AUD/USD holds below pre-US election rates as trades at its lowest level since 2022, and the weakness may persist in 2025 should the Reserve Bank of Australia (RBA) alter the path for monetary policy.

Reserve Bank of Australia Cash Rate Target

Keep in mind, AUD/USD took out the 2023 low (0.6270) even though the RBA kept the cash rate at 4.35% throughout the year, and the central bank may retain the current policy over the coming months as ‘underlying inflation is still high.’

However, the RBA may come under pressure to change gears amid the fragile recovery in China, Australia’s largest trading partner, and the threat of a trade war may drag on Asia/Pacific economies even though Chinese authorities pledge to increase spending in 2025 after deploying a $1.4T package to support local government debts.

With that said, the RBA may start to adjust its forward guidance for monetary policy as the central bank acknowledges that ‘growth in output has been weak,’ and the Australian Dollar may face additional headwinds in 2025 should Governor Michele Bullock and Co. may prepare to Australian households and businesses for a less restrictive policy.

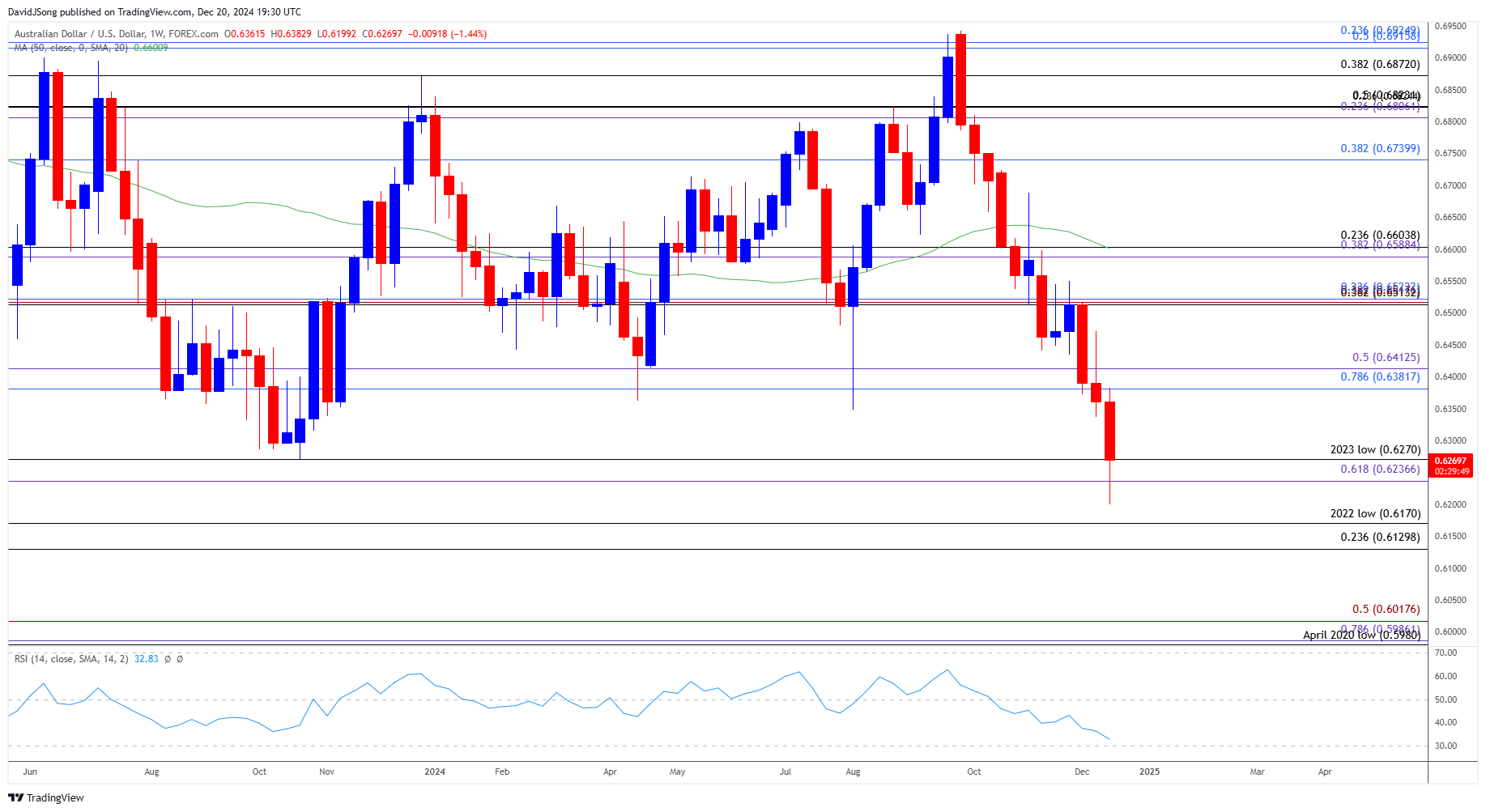

AUD/USD Weekly Chart

Source: TradingView - Chart Prepared by David Song, Senior Strategist

AUD/USD trades to fresh yearly lows going into the end of 2024, with the depreciation in the exchange rate pushing the weekly Relative Strength Index (RSI) to its lowest level since 2022.

In turn, AUD/USD may attempt to test the 2022 low (0.6170) as it continues to carve a series of lower highs and lows on a weekly timeframe, with a break/close below 0.6130 (23.6% Fibonacci retracement) opening up the April 2020 low (0.5980).

Nevertheless, lack of momentum to test the 2022 low (0.6170) may keep the RSI above overbought territory but need a move back above the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region for AUD/USD to snap the bearish price series.

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong