Summary of the RBAs August statement

- The Board decided to leave the cash rate target unchanged at 4.1%

- Inflation in Australia is declining but is still too high at 6%

- Goods price inflation has eased, but the prices of many services are rising briskly

- Below-trend growth in Australia is expected to continue for a while

- Conditions in the labour market remain very tight, although they have eased a little

- The recent data are consistent with inflation returning to the 2–3 per cent target range over the forecast horizon

- Services price inflation has been surprisingly persistent overseas and the same could occur in Australia

- The outlook for household consumption is also an ongoing source of uncertainty

- Some further tightening of monetary policy may be required

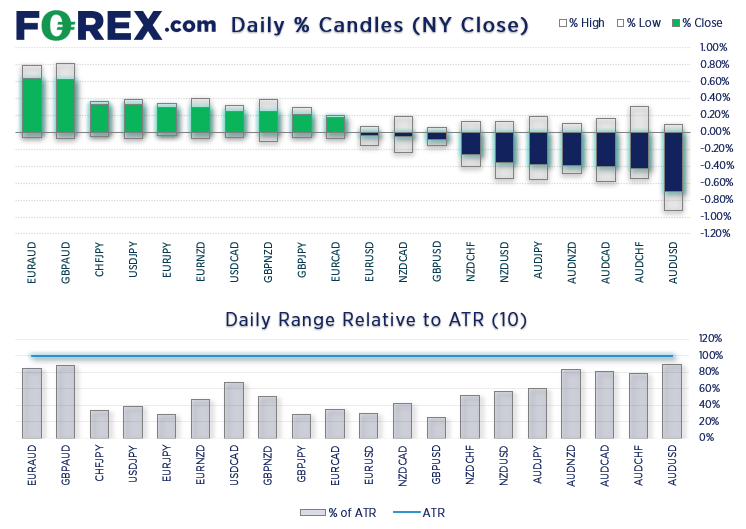

The RBA held their interest rate at 4.1% for a second consecutive month. And the fact AUD fell over -0.6% and the ASX touched a high of the week shows that not everyone was positioned for the outcome. Weaker than expected manufacturing PMI data from China weighed on the Aussie ahead of the RBA’s decision, so we’ll assume the reaction may have been larger had that data not been scheduled.

It would have sent a confusing message if the RBA hiked today, given trimmed mean inflation met their June forecast and retail trade dipped ahead of today’s decision. Whilst employment remains tight, they also forecast unemployment to be the current rate of 3.5% anyway. And with US inflation measures pointing lower, it provides another month for homeowners to enjoy the current rate. Of course, the pressure for the RBA to hike once or twice more remain in play, especially with oil prices now rising which adds risk of another wave of inflation later this year.

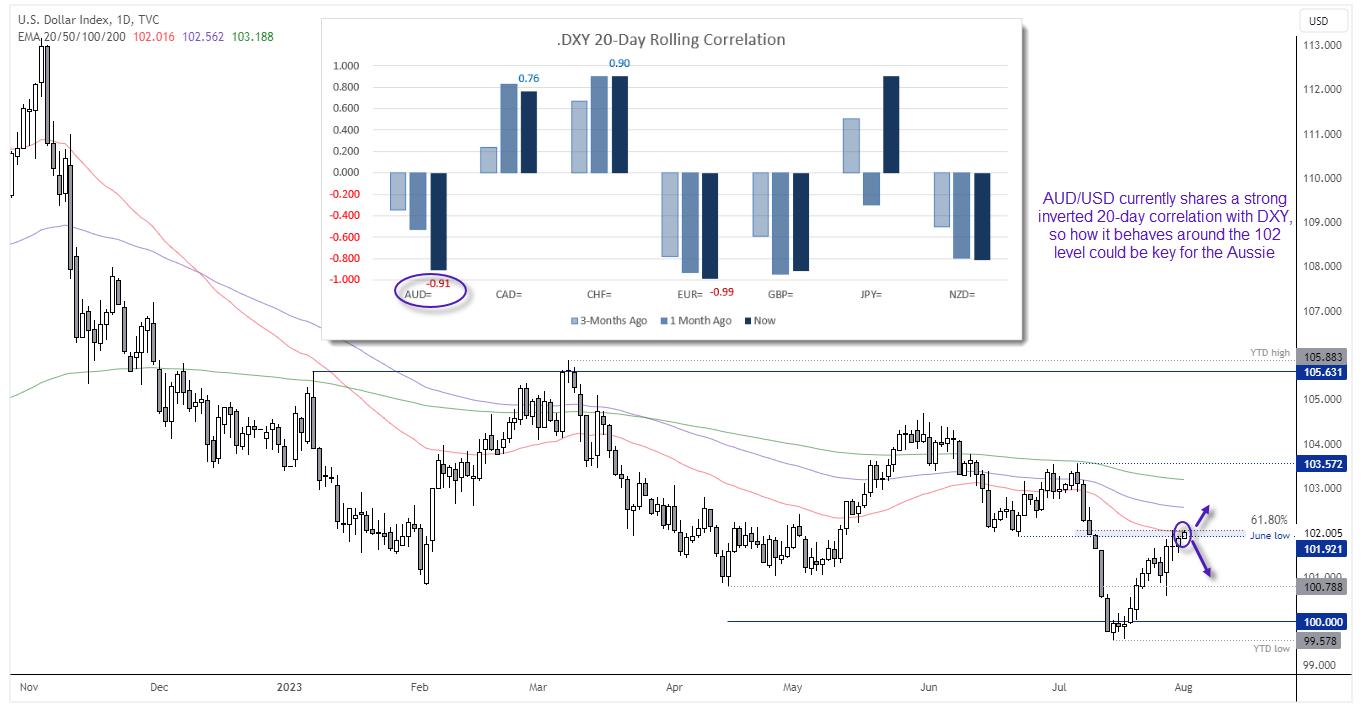

AUD/USD and DXY share a strong (inverted) correlation

The US dollar index (DXY) has continue to strengthen since its June low, although momentum is slowing and it shows the potential to pause or retrace lower form the 102, near the 50-day EMA, 61.8% Fibonacci level and June low. And that could be beneficial for AUD/USD bulls over the near-term if DXY retraces lower, given DXY and AUD currently share a strong inverted 20-day correlation. Of course, this also means that AUD could face further selling pressure if DXY breaks higher, but it means DXY is worth keeping a close eye on regardless of which way its next move is.

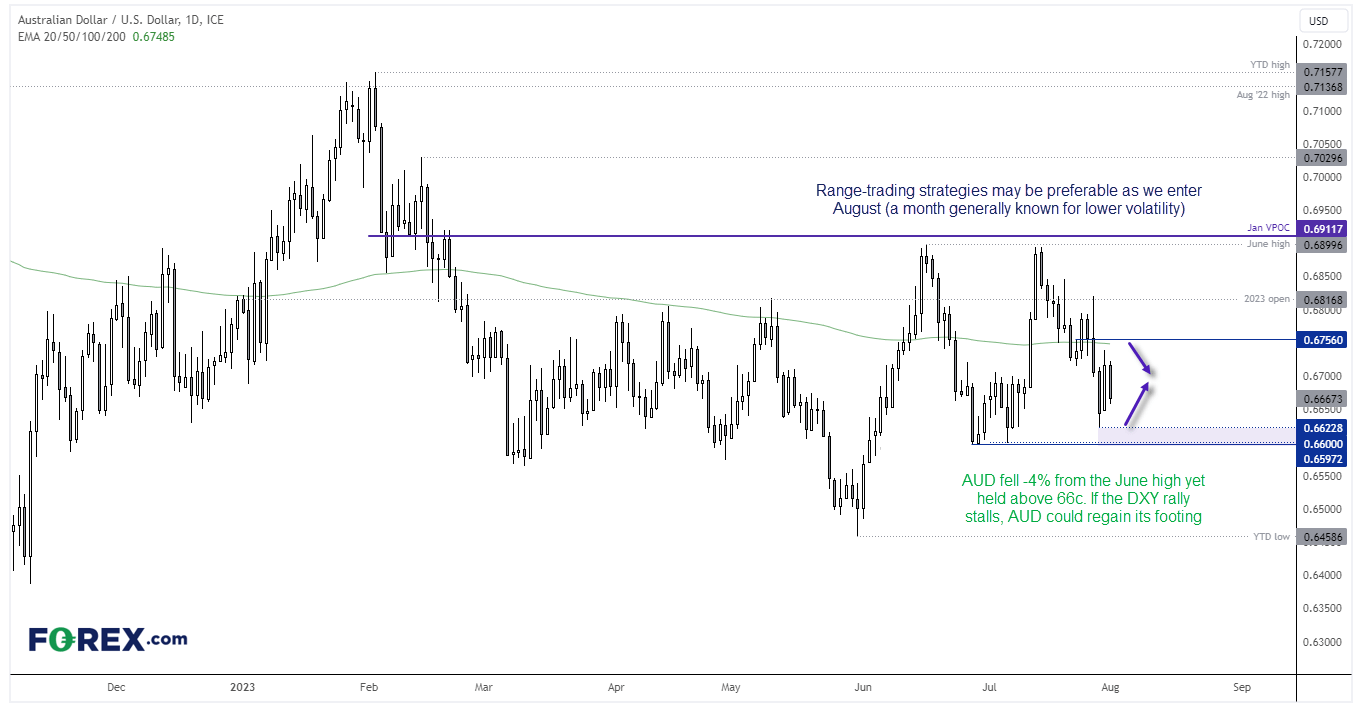

AUD/USD daily chart

If today’s pause realty was a surprise, I would have expected it to at least break Monday’s low. AUD/USD fell nearly -4% in 10 days from the June high, and the fact today’s sells off is holding above the weekly low shows there is some support above the current cycle lows.

It may not be the prettiest of charts, but playing the range (bullish around lows or bearish around highs) may be the better play, given we’re now the historically quiet month of August. And that range is roughly between 0.6630 – 0.6750, near the 200-day EMA.

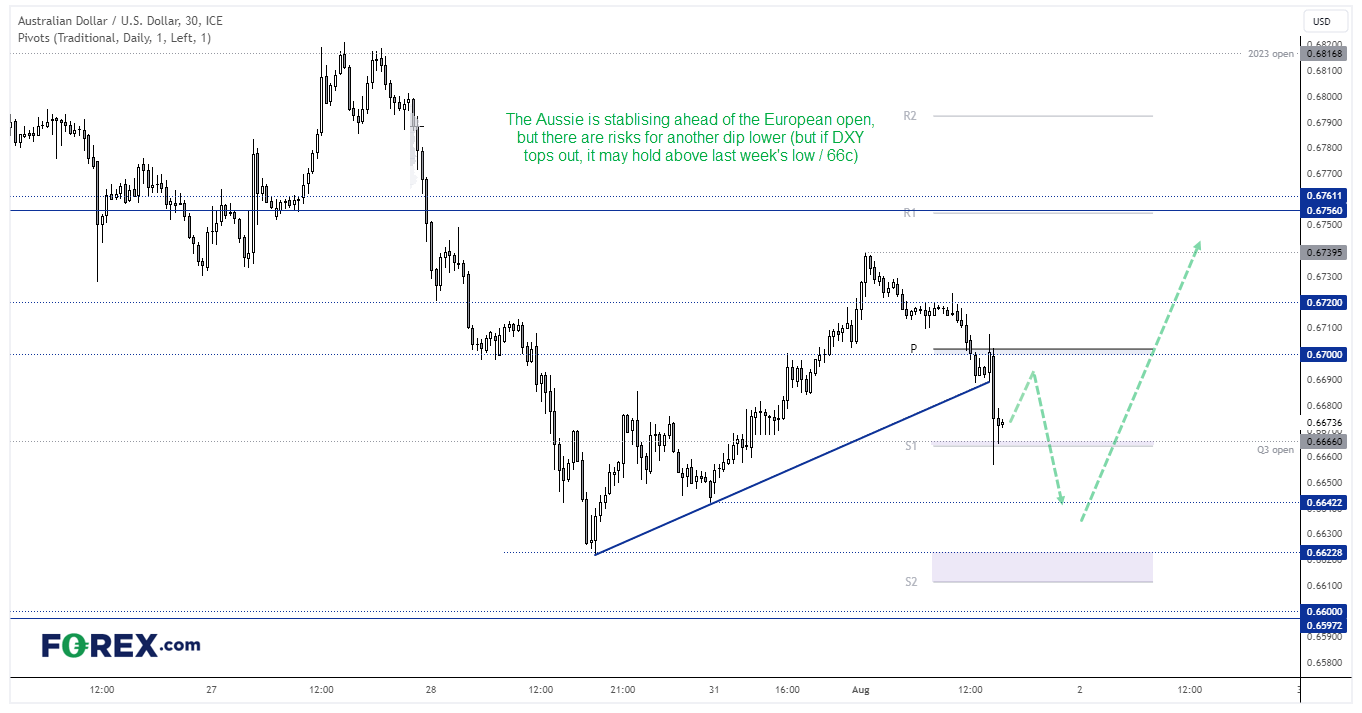

AUD/USD 30-minute chart:

AUD/USD has found support around the Q3 open and weekly S1 pivot. It may not be the nicest of levels for bulls to enter, but the longer this levels hold the great the odds may be for profits to be booked and for AUD/USD to retrace against the initial RBA-hold losses. At which case we may see bears reconsider entering beneath the 0.6690 area to see if it can be driven lower. We should also factor in that traders across Europe and the US are yet to respond, so maybe there is some more juice in the bearish tank.

However, I continue to suspect that AUD/USD will be able to build a base above 0.6620, and perhaps even move towards the 0.6755 – 60 area (assuming the DXY rally retraces lower).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge