AUD/USD Outlook

AUD/USD no longer carves a series of higher highs and lows as it pulls back from a fresh monthly high (0.6804), and the exchange rate may struggle to retain the advance from the start of the month as it appears to be reversing ahead of the April high (0.6806).

AUD/USD rate rally stalls ahead of April high

AUD/USD seems to be unfazed by Australia’s 2023-24 federal budget even though the government plans for a budget surplus for the first time in 15 years, and the exchange rate may trade within the April range after staging a six-day rally for the first time this year.

Register here for the next Live Economic Coverage event with David Song

It remains to be seen if the update to the US Consumer Price Index (CPI) will influence the near-term outlook for AUD/USD as the headline reading is expected to hold steady at 5.0% per annum in April, while the core rate of inflation is seen narrowing to 5.5% from 5.6% per annum the month prior.

Evidence of persistent price growth may generate a bullish reaction in the US Dollar as raises the Federal Reserve’s scope to further combat inflation, and the central bank may pursue a more restrictive policy at its next interest rate decision on June 14 as Chairman Jerome Powell and Co. ‘are prepared to do more if greater monetary policy restraint is warranted.’

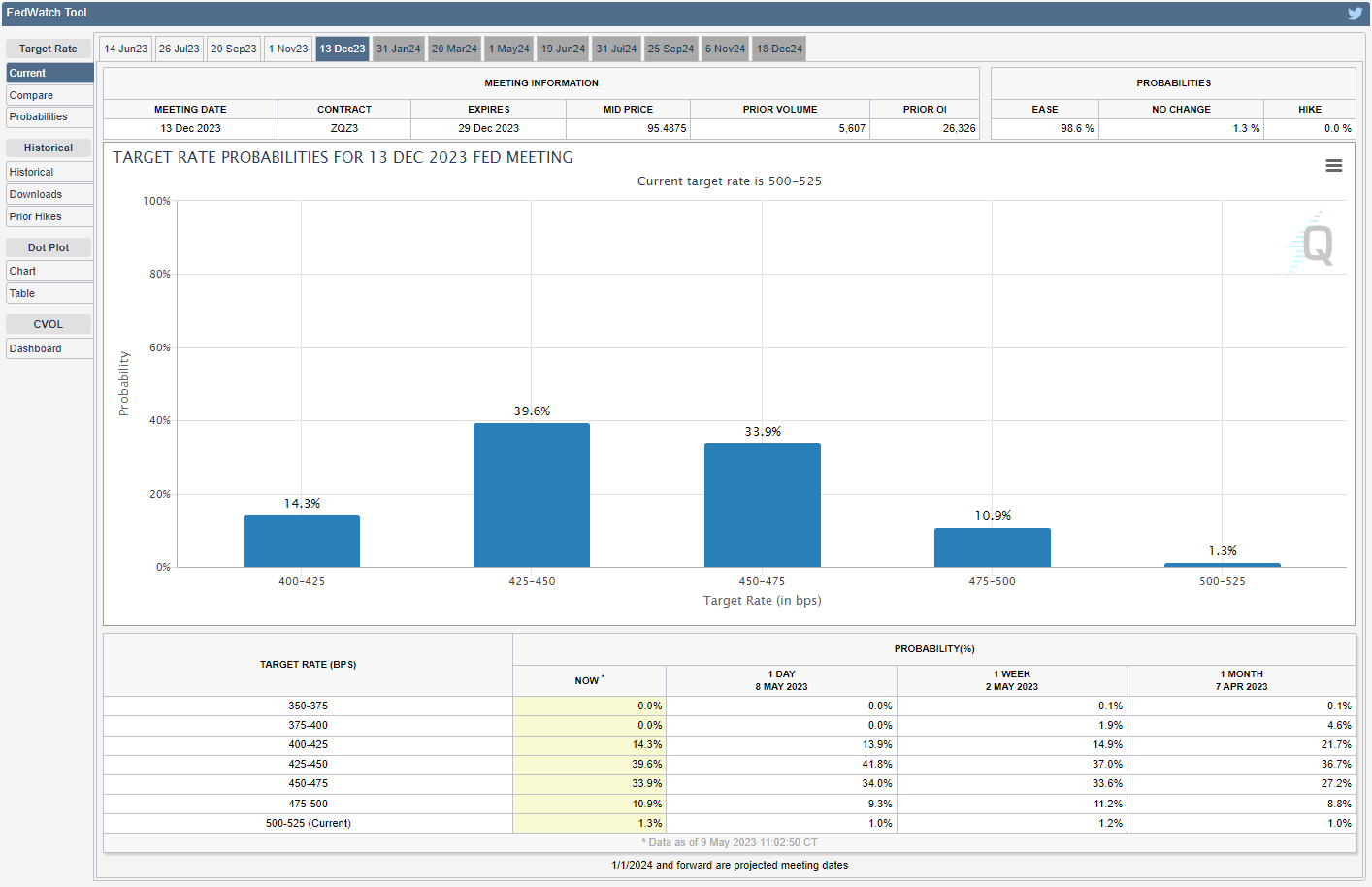

Source: CME

Until then, developments coming out of the US may sway AUD/USD as the CME FedWatch Tool continues to reflect speculation for a looming change in regime, and an unexpected downtick in the headline CPI may fuel expectations for lower US interest rates as the Federal Open Market Committee (FOMC) acknowledges that ‘the economy is likely to face further headwinds from tighter credit conditions.’

With that said, the update to the US CPI may drag on AUD/USD should the update reveal sticky inflation, and the exchange rate struggle to retain the advance from the start of the month as it appears to be reversing ahead of the April high (0.6806).

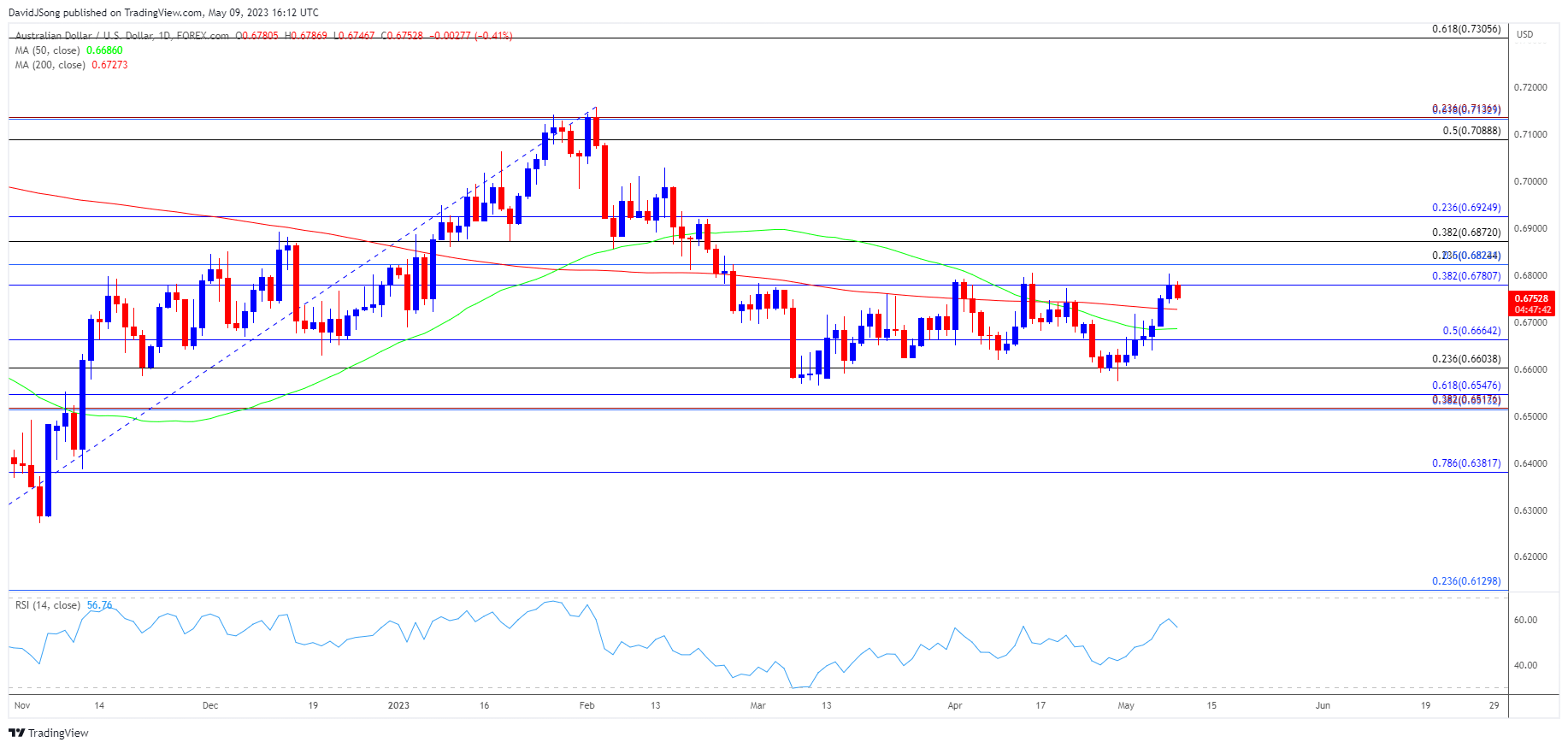

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- Keep in a mind, a ‘death cross’ formation took shape last month as the 50-Day SMA (0.6686) crossed below the 200-Day SMA (0.6727), but the failed attempt to test the yearly low (0.6565) has generated a six-day rally in AUD/USD for the first time in 2023.

- Nevertheless, the advance from the monthly low (0.6608) appears to have stalled ahead of the April high (0.6806) as it fails to extend the series of higher highs and lows from last week, and lack of momentum to break/close above the 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement) region may push AUD/USD back towards 0.6660 (50% Fibonacci retracement) if it fails to hold above the moving averages.

- Next area of interest comes in around the 0.6600 (23.6% Fibonacci retracement) handle, with a breach of the April low (0.6574) bringing the yearly low (0.6565) on the radar.

Additional Resources

Gold price rebounds ahead of monthly low with US CPI on tap

USD/CAD reverses ahead of April high with monthly open in focus

--- Written by David Song, Strategist