Australian Dollar Outlook: AUD/USD

AUD/USD snaps the series of lower highs and lows from last week ahead of the Reserve Bank of Australia (RBA) Minutes, but the exchange rate may track the negative slope in the 50-Day SMA (0.6420) amid the failed attempts to trade back above the moving average.

Australian Dollar Forecast: AUD/USD Enclosed in Monthly Opening Range

AUD/USD appears to be defending the opening range for October as it bounces back ahead of the monthly low (0.6286), and the exchange rate may stage a larger rebound as the US Dollar struggles to hold its ground against most of its major counterparts.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Australia Economic Calendar

Looking ahead, it remains to be seen if the RBA Minutes will sway AUD/USD as the central bank keeps the Official Cash Rate (OCR) at 4.10% for four straight meetings, and the wait-and-see approach in managing monetary policy may do little to shore up the Australian Dollar as the central bank insists that ‘the recent data are consistent with inflation returning to the 2–3 per cent target range over the forecast period.’

As a result, more of the same from the RBA may curb the recent rebound in AUD/USD as the central bank seems to be at the end of its hiking-cycle, but Governor Michele Bullock and Co. may keep the door open to implement higher interest rates ‘some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.’

With that said, recent price action raises the scope for a larger rebound in AUD/USD as it snaps the series of lower highs and lows from last week, but the exchange rate may track the negative slope in the 50-Day SMA (0.6420) amid the failed attempts to trade back above the moving average.

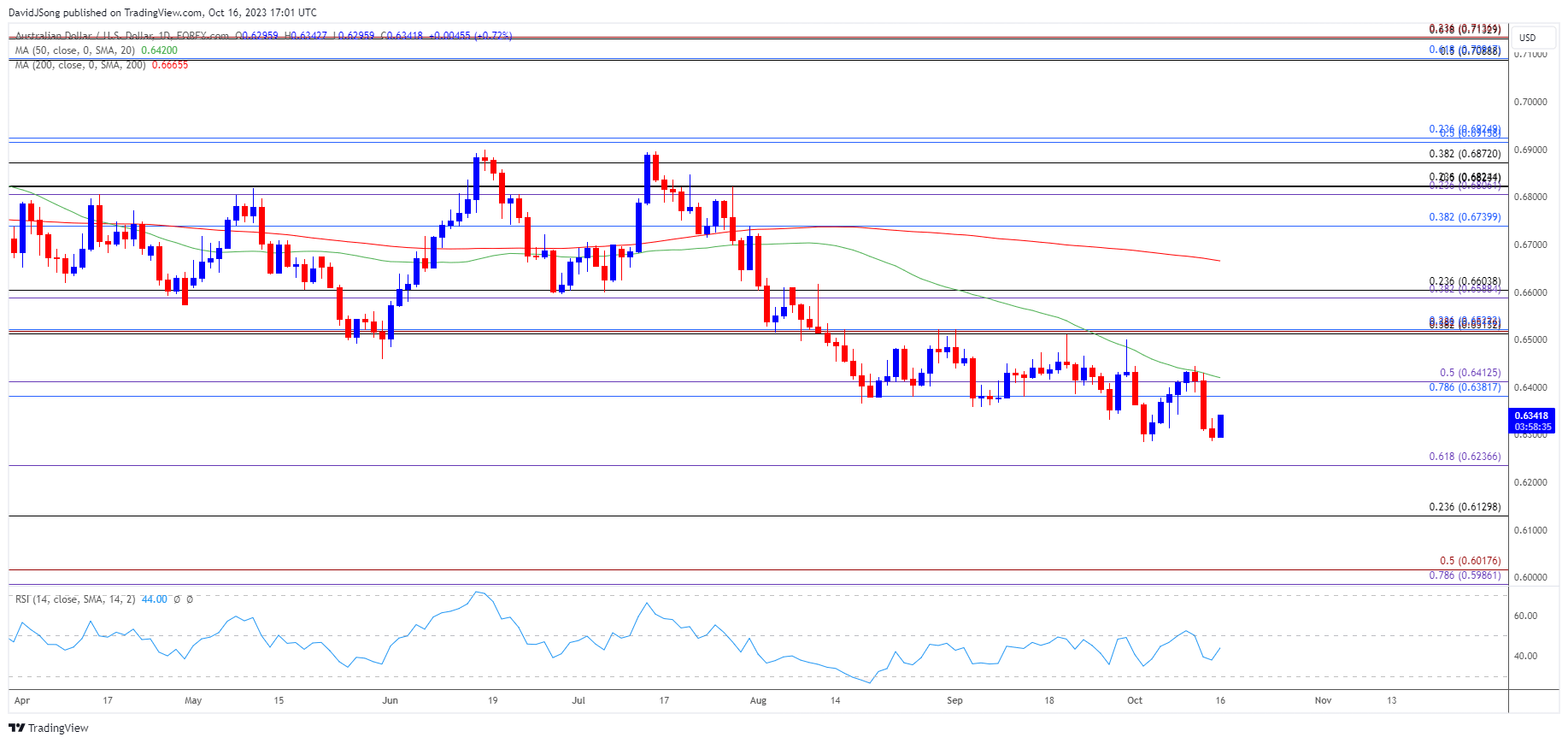

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD seems to be responding to the negative slope in 50-Day SMA (0.6420) amid the failed attempt to clear the monthly high (0.6445), with a breach below the November 2022 low (0.6272) opening up 0.6240 (61.8% Fibonacci extension).

- Next area of interest comes in around 2022 low (0.6170), but AUD/USD may defend the opening range for October as it clears the series of lower highs and lows from last week.

- Failure to push below the monthly low (0.6286) may generate range bound conditions in AUD/USD, with a move above the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region raising the scope for another test of the moving average.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Pending Breakout of Monthly Opening Range

US Dollar Forecast: USD/CAD Defends Monthly Low Ahead of US CPI

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong