Australian Dollar Outlook: AUD/USD

AUD/USD trades to a fresh weekly low (0.6605) as the Reserve Bank of Australia (RBA) unexpectedly kept the Official Cash rate (OCR) at 4.10%, and the exchange rate may struggle to hold its ground ahead of the US Non-Farm Payrolls (NFP) report if it fails to defend the July low (0.6599).

AUD/USD Post-RBA Weakness Brings Test of July Low

AUD/USD remains under pressure following the failed attempt to test the June high (0.6900), and the Australian Dollar may continue to underperform against its US counterpart as the RBA retains a wait-and-see approach in managing monetary policy.

It seems as though the RBA is hesitant to implement higher interest rates as the ‘Australian economy is experiencing a period of below-trend growth,’ and Governor Philip Lowe and Co. may stick to the sidelines as the next meeting on September 5 as ‘the recent data are consistent with inflation returning to the 2–3 per cent target range over the forecast horizon.’

As a result, AUD/USD may continue to give back the advance from the yearly low (0.6459) even though the RBA insists that ‘some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe,’ and developments coming out of the US may sway the exchange rate later this week as the NFP report is anticipated to show another rise in employment.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

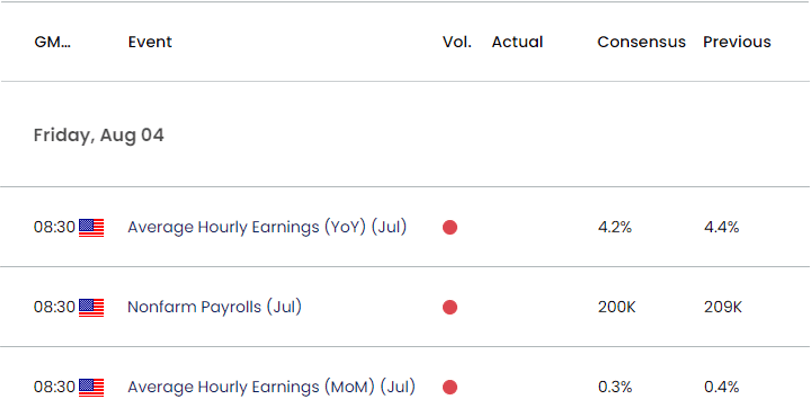

US Economic Calendar

The US economy is expected to add 200K jobs in July following the 209K expansion the month prior, and a further improvement in the labor market may push the Federal Reserve to pursue a more restrictive policy as inflation remains above the central bank’s 2% target.

In turn, speculation for another Fed rate-hike may keep AUD/USD under pressure as the RBA sits on the sidelines, but a weaker-than-expected NFP print may produce headwinds for the Greenback as it puts pressure on the Federal Open Market Committee (FOMC) to conclude its hiking-cycle.

With that said, the update to the US NFP report may sway AUD/USD as the Fed keeps the door open to implement higher interest rates, but the exchange rate may continue to give back the advance from the yearly low (0.6459) if it fails to defend the July low (0.6599).

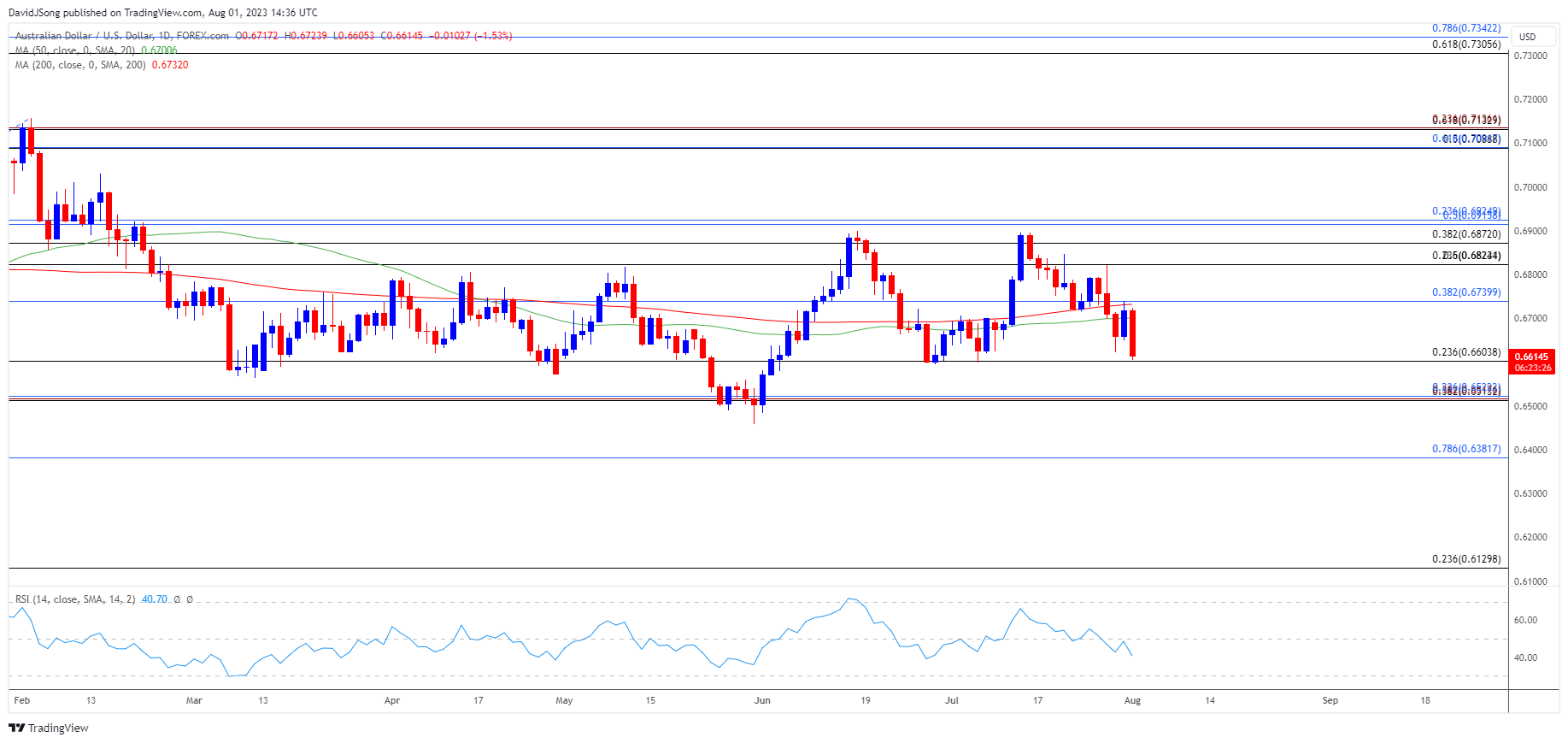

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD approaches the July low (0.6599) following the failed attempt to test the June high (0.6900), with a break/close below the 0.6600 (23.6% Fibonacci retracement) handle bringing the 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement) region on the radar.

- Failure to defend the May low (0.6459) may push AUD/USD towards 0.6380 (78.6% Fibonacci retracement), with the next area of interest coming in around the November 2022 low (0.6272).

- Nevertheless, AUD/USD may face range bound conditions if it defends the July low (0.6599), with a move above 0.6740 (38.2% Fibonacci retracement) bringing 0.6820 (23.6% Fibonacci retracement) back on the radar.

Additional Market Outlooks

Japanese Yen Forecast: Post-BoJ Rebound Keeps USD/JPY Above July Low

USD/CAD Range Vulnerable to Slowing US PCE Inflation

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong