AUD/USD Outlook

AUD/USD bounces along the 50-Day (0.6679) and 200-Day (0.6692) SMA as it holds above last week’s low (0.6663), and the exchange rate may attempt to retrace the decline from the monthly high (0.6900) if the Reserve Bank of Australia (RBA) pursues a more restrictive policy.

AUD/USD Rate Outlook Hinges on RBA Rate Decision

AUD/USD trades to a fresh weekly high (0.6721) as the US Dollar weakens against most of its major counterparts, and the exchange rate may appreciate over the remainder of the month amid the limited reaction to the US Durable Goods Orders report, which showed demand for large-ticket items unexpected climbing 1.7% in May.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Looking ahead, it remains to be seen if the RBA will raise the official cash rate (OCR) for the third consecutive meeting as ‘inflation had passed its peak but remained well above target,’ and the central bank may continue to carry out its hiking-cycle as ‘recent data suggested that inflation risks had shifted somewhat to the upside.’

As a result, another RBA rate hike may generate a bullish reaction in AUD/USD as the Federal Reserve moves to the sidelines, but the Australian Dollar may face headwinds should Governor Philip Lowe and Co. adopts a wait-and-see approach for monetary policy.

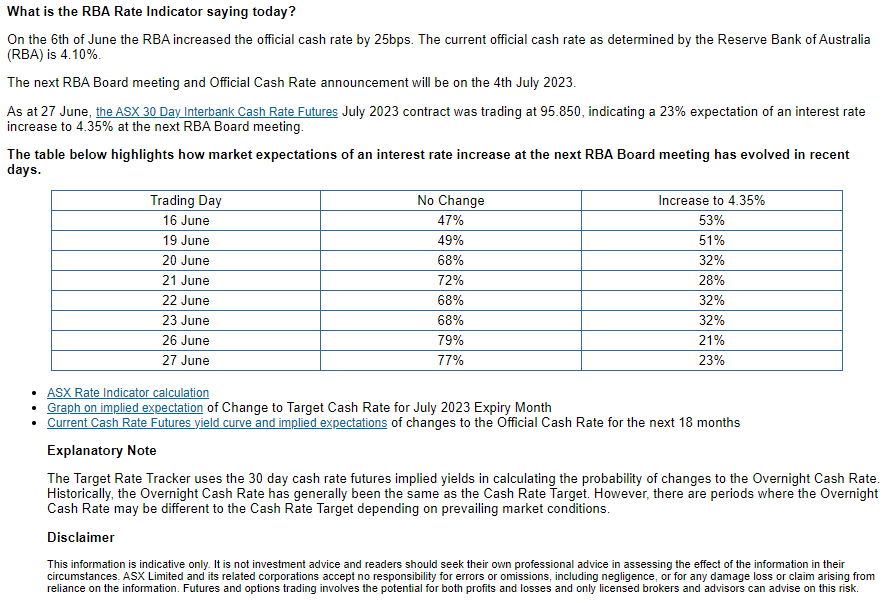

Source: ASX

According to the ASX RBA Rate Indicator, the ‘30 Day Interbank Cash Rate Futures July 2023 contract was trading at 95.850, indicating a 23% expectation of an interest rate increase to 4.35%,’ and limited expectations for higher interest rates may generate range bound conditions for AUD/USD as it shows a lackluster response to the data prints coming out of the US.

With that said, AUD/USD may continue to along the 50-Day (0.6679) and 200-Day (0.6692) SMA going into the end of the month, but the exchange rate may attempt to retrace the decline from the monthly high (0.6900) if the RBA implements a more restrictive policy.

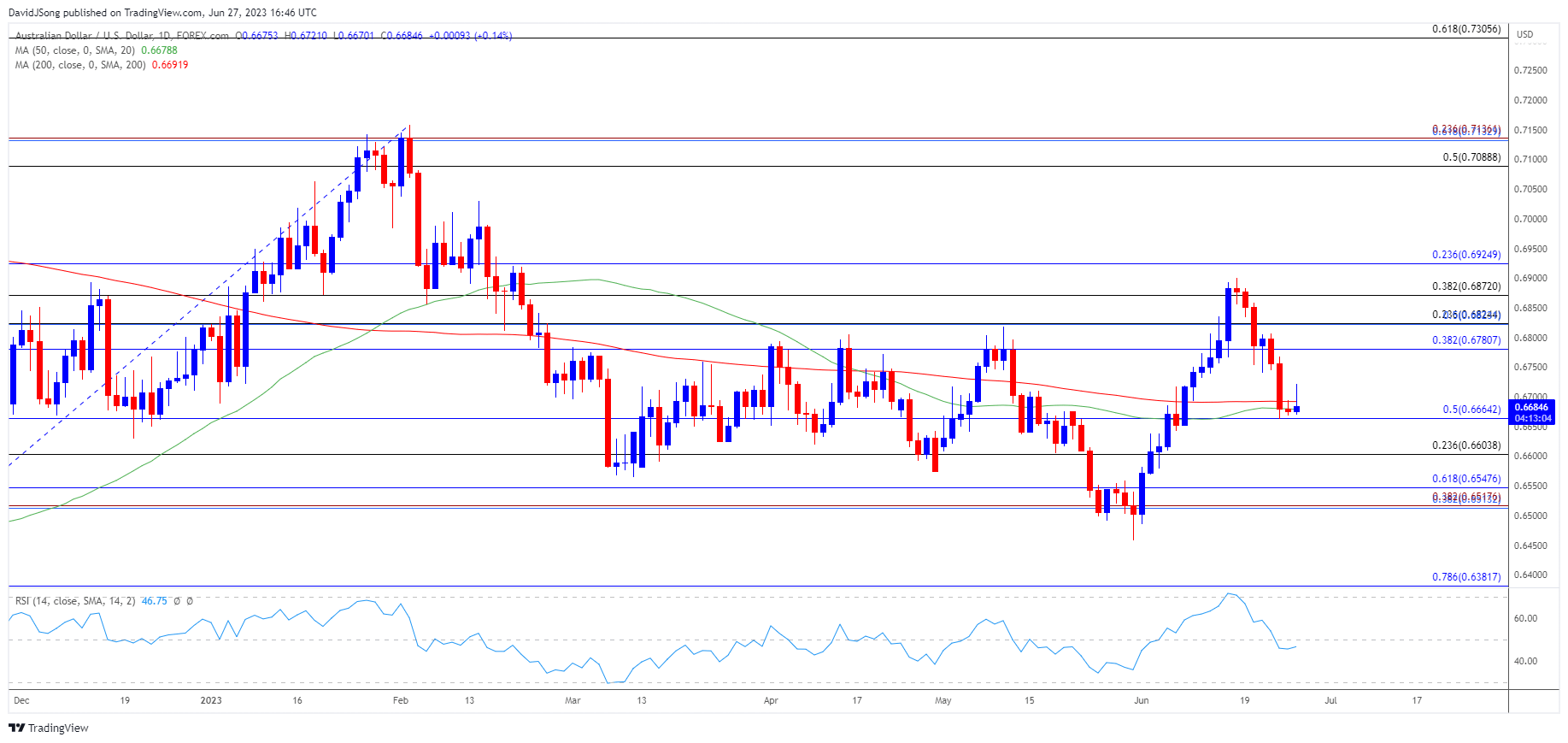

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD holds above last week’s low (0.6663) to bounce along the 50-Day (0.6679) and 200-Day (0.6692) SMA, and lack of momentum to break/close below 0.6660 (50% Fibonacci retracement) may push the exchange rate back towards the 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement) region.

- Next area of interest comes in around 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement), which incorporates the monthly high (0.6900), but the exchange rate may face range bound conditions as both moving averages reflect flat slope.

- Failure to push above the 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement) region may keep AUD/USD within a defined range, but a break/close below 0.6660 (50% Fibonacci retracement) opens up the 0.6600 (23.6% Fibonacci retracement) handle, with the next area of interest coming in around 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement).

Additional Market Outlooks

Gold Price Struggles to Push Above Former Support

EUR/USD Fails to Test May High as Fed Officials Defend Higher Rates

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong