Australia Employment Change

Australia’s Employment report showed a 50.2K rise in June following the 39.5K rise the month prior, while the jobless rate widening to 4.1% from 4.1% during the same period amid an increase in the labor force participation rate.

Australia Economic Calendar – July 17, 2024

A deeper look at the report showed a rise in both full-time and part-time employment, with the update noting that ‘part-time share of employment was 31.0%,’ while the gauge for youth unemployment held at 9.6% in June.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

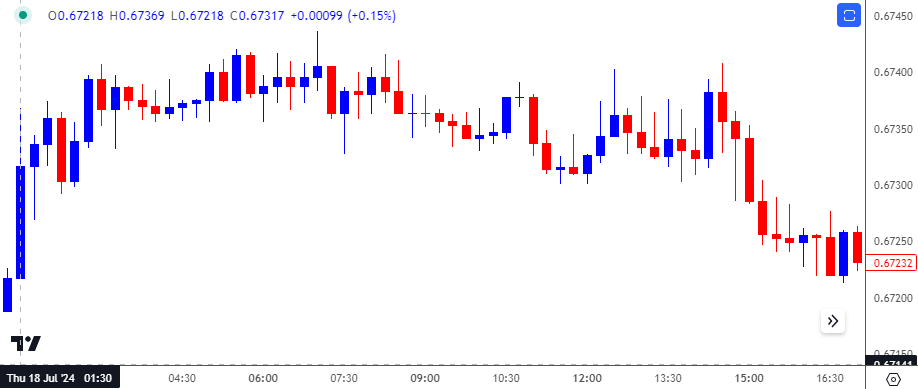

AUD/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

AUD/USD rallied following the larger-than-expected rise in Australia Employment, with the exchange rate climbing to a session high of 0.6744. However, the market reaction was short-lived as AUD/USD closed the day at 0.6706.

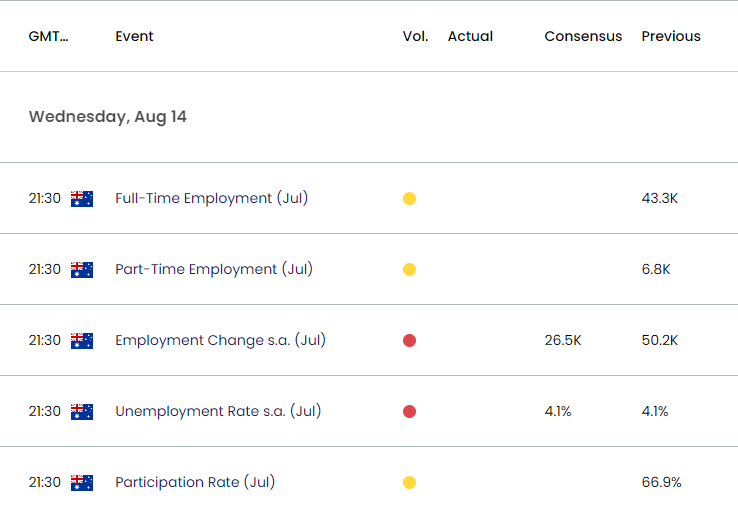

Looking ahead, Australia is anticipated to add 26.5 jobs in July following the 50.2K expansion the month prior, while the jobless rate is seen holding steady at 4.1% during the same period.

Another increase in Australia Employment may encourage the Reserve Bank of Australia (RBA) to retain a restrictive policy as ‘inflation is still some way above the midpoint of the 2–3 per cent target range,’ and evidence of a strong labor market may spur a bullish reaction in the Australian Dollar as it raises the central bank’s scope to keep interest rates higher for longer.

However, a weaker-than-expected jobs report may put pressure on Governor Michele Bullock and Co. to adopt a less-restrictive policy, and the Australian Dollar may face headwinds ahead of the next RBA meeting on September 24 as signs of a slowing economy fuels speculation for a rate-cut in 2024.

Additional Market Outlooks

GBP/USD Rebounds Ahead of July Low with UK Employment, CPI on Tap

Canadian Dollar Forecast: USD/CAD Flirts with 50-Day SMA

US Dollar Forecast: USD/JPY Continues to Defend January Low

Gold Price to Eye Monthly High on Failure to Close Below 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong