Australia Dollar Outlook: AUD/USD

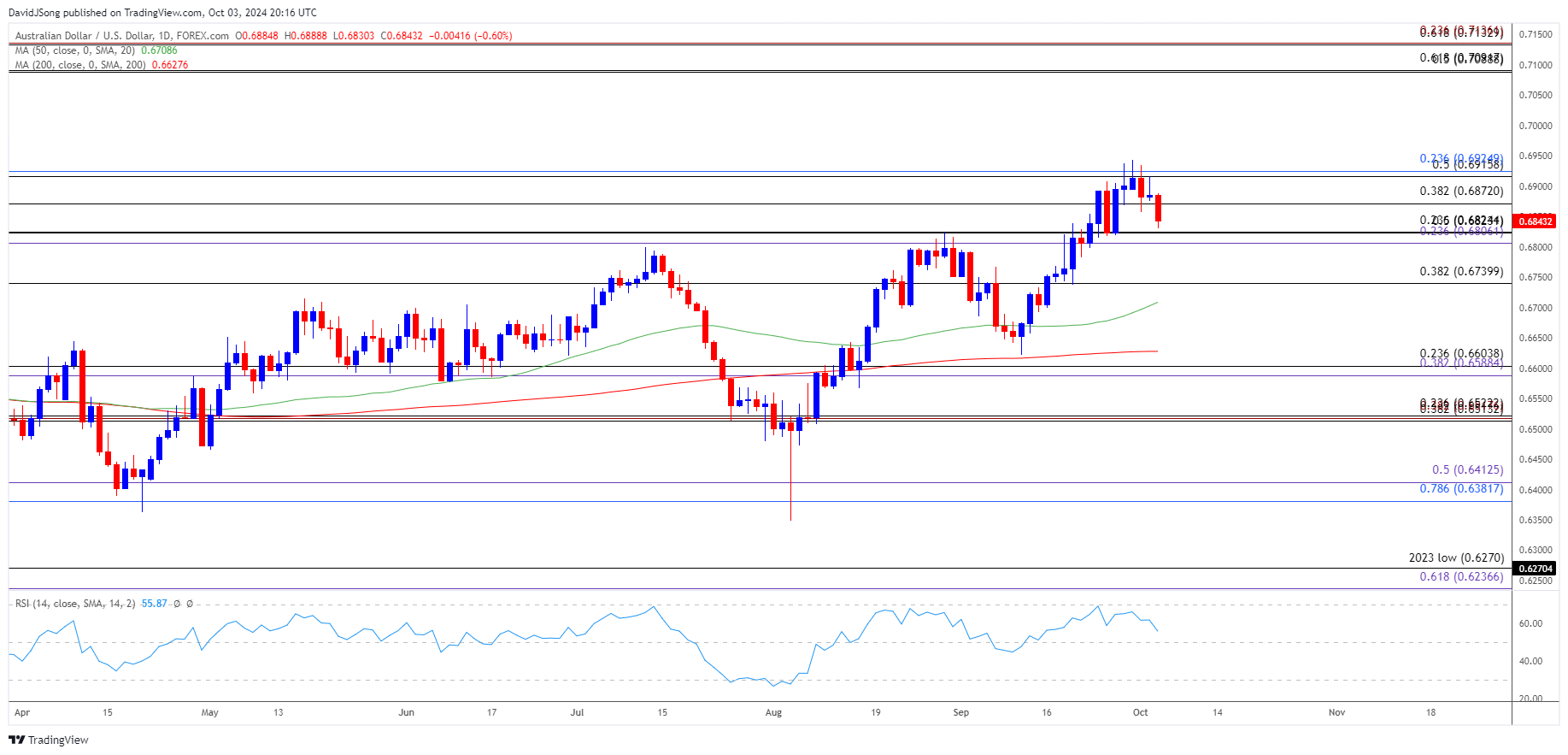

AUD/USD slips to a fresh weekly low (0.6830) as the ISM Services survey climbs to 54.9 in September from 51.5 the month prior to mark the highest reading since February 2023, with the recent weakness in the exchange rate pulling the Relative Strength Index (RSI) away from overbought territory.

AUD/USD Forecast: RSI Continues to Move Away from Overbought Zone

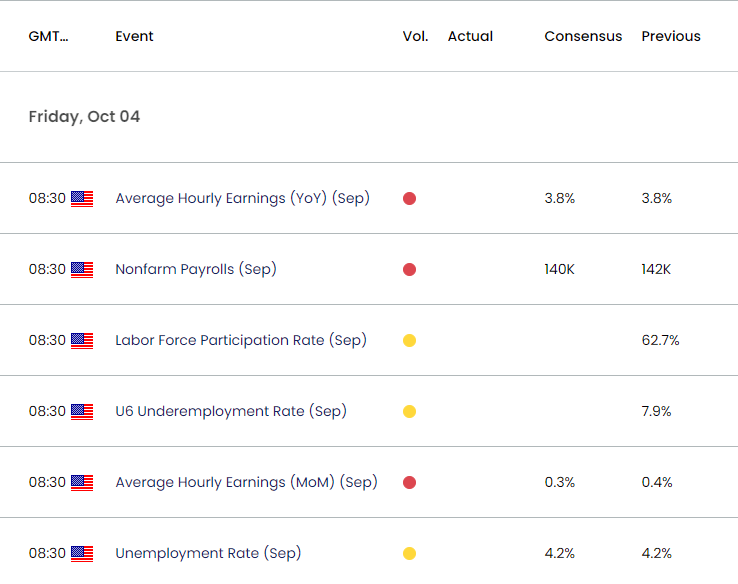

AUD/USD extends the decline from the start of the month as the ongoing expansion in US service-based activity puts pressure on the Federal Reserve to further combat inflation, and the update to the Non-Farm Payrolls (NFP) report may also influence the exchange rate as the update in anticipated to show the economy adding 140K jobs in September.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

At the same time, the Unemployment Rate is expected to hold steady at 4.2% during the same period, while Average Hourly Earnings are projected to increase 3.8% for the second straight month.

In turn, signs of a strong labor market may lead to a greater dissent within the Federal Open Market Committee (FOMC) as the economy shows little signs of an imminent recession, and a positive development may generate a bullish reaction in the US Dollar amid waning expectations for another 50bp Fed rate cut.

With that said, AUD/USD may continue to give back the advance from the September low (0.6622) as the Relative Strength Index (RSI) continues to move away from overbought territory, but a weaker-than-expected NFP print may curb the recent weakness in the exchange rate as puts pressure on the FOMC to quickly unwind its restrictive policy.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD extends the decline from the start of the month amid the failed attempts to close above the 0.6920 (50% Fibonacci retracement) to 0.6930 (23.6% Fibonacci retracement) region.

- A break/close below the 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) area brings 0.6740 (38.2% Fibonacci retracement) on the radar, with the next area of interest coming in around the September low (0.6622).

- At the same time, AUD/USD may attempt to retrace the decline from the September high (0.6943) if it holds above the 0.6810 (23.6% Fibonacci extension) to 0.6820 (23.6% Fibonacci retracement) area but need a close above the 0.6920 (50% Fibonacci retracement) to 0.6930 (23.6% Fibonacci retracement) region to open up the 0.7090 (50% Fibonacci retracement) to 0.7140 (23.6% Fibonacci extension) zone.

Additional Market Outlooks

US Non-Farm Payrolls (NFP) Report Preview (SEP 2024)

EUR/USD Vulnerable on Close Below 50-Day SMA

USD/JPY Outlook Mired by Negative Slope in 50-Day SMA

Gold Price Weakness Pulls RSI Back from Overbought Zone

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong