Australia Dollar Outlook: AUD/USD

AUD/USD extends the decline following the US Non-Farm Payrolls (NFP) report to register a fresh monthly low (0.6648), and the recent weakness in the exchange rate may persist as it initiates a series of lower highs and lows.

Australia Dollar Forecast: AUD/USD Reverses Ahead of January High

AUD/USD may track the August range as it reverses ahead of the January high (0.6839), and the Relative Strength Index (RSI) may continue to show the bullish momentum abating as it moves away from overbought territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

With that said, AUD/USD may struggle to retain the advance from the August low (0.6349), but the exchange rate may consolidate ahead of the Federal Reserve interest rate decision on September 18 as Chairman Jerome Powell insists that ‘the time has come for policy to adjust.’

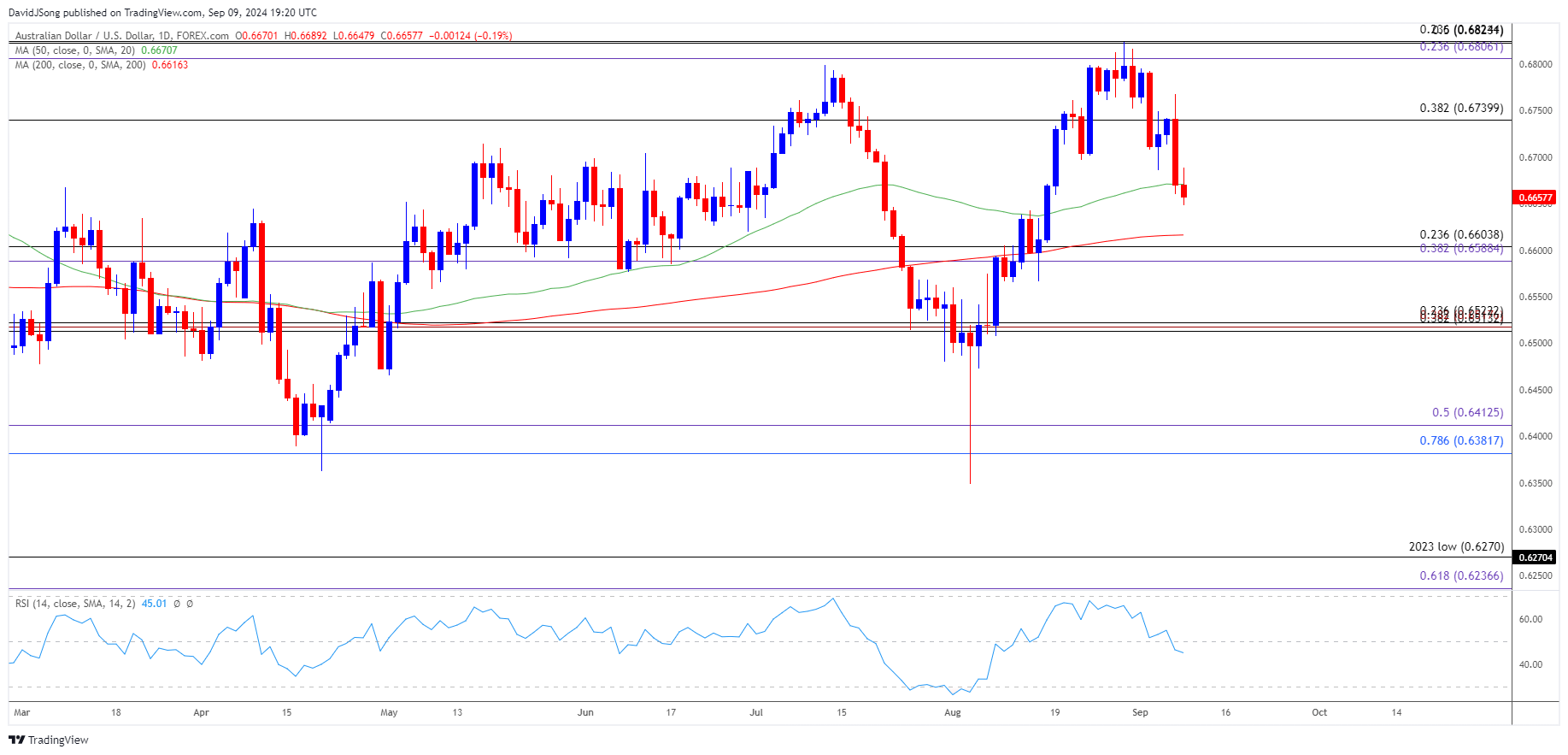

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- Failure to hold within the opening range for September may push AUD/USD back towards the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region as it slips to a fresh monthly low (0.6648).

- A break/close below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) area brings the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone on the radar, with the next region of interest coming in around the August low (0.6349).

- Nevertheless, AUD/USD may attempt to retrace the decline from the August high (0.6824) if it manages to climb back above 0.6740 (38.2% Fibonacci retracement) but need a breach above the 0.6810 (23.5% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) zone to open up the January high (0.6839).

Additional Market Outlooks

UK Employment Change Report Preview (JUL 2024)

EUR/USD Pulls Back Ahead of August High with US CPI in Focus

GBP/USD Rebound Pushes RSI Back Towards Overbought Zone

Gold Price Outlook Supported by Positive Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong