Australian Dollar Outlook: AUD/USD

AUD/USD snaps the series of higher highs and lows from last week even as the Reserve Bank of Australia (RBA) delivers a 25bp rate-hike, and the exchange rate may struggle to retain the rebound from the yearly low (0.6270) if it fails to defend the monthly low (0.6318).

AUD/USD Susceptible to Test of Monthly Low on Post-RBA Weakness

AUD/USD is under pressure after taking out the September high (0.6522) at the start of the week, and the Australian Dollar may face headwinds over the remainder of the year as the RBA appears to be at the end of its hiking-cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

It seems as though the RBA will revert to a wait-and-see approach as the monetary policy outlook ‘will depend upon the data and the evolving assessment of risks,’ and Governor Michele Bullock and Co. may continue to adjust the forward guidance at the next meeting on December 5 as the central bank pledges to ‘pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market.’

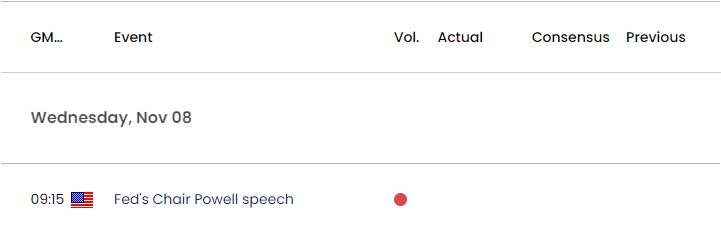

US Economic Calendar

Until then, speculation surrounding US monetary policy may sway AUD/USD as the Federal Reserve plans to ‘make our decisions meeting by meeting,’ and fresh remarks from Chairman Jerome Powell may sway foreign exchange markets as the Federal Open Market Committee (FOMC) mulls ‘the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time.’

In turn, the Greenback may continue to bounce back against its Australian counterpart as Chairman Powell warns that the ‘Committee is not thinking about rate cuts right now at all,’ but little hints of another Fed rate-hike may prop up AUD/USD as it fuels expectations of seeing US interest rates unchanged over the remainder of the year.

With that said, AUD/USD may try to track the flattening slope in the 50-Day SMA (0.6394) if Chairman Powell shows little interest in delivering another rate-hike, but the exchange rate may struggle to retain the rebound from the yearly low (0.6270) if it fails to defend the monthly low (0.6318).

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD snaps the series of higher highs and lows from last week after clearing the September high (0.6522), with a close below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) area raising the scope for a test of the monthly low (0.6318).

- Failure to defend the opening range for November may push AUD/USD towards the yearly low (0.6270), with a break/close below 0.6240 (61.8% Fibonacci extension) bringing the 2022 low (0.6170) on the radar.

- Nevertheless, AUD/USD may try to track the flattening slope in the 50-Day SMA (0.6394) if it defends the opening range for November, but need a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region to open up the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area.

Additional Market Outlooks

US Dollar Forecast: USD/CAD Tests Positive Slope in 50-Day SMA

Euro Forecast: EUR/USD Clears October Range on Soft US NFP Report

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong