Australian Dollar Outlook: AUD/USD

AUD/USD pulls back ahead of the May high (0.6714) as the Federal Reserve forecasts ‘that the appropriate level of the federal funds rate will be 5.1 percent at the end of this year,’ but the Reserve Bank of Australia (RBA) meeting may curb the recent weakness in the exchange rate as the central bank is expected to keep the cash rate on hold.

Australian Dollar Forecast: AUD/USD Pulls Back Ahead of RBA Meeting

AUD/USD no longer carves a series of higher highs and lows as it continues to pullback from the weekly high (0.6705), and the exchange rate may give back the advance from the monthly low (0.6576) as the Federal Open Market Committee (FOMC) reiterates that ‘we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

It seems as though the Fed will retain a data-dependent approach in managing monetary policy as Chairman Jerome Powell and Co. ‘will need to see more good data to bolster our confidence that inflation is moving sustainably toward 2 percent,’ and it remains to be seen if the Reserve Bank of Australia (RBA) will follow a similar path as the central bank warns that ‘inflation in Australia had declined more slowly than anticipated.’

Australia Economic Calendar

In turn, the RBA may keep the cash rate at 4.35% as ‘members agreed that it was important to convey that recent data and other information had signalled that the risks around inflation had risen somewhat,’ and more of the same from the central bank may curb the recent weakness in AUD/USD should the board keep the door open to implement higher interest rates.

However, the RBA may adjust the forward guidance for monetary policy as ‘the staff forecasts were for a period of subdued demand growth during the remainder of 2024,’ and signs of a growing dissent within central bank may produce headwinds for the Australian Dollar if Governor Michele Bullock and Co. start to discuss a less restrictive policy.

With that said, AUD/USD may face a larger pullback ahead of the RBA meeting as it no longer carves a series of higher highs and lows, but the exchange rate may stage further attempts to test the May high (0.6714) as the 50-Day SMA (0.6582) now reflects a positive slope.

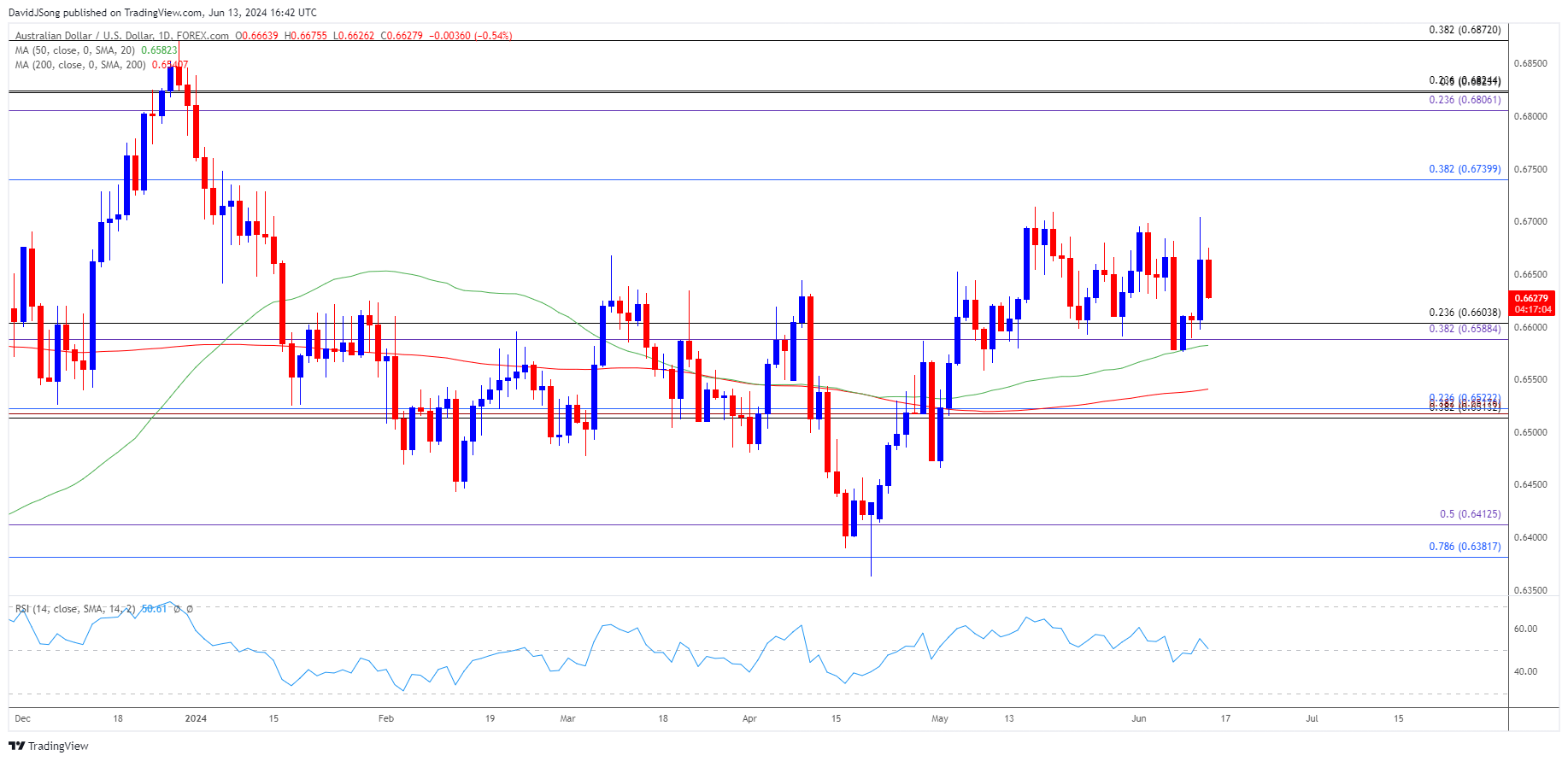

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- The recent advance in AUD/USD appears to have stalled ahead of the May high (0.6714) as it fails to extend the recent series of higher highs and lows, with a move below the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region raising the scope for a test of the monthly low (0.6576).

- Next area of interest comes in around the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement), but AUD/USD may retrace the decline from the monthly high (0.6705) as the 50-Day SMA (0.6582) now reflects a positive slope.

- In turn, AUD/USD may stage further attempts to test the May high (0.6714), with the next region of interest coming in around 0.6740 (38.2% Fibonacci retracement).

Additional Market Outlooks

USD/JPY Reverses Ahead of June High with Fed and BoJ on Tap

USD/CAD Clears May High with Fed Expected to Retain Restrictive Policy

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong