Australia Dollar Outlook: AUD/USD

AUD/USD clears the July high (0.6799) as the update to Australia’s Consumer Price Index (CPI) shows a higher-than-expected print, but lack of momentum to test the January high (0.6839) may keep the Relative Strength Index (RSI) out of overbought territory.

AUD/USD Vulnerable amid Struggle to Test January High

AUD/USD may stage additional attempts to breakout of the range bound price action from earlier this week as it registers a fresh monthly high (0.6813), and Australia’s Retail Sales report may also influence the exchange rate as household spending is expected to increase for the fourth consecutive month.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

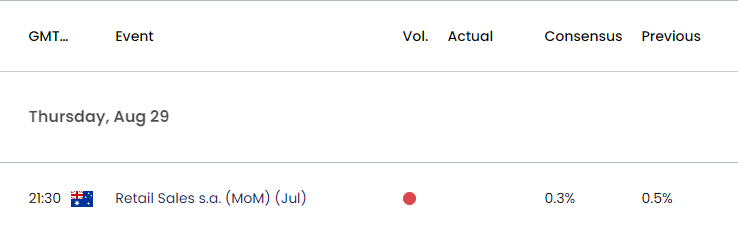

Australia Economic Calendar

Australia Retail Sales are projected to increase 0.3% in July following the 0.5% expansion the month prior, and a positive development may generate a bullish reaction in the Australian Dollar as it raises the Reserve Bank of Australia’s (RBA) scope to further combat inflation.

However, a weaker-than-expected retail sales report may put pressure on Governor Michele Bullock and Co. to alter the path for monetary policy, and signs of a slowing economy may drag on AUD/USD as it fuels speculation for an RBA rate-cut.

With that said, developments coming out of Australia may continue to sway AUD/USD as it registers a fresh monthly high (0.6813), but the exchange rate may consolidate over the remainder of the month as it struggles to test the January high (0.6839).

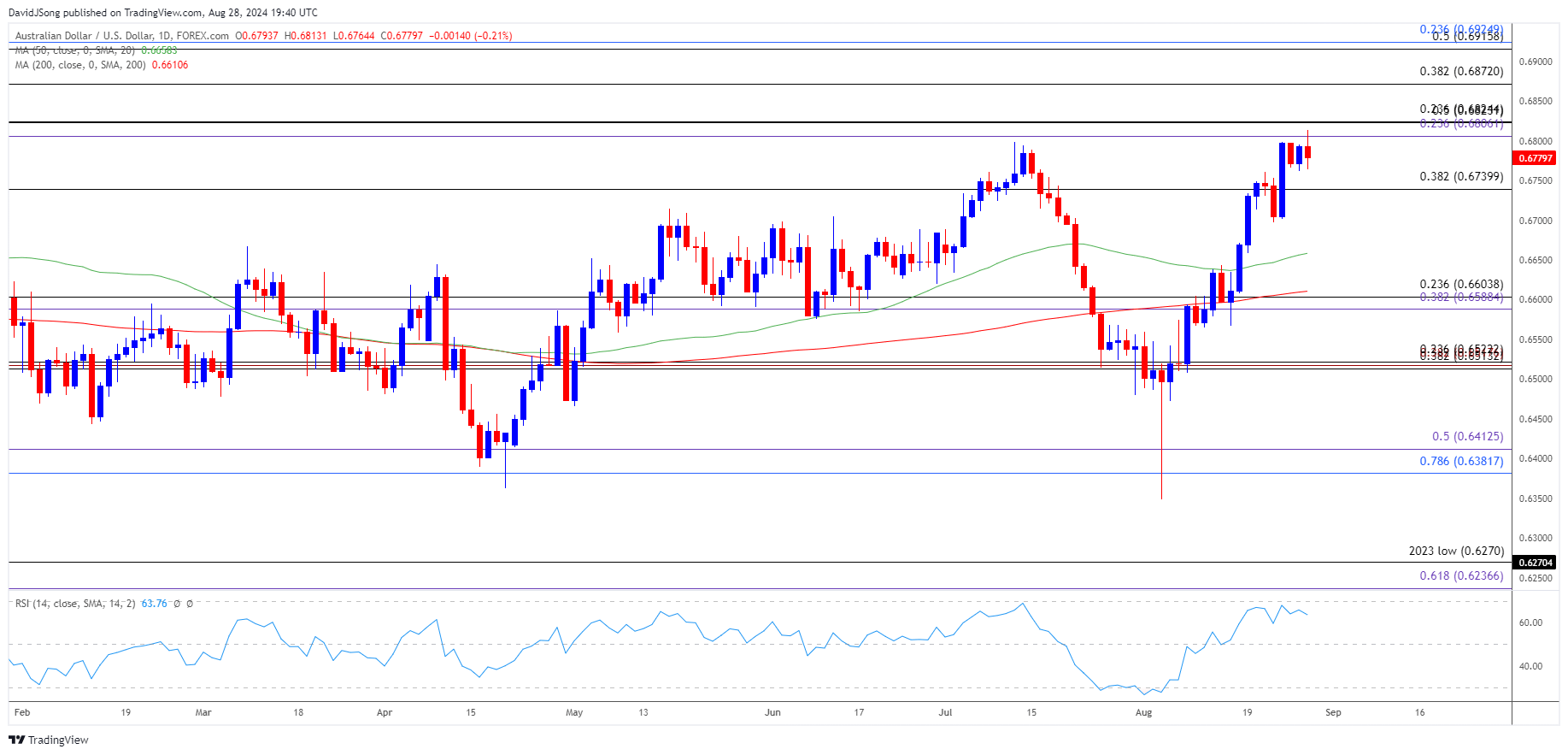

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD may continue to trade to fresh monthly highs as it attempts to break out of the range bound price action from earlier this week, with a break/close above the 0.6810 (23.5% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) region bringing the January high (0.6839) on the radar.

- Next area of interest comes in around 0.6920 (50% Fibonacci retracement) to 0.6930 (23.6% Fibonacci retracement), but AUD/USD may largely mirror the price action from last month if it fails to break/close above the 0.6810 (23.5% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) region.

- Failure to defend the weekly low (0.6762) may push AUD/USD back towards 0.6740 (38.2% Fibonacci retracement), with a breach below the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area opening up the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Susceptible to RSI Sell Signal

Euro Forecast: EUR/USD Preserves Advance Following Fed Symposium

USD/JPY Rebounds Ahead of Monthly Low to Keep RSI Above 30

USD/CAD Falls Towards April Low as Fed Signals Policy Adjustment

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong