Australian Dollar Outlook: AUD/USD

AUD/USD continues to register fresh monthly lows after clearing the July low (0.6599) and the exchange rate may face further decline ahead of the update to the US Consumer Price Index (CPI) if it fails to defend the June low (0.6485).

AUD/USD Rate Reaction to June Low in Focus

AUD/USD trades to a fresh monthly low (0.6500) on the back of US Dollar strength, and data prints coming out of the US may sway the exchange rate as the Reserve Bank of Australia (RBA) moves to the sidelines.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

US Economic Calendar

The update to the US CPI may put pressure on the Federal Reserve to further combat inflation as the headline reading is projected to increase to 3.3% in July from 3.0% per annum the month prior while the core rate is expected to hold steady at 4.8% during the same period.

Evidence of sticky inflation may generate a bullish reaction in the US Dollar as Fed officials keep the door open to implement higher interest rates, but a softer-than-expected CPI print may curb the recent weakness in AUD/USD as it fuels speculation for a looming change in regime.

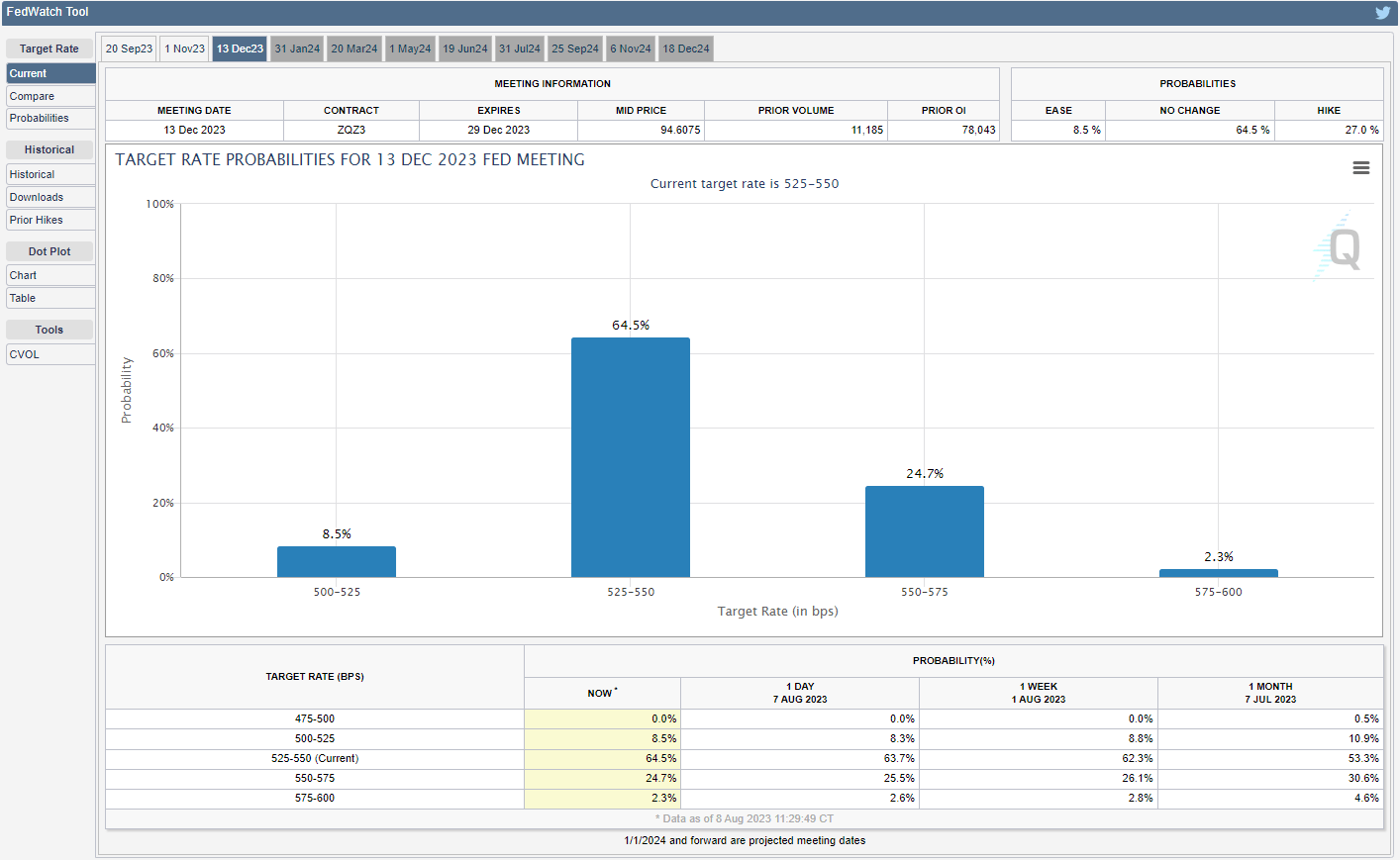

Source: CME

In turn, AUD/USD may track the June range as the CME FedWatch Tool reflects a greater than 70% probability of seeing US interest rates unchanged over the remainder of the year, and it remains to be seen if Chairman Jerome Powell and Co. will adjust the forward guidance at the next meeting in September as the central bank is slated to update the Summary of Economic Projections (SEP).

With that said, the update to the US CPI may influence the near-term outlook for AUD/USD as the FOMC appears to be nearing the end of its hiking-cycle, but the exchange rate may extend the decline from the start of the month if it fails to defend the June low (0.6485).

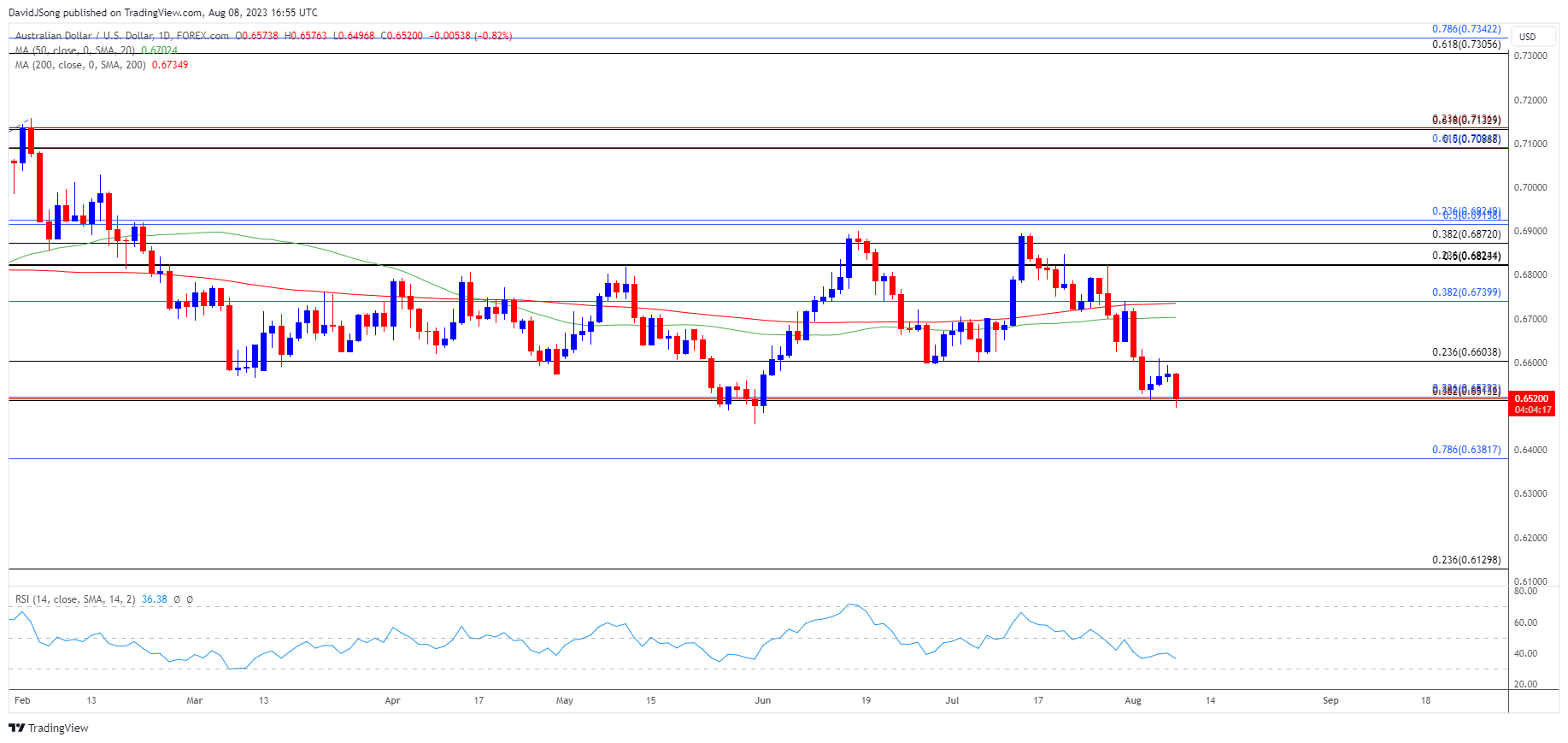

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD approaches the June low (0.6485) after failing to defend the July low (0.6599), with a close below the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region raising the scope for a test of the yearly low (0.6459).

- Next area of interest comes in around 0.6380 (78.6% Fibonacci retracement) followed by the November 2022 low (0.6272), but AUD/USD may trade within a defined range if it defends the June low (0.6485).

- A close back above the 0.6600 (23.6% Fibonacci retracement) handle may push AUD/USD towards 0.6740 (38.2% Fibonacci retracement), with the next area of interest coming in around 0.6820 (23.6% Fibonacci retracement).

Additional Market Outlooks

USD/JPY Outlook Mired by Failure to Test June High

GBP/USD Post-BoE Weakness Undermines Rebound from June Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong