Australia Dollar Outlook: AUD/USD

AUD/USD is on the cusp of testing the August high (0.6824) as it extends the series of higher highs and lows from last week.

AUD/USD on Cusp of Testing August High following Fed Rate Cut

AUD/USD trades to a fresh monthly high (0.6821) as the Federal Reserve delivers a 50bp rate-cut, and speculation for a further shift in US monetary policy may keep the exchange rate afloat as Chairman Jerome Powell and Co. now forecast the federal funds rate ‘will be 4.4% at end of this year.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

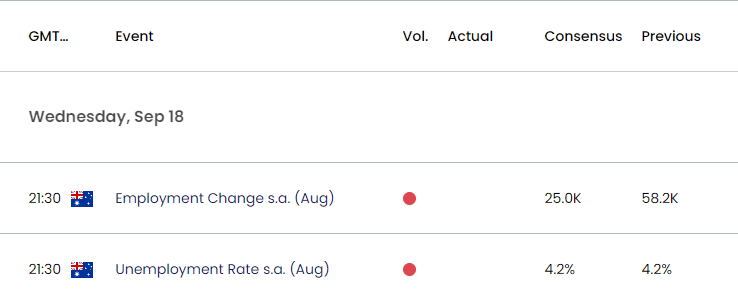

Australia Economic Calendar

In addition, the update to Australia’s Employment report may also influence AUD/USD as the economy is expected to add 25.0K jobs in August, and the Reserve Bank of Australia (RBA) may stick to the sidelines at its next meeting on September 24 as ‘it was unlikely that the cash rate target would be reduced in the short term.’

With that said, signs of a resilient labor market may generate a bullish reaction in the Australian Dollar as it raises the RBA’s scope to further combat inflation, but a weaker-than-expected employment report may drag on AUD/USD as it puts pressure on the central bank to support the economy.

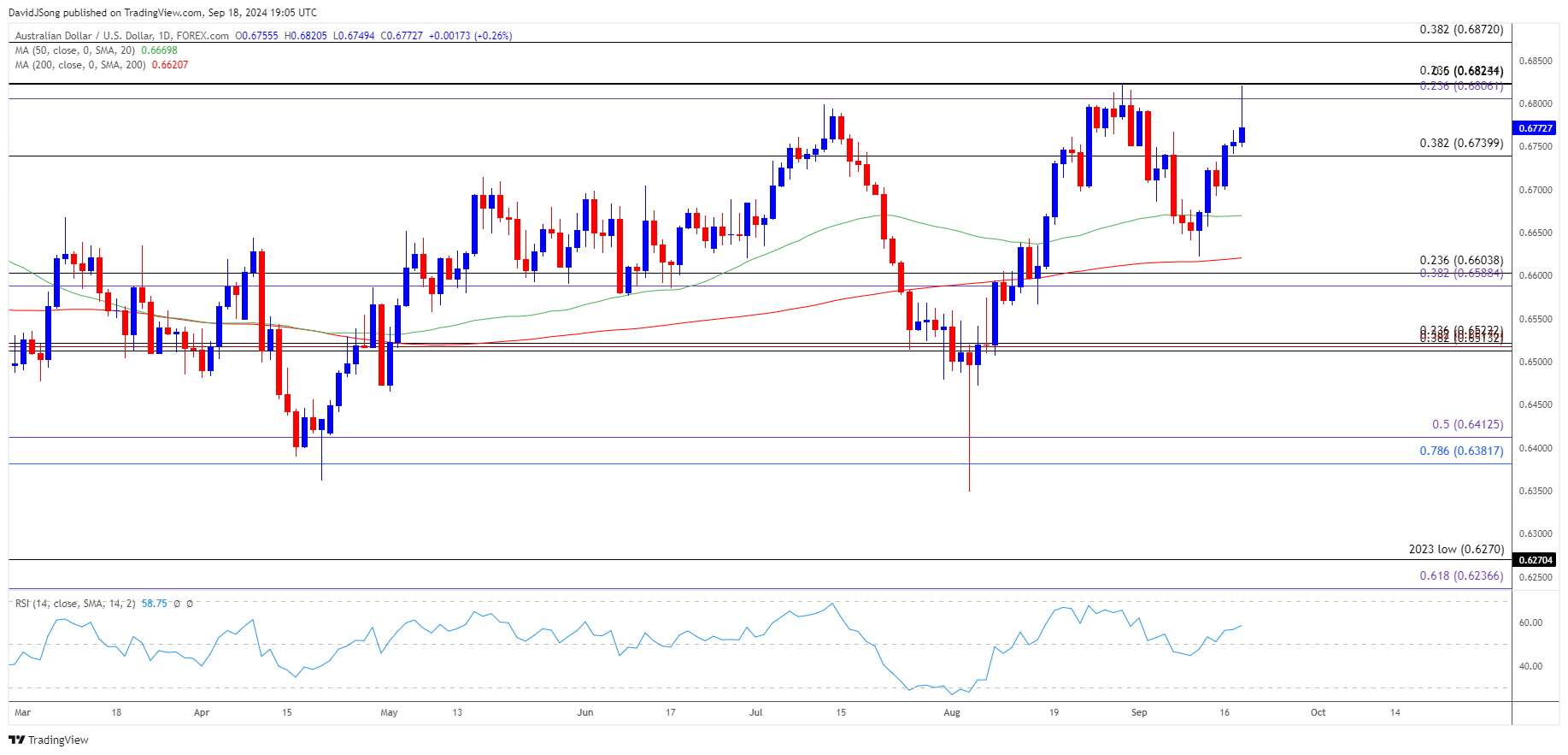

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD extends the series of higher highs and lows from last week to register a fresh monthly high (0.6813), with a break/close above the 0.6810 (23.5% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) zone bringing the January high (0.6839) on the radar.

- Next area of interest comes in around 0.6870 (38.2% Fibonacci retracement), which largely lines up with the December 2023 high (0.6871), but failure to clear the August high (0.6824) may keep AUD/USD within last month’s range.

- Failure to hold above 0.6740 (38.2% Fibonacci retracement) would negate the bullish price series in AUD/USD, with a breach below the monthly low (0.6622) opening up the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) region.

Additional Market Outlooks

EUR/USD Struggles to Test Monthly High Ahead of Fed Rate Decision

US Dollar Forecast: USD/JPY Clears December Low with Fed on Tap

GBP/USD Bull-Flag Starts to Unfold ahead of Fed and BoE Rate Decision

Gold Price Breakout Pushes RSI Toward Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong