AUD/USD Outlook: AUD/USD

AUD/USD trades to a fresh monthly low (0.6354) as it extends the series of lower highs and lows from earlier this week, and the exchange rate may track the negative slope in the 50-Day SMA (0.6498) as it snaps the range bound price action from earlier this month.

Australian Dollar Forecast: AUD/USD Range Breaks Down

AUD/USD struggles to hold its ground after failing to push above the moving average during the previous week, but Australia’s Retail Sales report may prop up the exchange rate as the update is anticipated to show another rise in household consumption.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

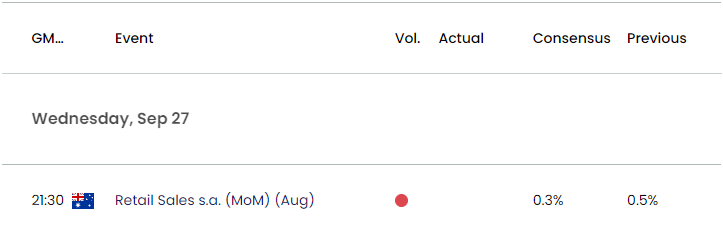

Australia Economic Calendar

Retail spending is projected to increase 0.3% in August after expanding 0.5% the month prior, and a positive development may spur a bullish reaction in the Australian Dollar as it puts pressure on the Reserve Bank of Australia (RBA) to further combat inflation.

However, a weaker-than-expected retail sales report may drag on AUD/USD as Governor Philip Lowe and Co. acknowledge that the ‘economy was experiencing a period of subdued growth,’ and the Australian Dollar may face headwinds ahead of the next RBA meeting on October 3 as the ‘recent flow of data was consistent with inflation returning to target within a reasonable timeframe while the cash rate remained at its present level.’

With that said, recent price action raises the scope for a further decline in AUD/USD as it carves a series of lower highs and lows, and exchange rate may track the negative slope in the 50-Day SMA (0.6498) as it fails to retain the range-bound price action from earlier this month.

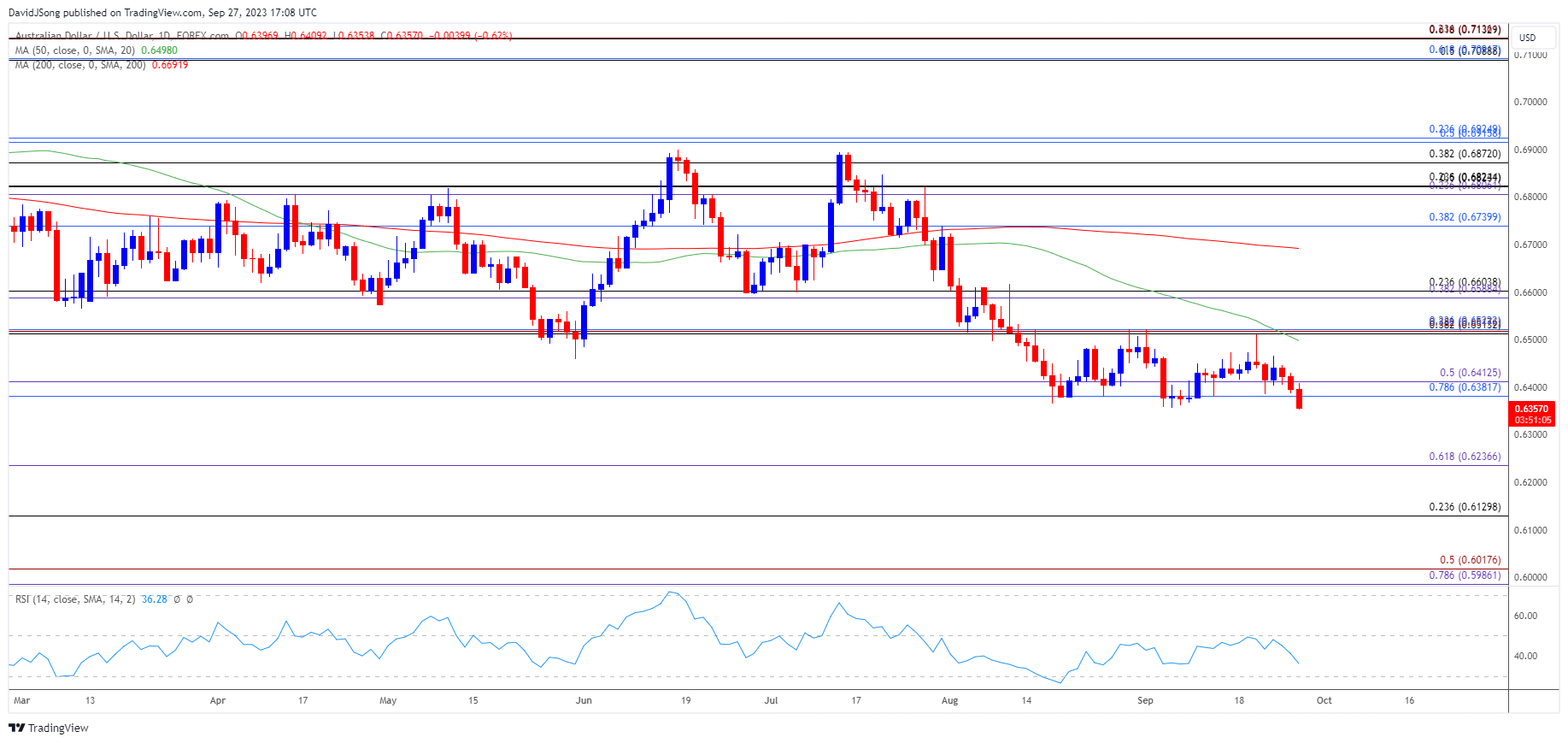

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD is under pressure following the failed attempt to test the September high (0.6522), and the exchange rate may track the negative slope in the 50-Day SMA (0.6498) as it snaps the range bound price action from earlier this month.

- Failure to hold above the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) area may push AUD/USD towards the November 2022 low (0.6272), with the next area of interest coming in around 0.6240 (61.8% Fibonacci extension).

- Nevertheless, lack of momentum to test the November 2022 low (0.6272) may keep the Relative Strength Index (RSI) out of oversold territory, with a move back above the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) area bringing the September high (0.6522) back on the radar.

Additional Market Outlooks

EUR/USD Forecast: RSI Flirts with Oversold Zone Ahead of Euro Area CPI

US Dollar Forecast: USD/JPY Mirrors Rise in Long-Term US Yields

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong