue to adjust the forward guidance as Fed officials project ‘that the appropriate level of the federal funds rate will be 5.1 percent at the end of this year,’ but the Reserve Bank of Australia (RBA) seems to be in no rush to switch gears as the central bank ‘expects that it will be some time yet before inflation is sustainably in the target range.’

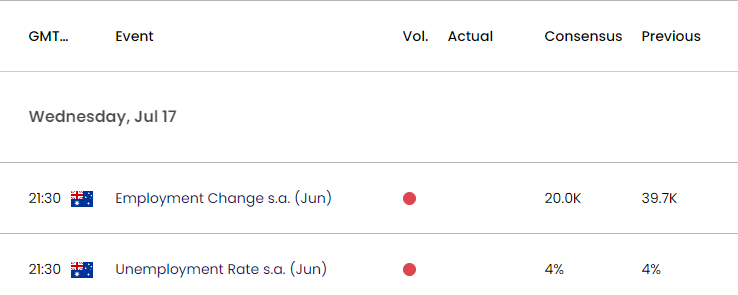

Australia Economic Calendar

In turn, the update to Australia’s Employment report may keep the RBA on the sidelines as the economy is expected to add 20.0K jobs in June, and signs of a healthy labor market may curb the recent decline in AUD/USD as it raises the central bank’s scope to further combat inflation.

However, a weaker-than-expected employment report may put pressure on the RBA to pursue a more accommodative stance, and indications of a slowing job growth may drag on AUD/USD as it puts pressure on Governor Michele Bullock and Co. to alter the path for monetary policy.

With that said, AUD/USD may continue to give back the advance from the monthly low (0.6634) amid the failed attempt to test the January high (0.6839), but the exchange rate may track the positive slope in the 50-Day SMA (0.6666) as it holds above the moving average.

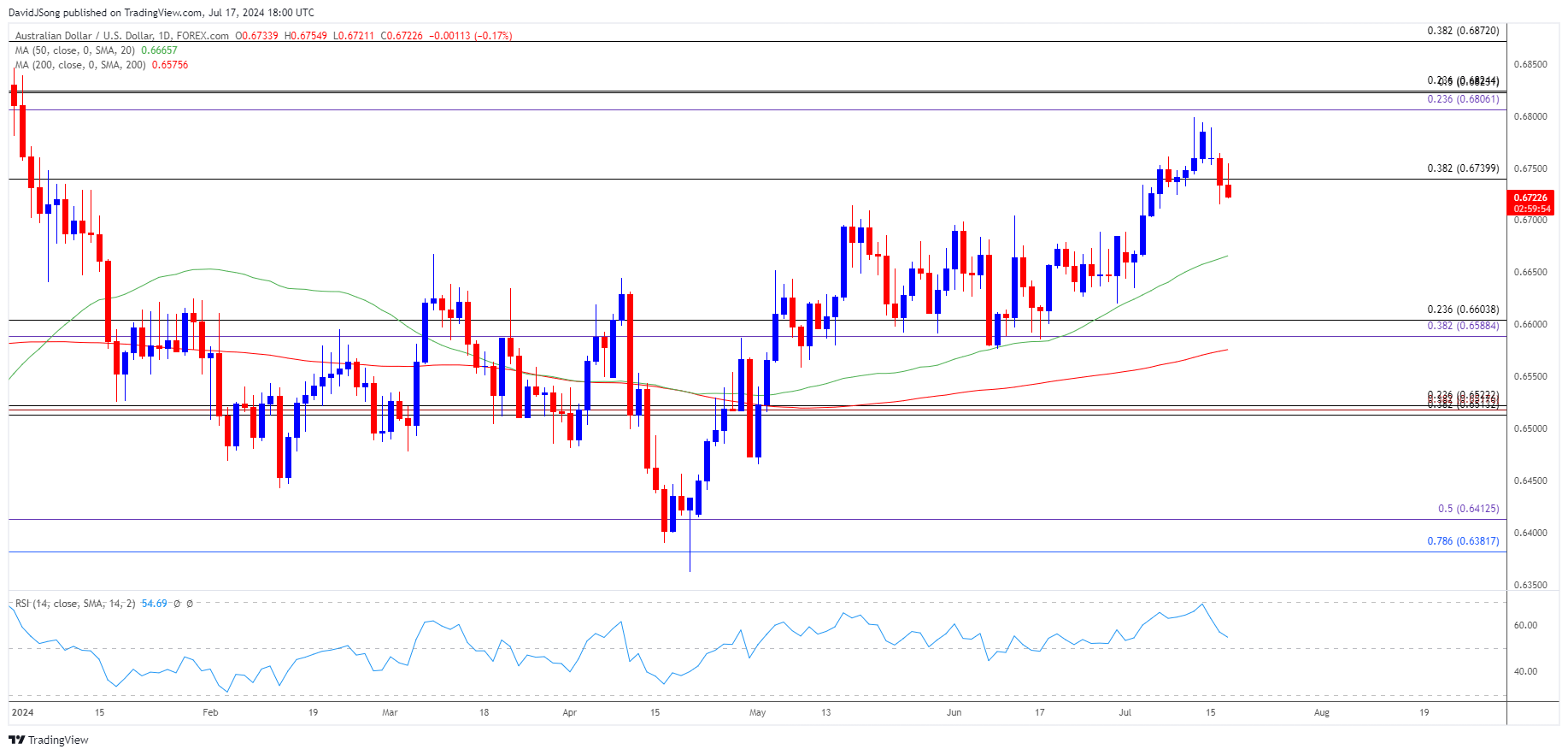

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD pulls back ahead of the January high (0.6839) to keep the Relative Strength Index (RSI) below 70, and the oscillator may continue to show the bullish momentum abating as it moves away from overbought territory.

- Failure to defend the weekly low (0.6715) may push AUD/USD towards the 50-Day SMA (0.6666), with the next area of interest coming in around the monthly low (0.6634).

- Nevertheless, AUD/USD may track the positive slope in the moving average should it continues to hold above the indicator but need a break/close above the 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) to bring the January high (0.6839) back on the radar.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of Canada CPI

Euro Forecast: EUR/USD Eyes June High Ahead of ECB Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong