Australian Dollar Outlook: AUD/USD

AUD/USD recovers ahead of the monthly low (0.6318) as the US Consumer Price Index (CPI) reveals slowing inflation, and Australia’s Employment report may keep the exchange rate afloat as the update is anticipated to show another rise in job growth.

AUD/USD Recovers Ahead of Monthly Low amid Slowing US CPI

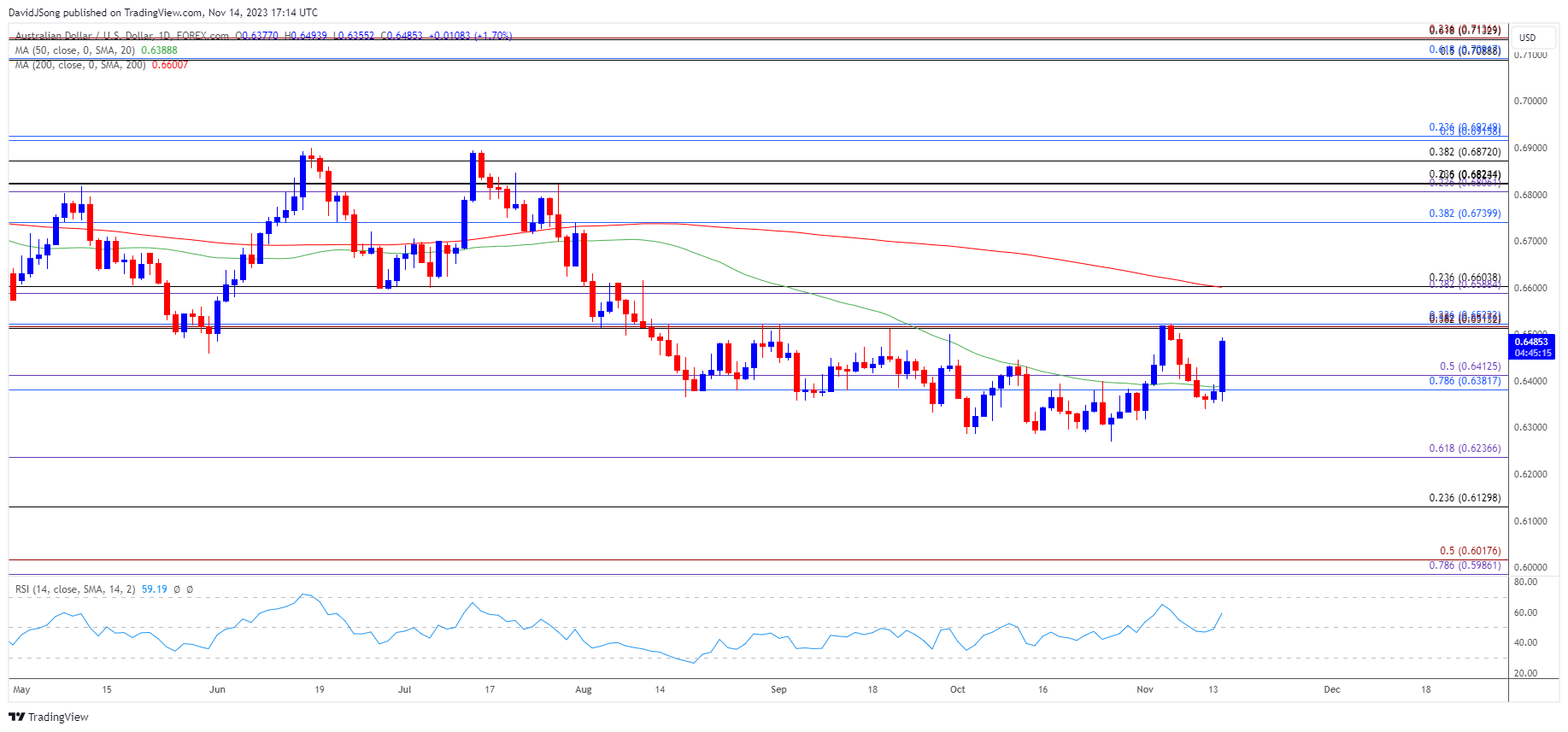

AUD/USD carves a series of higher highs and lows to trade back above the 50-Day SMA (0.6388), but the exchange rate may trade within a defined range ahead of the next Reserve Bank of Australia (RBA) meeting on December 5 should it track the flattening slope in the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Australia Economic Calendar

Until then, data prints coming out of Australia may sway AUD/USD as the RBA insists that the monetary policy outlook ‘will depend upon the data and the evolving assessment of risks,’ and another rise in Australia Employment may boost the central bank’s scope to implement higher interest rates as Governor Michele Bullock and Co. acknowledge that ‘the risk of inflation remaining higher for longer has increased.’

In turn, a positive development may generate a bullish reaction in the Australian Dollar as it fuels speculation for another RBA rate-hike, but a weaker-than-expected employment report may curb the recent advance in AUD/USD as the central bank appears to be at or nearing the end of its hiking-cycle.

With that said, AUD/USD may extend the recent series of higher highs and lows as it bounces back ahead of the monthly low (0.6318), but the exchange rate may face range bound conditions should it track the flattening slope in the 50-Day SMA (0.6388).

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD bounces back ahead of the monthly low (0.6318) to trade back above the 50-Day SMA (0.6388), and the exchange rate may stage another attempt to test the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region as it carves a fresh series of higher highs and lows.

- A breach above the monthly high (0.6523) may lead to a test of the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area, but AUD/USD may track the flattening slope in the moving average if it struggles to break above the November range.

- Failure to clear the monthly high (0.6523) may pull AUD/USD back towards the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone, but lack of momentum to defend the November low (0.6318) opens up the yearly low (0.6270).

Additional Market Outlooks

USD/CAD Forecast: November High in Focus Following Test of 50-Day SMA

US Dollar Forecast: USD/JPY on Cusp of Testing Yearly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong