Australian Technical Forecast: AUD/USD Weekly Trade Levels

- Australian Dollar rallies more than 5.5% off yearly lows to multi-month highs

- AUD/USD bulls falter at major resistance pivot- risk for exhaustion / price inflection

- Resistance 6673/90 (key), 6810/19, 6922- Support 6556/63, 6496, 6433

The Australian Dollar surged more than 5.5% off the yearly lows with a breakout of the December downtrend now testing the first major resistance hurdle. Bulls on notice into the close of the month with the bulls vulnerable sub-6700. Battle lines drawn on the AUD/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In last month’s Australian Dollar Technical Forecast we noted that the, “rebound off fresh yearly lows is now testing confluent resistance at the 2024 downtrend. From a trading standpoint, losses should be limited to 6433 IF price is heading higher here with a close above the December slope needed to fuel the next leg in price.” AUD/USD registered an intraweek low at 6465 that week before breaking higher into the May open. Aussie has rallied 3.85% month-to-date with the advance extending to levels not seen since January.

The rally is testing confluent resistance this week at 6673/90 – a region defined by the 2019 low, the 2008 low-week close (LWC), the 61.8% Fibonacci retracement of the December decline and the 100% extension of the April rally. The immediate focus is on a reaction off this mark with the risk for topside exhaustion / price inflection into the close of the month.

Initial weekly support rests with the 38.2% retracement / 52-week moving average at 6556/63 backed by bullish invalidation at the 61.8% retracement of the April advance at 6496. Ultimately, a break / weekly close below the 2024 LWC at 6433 would be needed to mark resumption of the broader downtrend.

A topside breach above this key pivot zone would keep the focus on a stretch towards the objective yearly open / 61.8% retracement at 6810/19 and key resistance at the 2023 high-week close (HWC) at 6922- both levels of interest for possible topside exhaustion / price inflection IF reached.

Bottom line: The AUD/USD breakout has extended into the first major resistance hurdle and leaves the bulls vulnerable into the close of the month. From a trading standpoint, losses should be limited to t 6556 IF Aussie is heading higher on this stretch with a breach / weekly close above 6700 needed to fuel the next leg higher in price. Note that losses beyond 6433 could fuel another accelerated decline – stay nimble into the monthly cross and watch the weekly closes here. Review my latest Australian Dollar Short-term Outlook for a closer look at the near-term AUD/USD technical trade levels.

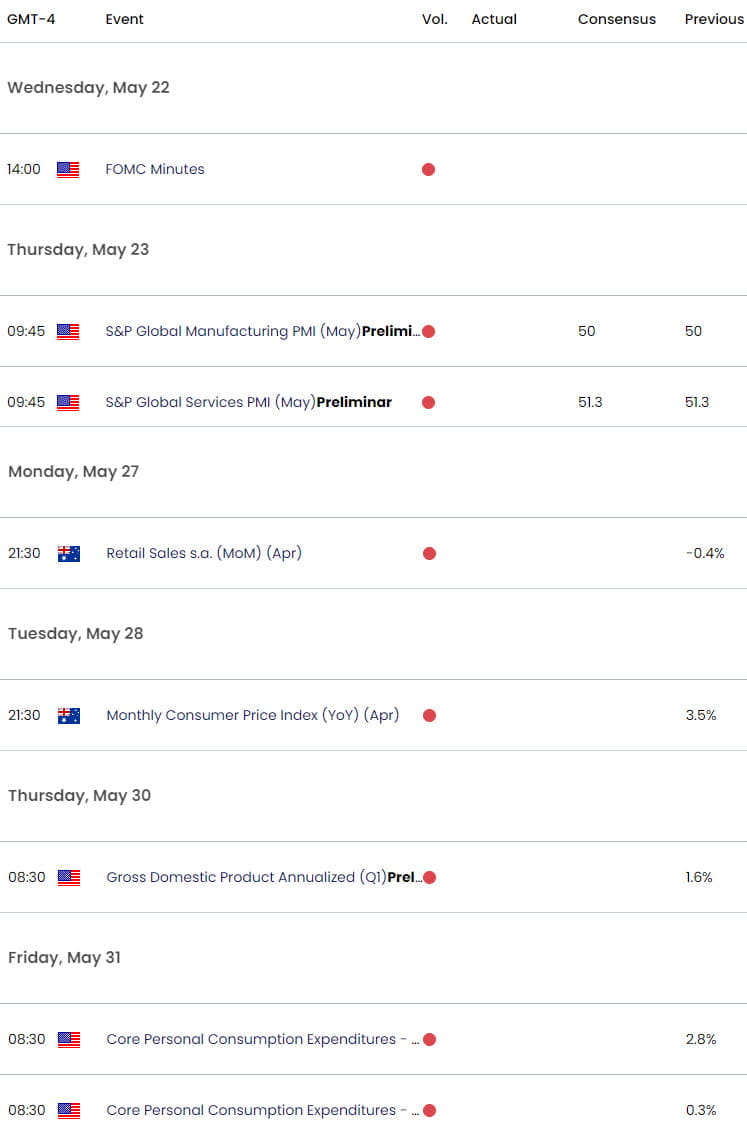

Australia / US Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Gold (XAU/USD)

- Canadian Dollar (USD/CAD)

- US Dollar Index (DXY)

- Euro (EUR/USD)

- Crude Oil (WTI)

- British Pound (GBP/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex